LONDON, England - Although the US and rest of the world remains in shock at the surprise result of the US Presidential election, business continues as usual with the sale of GE’s water business.

At the end of October GE announced it would be selling off the Water & Process Technologies division following a proposed merger of the its Oil & Gas business with Baker Hughes (read story).

GE plans to purchase a majority stake in the oil services firm for an alleged $7.4 billon, eventually folding the company into its own oil & gas business to create a $32 billion a year portfolio.

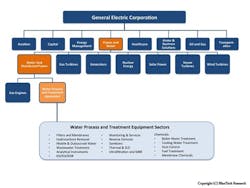

With a target sale date less than eight months away to offload its water assets, time is ticking to find a buyer who can handle GE’s mixed technology offering, including ZLD (zero liquid discharge), MBR (membrane bioreactor) and EDR (electrodialysis), among others.

One potential buyer could be US global science and technology company, Danaher Corporation, according to Paul O'Callaghan, CEO of water market analyst company, BlueTech Research.

He told WWi magazine: “I think a likely potential buyer is Danaher. They have a strong position in water already, Pall was also a large acquisition.”

He said: “An outsider play might be an Oil & Gas company seeking to adapt and diversify to future proof in a low carbon economy…I think it's possible a Chinese player would buy the company, but it's such a mixed assortment of different things, it's hard to know.”

A Fortune 200 company, Danaher completed an acquisition of Pall Corporation in August last year. Before that, it acquired ultraviolet treatment (UV) company Trojan Technologies for CAD$247 million in 2004.

The company’s environment and water quality group also includes industrial wastewaterchemical company, ChemTreat, flow instrumentation firm McCrometer and analytical instrument company, Hach.

In its third quarter 2016 results, Danaher reported revenues of $4.1 billion, with net earnings of $402.6 million.

Speaking to WWi magazine, David Lloyd Owen, managing director of consultancy Envisager, said: “Danaher could be a good bet. Water is closer to the company's heart, rather than one bit of a vast portfolio. It is big enough to buy it without undue fiscal pain. The acquisition would be large enough to be taken very seriously indeed.”

Danaher was unavailable to comment.

Ralph Exton, chief marketing officer, water and process technologies for GE Power, said: “We do not speculate or comment on who may be the eventual buyer of the business.”

It was in 2002 when GE entered the water treatment market, with a $1.8 billion purchase of BetzDearborn from Hecules. Four years later it grew this business with the high profile purchase of membrane manufacturer, Zenon Environmental, for $650 million.

“The margins were always a challenge for GE in water,” said BlueTech Research’s O'Callaghan. “They like capital intensive high barrier to entry markets where they occupy a dominant position in the top three. Operating in a fragmented low margin market was always going to be something GE would struggle with.

“However, the GE water business really started to find its groove in the past 24 months. There was a very clear vision to get into low energy and energy neutral wastewater treatment. The strength in IoT (Internet of Things) and predictive analytics also help future-proof the business. While GE corporate and water may part ways, the water business itself is solid, and was certainly finding its mojo.”

It was in the last 12 months that GE created a new business unit to house GE Water and Process Technologies, called GE Water and Distributed Power.

The company set out a vision to get into low energy and energy neutral wastewater treatment space, following an acquisition of UK anaerobic digestion company Monsal. The power-water alignment could enable GE to use its Jenbacher gas engine in the anaerobic digestion projects.

However, as O’Callaghan added: “While this makes for a good story, the alignment was somewhat artificial and was also partly driven by a need to create a profit & loss (P&L) centre greater than $2 billion. The combination of Water and Process Technologies with Distributed power, provided a P&L with the scale required within GE Power and Water.”

The company as a whole has moved away from undertaking EPC (engineering, procurement & construction) contracts and is focused on providing packaged and mobile systems.

###

Read more

GE looks to sell its water & treatment process technologies business

GE to acquire Monsal to expand wastewater offerings, generate renewable energy

About the Author

Tom Freyberg

Tom Freyberg is an experienced environmental journalist, having worked across a variety of business-to-business titles. Since joining Pennwell in 2010, he has been influential in developing international partnerships for the water brand and has overseen digital developments, including 360 degree video case studies. He has interviewed high level figures, including NYSE CEO’s and Environmental Ministers. A known figure in the global water industry, Tom has chaired and spoken at conferences around the world, from Helsinki, to London and Singapore. An English graduate from Exeter University, Tom completed his PMA journalism training in London.