By Jeff Gunderson

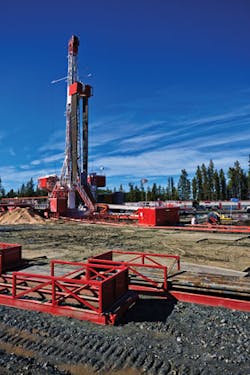

Beginning around the midpoint of 2014, global oil and gas prices started falling sharply and have continued to plummet in dramatic fashion into early 2016, leading to a contraction in fracking activity. With this, water treatment providers servicing oil and gas operators have had to quickly adapt to what has become the new normal in the unconventional oil and gas market: an environment of tighter capital spending.

In a 2015 report, Boston-based Lux Research examined the new U.S. fracking landscape, where fracking activity dropped by over 40 percent from October 2014 to February 2015 (from 2,300 fracks to 1,350). Despite this precipitous decline, the market for water management - from sourcing to disposal - remains strong for those who know how to play the opportunity, Lux concluded.

In Surviving the Shakeout in Frac Water Treatment Technologies, Lux found that as oil and gas companies look for ways to cut back on capital spending, operators are turning to new technologies in water treatment to tighten up their water management strategies and lower costs associated with water treatment, transportation, and disposal.

“We are seeing cost cutting across the whole activity and many frack water treatment players have dropped out, but those that survive the current downtown are likely to see more favorable conditions,” said Brent Giles, a research director at Lux Research. “No single technology or water management approach will win in the frack water treatment space. Rather, companies will employ a mixture of water disposal, centralized treatment and on-site treatment using physical, thermal and electrochemical methods.”

The market for water treatment within this field also remains highly fragmented, with different problems in different places including regional challenges related to disposal, according to Giles. “Companies have always struggled with treating the more contaminated, higher salinity water that is characteristic of the Marcellus shale, but because of limited disposal opportunities and higher tipping and transportation costs, it still makes economic sense to employ treatment for reuse in that region,” he said.

In contrast, the amount of reuse in Texas is significantly lower, where tipping fees and transportation costs are much less and operators have access to nearly 1,000 times as many in-state disposal wells as Marcellus operators, according to data from the report.

Stricter Regulations to Come?

Lux’s report made mention of the recent U.S. Department of the Interior’s first ever federal-level regulations pertaining to fracking and wastewater from frack operations, which require operators who frack on federal lands to disclose all chemical use to the Bureau of Land Management. The regulations also prohibit the practice of storing untreated flowback and produced water in open impoundments on site.

Importantly, the rules set the tone for the U.S. Environmental Protection Agency (EPA) and state governments to follow suit and issue stricter oversight on water transportation and disposal, as well as new rules that aim to facilitate more extensive water recycling, Lux found.

Optimizing Water Management Processes

With oil and gas prices still low, and producers increasingly looking to scale back their water management budgets, one water treatment provider has found positive momentum in the Permian Basin of West Texas behind an automated, modular system that can be remotely operated, minimizing operational costs. Purestream Services’ IGF Plus commercial system utilizes induced gas flotation technology plus filtration to remove solids, oil, and grease to below 5 parts per million from produced and frack water. By enabling for reuse, the system also allows producers to save on disposal costs and reduce the cost of sourcing fresh water for drilling.

According to Purestream, the IGF system can bring over $300,000 in savings per completed well in some locations as compared to traditional disposal and sourcing methods. The company recently signed a new contract to treat 10,000 barrels per day of produced and frack water for reuse in the Permian Basin, boosting the total volume of water treated by Purestream to 45,000 barrels per day in that region.

“I think the best way to describe water management in the industry at this point in time is ‘optimization,’” said Purestream CEO Neil Richardson. “Producers are driving down costs and searching for ways to optimize their total water usage, creating a need for more innovative technologies and solutions. Innovation came when the industry developed unconventional extraction methods; now we’re seeing examples of innovation with respect to water management.”

As with the IGF system, Richardson said Purestream is working on developing further water treatment technologies for the upstream market that can drive out operational inefficiencies and reduce costs associated with water handling, treatment and disposal. “We believe those pieces are essential to competing in this lower cost environment,” he said.

Shifting Drivers

Beyond a curbed spending environment for water management and treatment services, the slowdown in fracking has also had the effect of producing a different dynamic in terms of water management needs.

Devesh Sharma, managing director of Aquatech, said with frack activity down and reduced investment in new wells, source water requirements for fracking needs have likewise declined, driving a shift in the market from recycling and reuse to disposal solutions. “Instead of focusing on processing water for recycling to the next frack, the priority for oil and gas operators has shifted to managing produced water from their existing wells,” Sharma said. “The opportunity for water management is still there, but the needs are different.”

As the market continues to move to disposal, Sharma said brine management solutions such as evaporation, which can reduce brine concentrations, make more and more economic sense. “The value proposition can be considerable,” he said. “Evaporative technologies can potentially decrease the amount of trucking that is needed to haul wastewater to disposal wells by 10 to 15 times, which is usually very cost effective. And, as disposal quantities increase, we see the economic drivers in place for adopting modular crystallizer technologies and going to zero-liquid discharge.”

In the unconventional oil and gas space, Aquatech is positioned with a diverse array of wastewater management and treatment solutions for addressing a range of needs and site-specific challenges. These solutions include centralized treatment facilities, mobile units for treating produced and flowback water on the pad, and zero-liquid discharge incorporating ultrafiltration, reverse osmosis, and evaporation/crystallization technologies.

“Quite frankly, we’ve been curtailing our capital spending in this down time and maximizing usage of the equipment inventory that we have, but we are also doing a lot of permitting work for new central and satellite facilities,” Sharma said. “We want to be prepared for when the market does come back.”

About the Author: Jeff Gunderson is a correspondent for Industrial WaterWorld. He is a professional writer with over 10 years of experience, specializing in areas connected to water, environment and building, including wastewater, stormwater, infrastructure, natural resources, and sustainable design. He holds a master’s degree in environmental science and engineering from the Colorado School of Mines and a bachelor’s degree in general science from the University of Oregon.

Innovative Filter Helps Save Big, Recycle More

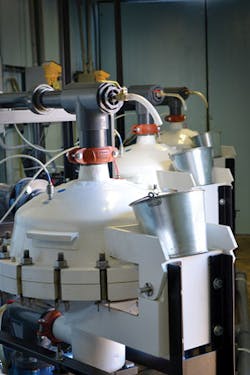

Companies wanting to recycle produced water in their oilfield operations first need to remove suspended solids as much as possible. Quite often, traditional bag filters cannot deliver the finer levels of filtration required without clogging issues.

Advanced high-solids filters consistently handle fine particles down to 15 microns and high solids from 100 to 10,000 mg/L. The benefits of minimal filter changes, higher water recovery, no backwashes, less sludge and the need for no to low chemicals not only add up to higher uptime but also lower consumables, maintenance, hauling and disposal costs.

Consequently, when an oilfield company asked its water infrastructure provider for help in reducing water costs, they chose TEQUATIC™ PLUS Filters. Advanced high-solids filtration was selected due to its ability to reliably filter oily, high-solids water without constant plugging, and the offer of continuous self-cleaning and fouling resistance. The provider also required the operational flexibility of these self-cleaning filters, including remote monitoring via mobile device.

The resulting water treatment system helped the oilfield operator recycle nearly 100 percent of its produced water, saving around $2 per barrel of water, and reducing operating costs by an estimated 60 percent.

Learn more at www.cleanfiltration.com.