Private water companies to bridge $500B water investment gap in U.S., finds study

BOSTON, MA, July 22, 2014 -- According to a new report from Bluefield Research, private water markets in the United States are poised for significant growth. With an infrastructure investment gap of more than $500 billion for drinking water and wastewater treatment over the next 20 years, a revised regulatory landscape is shaping new opportunities for private players looking to invest strategically in U.S. water.

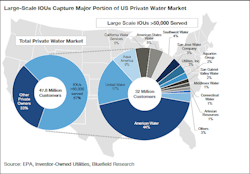

"New legislation and M&A potential are piquing the interest of domestic and international players -- particularly those seeking IOU plays," said Keith Hays, VP of Bluefield Research and lead analyst for the report, "U.S. Private Water Market: Opportunities & Strategies, 2014." He continued, "Large scale IOUs have focused their portfolios in states with larger populations and policies favorable to private participation in municipal water, including California, Texas, New York, New Jersey, Pennsylvania, and Florida. In addition, we've witnessed an increase in PPP interest on the part of municipalities in or near the service areas of existing large-scale IOUs."

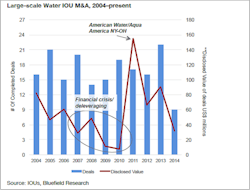

The field of large-scale IOUs (50,000 served) has seen several shifts in the past four years as competition for longer-term growth opportunities ramps up. These include new entrants acquiring incumbent IOUs or regional assets (e.g., Macquarie Capital, EPCOR, Corix Utilities, Liberty Utilities), as well as a steady flow of tuck-in acquisitions led by larger players seeking to solidify their regional presence (e.g., American Water, Aqua America, United Water).

In "U.S. Private Water Market: Opportunities & Strategies, 2014," Bluefield Research identifies multiple routes to market that players are pursuing that reflect a wide variance of state attractiveness and openness to private participation.

"Federal legislation may kick start a new phase of water infrastructure spending, but it is not a game-changer in terms of municipal funding options," said Hays. "Proven financial and operational benefits of private network management remain key drivers for more private water deals. In this context, 2014 and 2015 will be important years for firms to assess these opportunities and implement their strategies for a place in the U.S. market."

See a video on the report's findings:

See also:

"U.S. private water industry leaders deliver annual Report to Congress"

"Private Sector Funding Options for Water Infrastructure"

About Bluefield Research

Bluefield Research supports a growing roster of companies across key technology segments and industry verticals addressing risks and opportunities in the new water landscape. Companies are turning to Bluefield for in-depth, actionable intelligence into the water sector and the sector's impacts on key industries. The insights draw on primary research from the water, energy, power, mining, agriculture, financial sectors and their respective supply chains. Bluefield works with key decision-makers at utilities, project development companies, independent water and power providers, EPC companies, technology suppliers, manufacturers, and investment firms, giving them tools to define and execute strategies. For more information, visit www.bluefieldresearch.com.

###