The U.S. pharmaceuticals and drugs sector is a huge market. It generated a massive $213.75 billion in 2003 increasing to $239.4 billion in 2004 for a growth rate of 11.9%. The sheer size and wealth of the research-based pharmaceuticals industry and rising level of product development and associated sizeable research expenditure will continue to create challenges and opportunities for suppliers of water and wastewater treatment equipment.

Process water quality management is of paramount importance in pharmaceuticals manufacturing and is also a clear prerequisite for the sterilization of containers or medical devices in other healthcare applications. Outstanding quality is essential to meet the high standards and regulations associated with direct product ingredients for medicine, i.e., water for injection (WFI).

Additionally, in some cases, water may have been formed as part of a chemical reaction. The process wastewater generated by the production processes contains a variety of conventional parameters (e.g., BOD, TSS and pH) and other chemical constituents.

The United States has a rigorous set of standards for pharmaceutical water purification and quality standards. These standards are governed by the United States Pharmacopoeia-National Formulary (USP-NF) publications and current Good Manufacturing Practice (cGMP) as required legally by the U.S. Food and Drug Administration (FDA).

Frost & Sullivan interviewed executives at 76 pharmaceutical plants and discussed their opinions of current water and wastewater treatment practices, of suppliers and new entrants, and the main purchasing criteria among other factors in product selection.

Who is the end user?

The principal end-user groups in the pharmaceuticals industry are defined as establishments involved in manufacturing, fabricating or processing drugs in the pharmaceutical preparation for human or veterinary use. The products included are primarily intended for final consumption, such as ampoules, tablets, capsules, vials, ointments, medicinal powders, solutions and suspensions. Products of this industry consist of two important lines, namely pharmaceutical preparations promoted primarily to the dental, medical or veterinary professions and pharmaceutical preparations promoted primarily to the public. All hospitals are excluded, as they tend to present a slightly different customer base with general hospital water requirements.

The geographical distribution of facilities in this end-user group is widely dispersed among the states. The U.S. pharmaceuticals industry has traditionally been concentrated in New Jersey, California and New York. These three states account for about a third of facilities, employees and value of shipments - and are also some of the ideal locations to target for water and wastewater opportunities.

State of the Industry

Looking forward, the pharmaceuticals industry will face significant challenges in 2005, with a key challenge being identifying means of improving industry productivity. Unpromising research and development projects need to be terminated earlier in the clinical development process to improve overall productivity and reduce wasted investment. Potential strategies here include use of biomarkers and computational biology to predict a drug’s efficacy or toxicity in the preclinical phase before investment in clinical development is used.

With recent safety concerns and high profile product withdrawals, there are also concerns that regulatory agencies will tighten up safety and efficacy testing requirements. A particular focus will be on the application of pharmacogenomic techniques to improve indications of safety, but the advent of such techniques in the long run will improve industry productivity as more pharmacogenomic data is collated. Pharmacogenomics is a biotechnological science that combines medical, pharmacology, and genomics techniques and is concerned with developing drug therapies to compensate for genetic differences in patients that cause varied responses to a single therapeutic regimen.

Drivers & Restraints

The three most important drivers for on-site water and wastewater treatment demand are ultrapure water requirements, legislative forces and further upgrades. The three most important restraints for demand are the small scales of water requirements, use of municipalities for wastewater treatment and growing maturity particularly in a moderate replacement market.

So what problems does the end user face? According to the sample in this survey of North American pharmaceuticals facilities, TOC is by far the biggest problem faced. When it comes to selecting a supplier, high reliability and better water quality are the most important selection criteria for input water technologies.

Technology Adoption

Looking at the patterns and rate of uptake of the four main treatment categories - namely process water treatment, ultrapure water treatment, wastewater treatment and sludge treatment - Frost & Sullivan found of the four segments that the installation of process water treatment technologies was the highest. Installation levels for sludge treatment technologies are the lowest. In addition:

• Nearly a third (30%) of pharmaceutical manufacturing facilities had installed all four technology groups.

• Ongoing implementation is higher among process and ultrapure water treatment technologies than among wastewater and sludge treatment technologies.

• In general, high intent to implement these technologies in the future indicates opportunities for suppliers.

• Investment levels in both water and wastewater treatment technologies are expected to grow.

Selecting Suppliers

So what do pharmaceutical manufacturing facilities look for when selecting suppliers? Selection criteria vary somewhat by technology type; however, technical expertise and high service quality have high mentions across technologies.

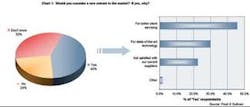

Still, less than half of respondents are willing to consider new entrants for buying wastewater treatment technologies, revealing a strong satisfaction with current suppliers and also, to some degree, strong brand loyalty. Chart 1 shows a breakdown of these reasons in favor of considering a new entrant.

Those that would consider a new entrant mention “better client servicing” (46%) as by far the main reason for considering a new entrant. The other prominent mentions include “state-of-the-art technology” (30%) and “not satisfied with current suppliers” (23%). New entrants need to position themselves as providers of superior service quality to gain a foothold into this market. Incumbents can preempt new entrants through a first-mover strategy of either improving their current service quality or by introducing state-of-art technology ahead of new entrants.

Reasons for dissatisfaction are varied. Price, which had relatively fewer mentions in the criteria for selection of supplier, is a prominent reason for dissatisfaction.

Siemens/USFilter and Millipore are strong players among the process water and ultrapure water technology segments. Other prominent suppliers in these two segments include Aquatech International Corp., Christ Water Technology Group, Culligan Industrial Group, Cuno, GE Water & Process Technologies, GEA Filtration, Infilco Degrémont, ITT Fluid Technology, Koch Membrane Systems, Nalco Company, Ozonia, Pall Corp., Sartorius Corp. and Zenon Environmental.

As competition grows fiercer and importance of upgrades and facilities rises, though, the benefits of evaluating potential new suppliers are becoming more prominent. Particularly, while many on-site treatment plants consist of various components and pieces of equipment, customers active in the advancing replacement markets are more likely to take on new suppliers in addition to, or even in place of, current ones.

Investment in Wastewater

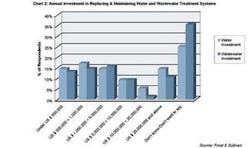

Chart 2 shows annual investment in replacing and maintaining water and wastewater treatment systems. The majority of those who revealed their investment figures mentioned annual investments of under $5,000,000. Nearly half (46%) of the respondents mentioned their investment levels had grown marginally over the past years. A similar proportion (49%) mentioned their investments would grow marginally in the future as well. Overall, nearly two thirds (65%) mentioned that their investment levels would increase in the future.

Outsourcing Trends

An anticipated trend is an increase in outsourcing to specialized contract manufacturing organizations, as diversified product pipelines will require more specialized manufacturing facilities, which require high capital investment. As observed in recent years, a trend in outsourcing to countries such as India and China to reduce manufacturing costs will continue.

All signs point to single-digit growth for the U.S. pharmaceutical industry in 2005, something that hasn’t happened since 1994. In the long term, as the effects of the Medicare prescription drug benefit on pricing take hold, more blockbusters go off patent and the FDA places more emphasis on safety data, pharmaceutical companies must strive for pipeline excellence to maintain high levels of profitability as they operate in an increasingly treacherous competitive environment.

Conclusion

There are a number of opportunities available for companies to work in the water and wastewater treatment space of the hugely important pharmaceuticals market. New entrants will need to position themselves as providers of superior service quality to gain a foothold. Incumbents can preempt new entrants through a first-mover strategy of either improving their current service quality or by introducing state-of-art technology ahead of new entrants.

About the Author: Matthew Barker is a senior industry analyst and program manager for the Water & Wastewater Treatment Unit of Frost & Sullivan. With a bachelor’s degree in environmental science from the UK’s Lancaster University, Barker has spent nearly six years analyzing the markets for technologies, plants and services within the water and wastewater industries sector. He initially worked from the company’s London office, before transferring to the San Antonio headquarters in May 2003. Contact: [email protected].