By Dieter Rothenberger

Multi-utilities promise to reap benefits for companies and customers, but are these advantages marketing hyperbole or reality?

Large corporations, such as RWE in Germany and Suez and Vivendi of France, are promoting the multi-utility concept, a recent trend in the utility sector in which one company provides various utility services. The combined production of these services promises to reap efficiency gains and to improve customer focus, making the multi-utility concept attractive to providers and customers. But do the advantages of the "new" concept materialise in reality? What can be learned from German multi-utilities on the municipal level, combining electricity, water, gas, district heating or public transport within one city, which have existed in Germany for more than one hundred years? Where are the important synergies of an integrated provision of utility services?

Governments worldwide try to increase efficiency, improve quality and lower cost in providing infrastructure services, such as electricity, gas, water or telecom, through deregulation. One reaction of various utility companies to this changing environment is to combine various utility services and enter the market as a multi-utility company. Internationally, the term "multi-utility" is associated with big multinational companies, active in more than one utility sector. Companies like United Utilities or Scottish Power Plc., France's Vivendi and Suez or Eon and RWE in Germany have expanded enormously in national and international energy and water markets during the last ten years. This expansion was partly supported by adopting a multi-utility strategy, offering various utility services for industrial customers, municipalities and household customers.

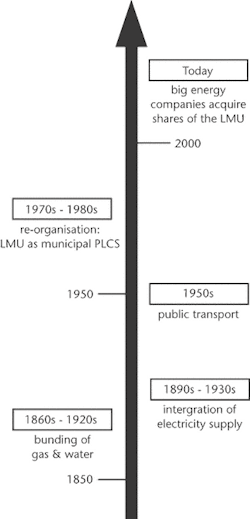

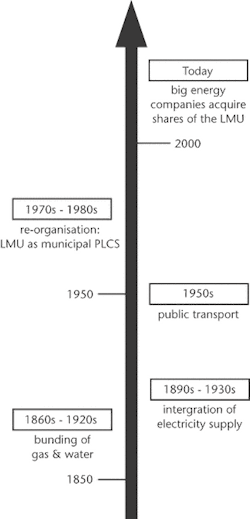

Much less well known are the precursors of these "new" multi-utilities — the so-called "Stadtwerke" in Germany, which have been the multi sector providers at the municipal level since the late 19th century. The approximately 900 municipal multi-utilities offer electricity, gas, water and district heating for "their" respective municipality and play a significant role in distributing electricity, gas, district heating or water. Their market share varies between 31% in electricity and 73% in gas, while in water they distribute more than 50% of total drinking water supplied to customers. The German water market faces a peculiar situation. It is highly dispersed with more than 7,000 water utilities. About 550 of them, which account for the largest ones, provide water and at least one additional product such as electricity, natural gas or district heating.

Around 1970, widespread corporatisation of the utilities started when organisations were re-founded as municipally owned Plcs. This means that utilities adopted a private-like management style with responsibility for all operational tasks, including budgetary decisions and capital investment. Political control was institutionalised in supervisory boards where politicians and occasionally other local stakeholders had to decide strategic issues.

The German electricity market opened to private investors in the late 1990s, and many experts predicted that only 50 of the 900 municipal multi-utilities would survive the fight for market shares. Now, almost five years after the introduction of competition it seems that many municipal utilities have actually benefited from liberalisation. Since they own the distribution network, they are paid network access charges from competitors supplying customers within their outreach. The historical reason for the integration of different service companies is the assumption that a multi-utility can deliver the same output more efficiently than individual companies. Synergies do exist. These synergies stem from so-called economies of scale and economies of scope. Economies of scale are efficiency gains due to mass production and the size of the company, e.g. better procurement conditions or the use of more sophisticated, but also more efficient information technology systems. This is particularly relevant for relatively small municipalities, where individual utilities would not be able to reach optimum company size.

Economies of scope are induced by the common production of two different goods, e.g. joint pipe laying for gas and water or centralised metering and billing.

The idea of combining various sectors within one company is common for both "new" and municipal multi-utilities, but there are also major differences. The big stock market listed companies are active in and for municipalities worldwide, and can reap economies of scale and benefit from experiences in many projects and many places. The drawback of these companies is that they seldom integrate energy and water supply within the same city or region. Municipal multi-utilities are normally limited to one service area, thus cannot benefit from lessons learned in many other projects; however they know their area and customers well, are locally embedded and often highly accepted. Since they provide multiple services within the same area, they can mainly reap economies of scope.

What are the benefits for companies and customers? First of all, the effects are reduced cost and possible tariff reductions. Examples for synergies can be found in joint meter reading, central purchasing, optimised fleet management or stock-keeping. Cost reduction and performance improvements are also to be expected in administration.

In a recent study, 75% of the companies estimated high cost savings in marketing and sales and 48% in billing and collection. For IT systems, between 10% and 30% of the companies expected major cost savings in human resources management or purchasing.

First estimations undertaken in LMUs operating in four areas (water, gas, electricity and district heating) came to the conclusion that a reduction of up to 25% of the staff cost and approximately a third of meter reading, billing and collection cost are possible. About 25 per cent of the total cost for expansion, operation and maintenance or repair of the grids can be saved from technical operations - if the various services are performed within the same service area. A study by British Gas and Electricity industries found that utilities combining gas and electricity services may achieve cost savings of up to 10 per cent.

Another point made by companies and business analysts is the possibility for cross-selling, since multi-utilities are able to deliver one-stop-shopping and integrated full service packages, tailor-made to customer requirements.

To evaluate the synergies from customer viewpoints, one has to differentiate between household and industrial customer. For industrial customers, added services, including contracting or energy-saving measures, seem as important as bundling energy products provision.

According to various recent studies, household customers appreciate the bundling of energy services more than additional services (e.g. finance) or a combination with telecommunications. Results also show that customers are less willing to change the electricity supplier just because they could get a bundled product. Some of these findings are also supported by the very brief appearance of Avida in Berlin, a subsidiary of Berlinwasser. Avida wanted to provide service-based bundle products in water, energy and telecommunications for household customers and businesses (not industry) in Berlin. One reason why the project was stopped after just a few months was low demand and customer interest. Only some 500 customers signed a contract during the first six months; the target was to achieve 10,000 within one year.

Other results indicate that customers that already have a multi-utility provider show a certain resistance to switch the electricity supplier, even if costs are lower. Given these findings one can assume that the bundled product plays a less important role as an impetus for change, especially if the customer already is with the local multi-utility. This certainly is one reason - beside the profits from network access charges - which helps municipal multi-utilities keep their position even in a liberalised and competitive energy market.

Summary

The multi-utility strategy can be seen as a recent fashion of major players in the utilities sector - but also as a traditional approach on a local level in Germany, Austria and Switzerland. Reaping benefits from economies of scale and of scope, they create synergies in technical and administrative operations, which are mainly relevant for locally embedded multi-utilities serving the same customer with more than one product. The benefits on the customer side remain unclear; the willingness of customers to change suppliers seems to be relatively low if they are already served by a multi-utility. Since this is mainly the case for municipal multi-utilities, RWE and other big players are increasingly acquiring shares of these municipal companies.

Therefore, multi-utility strategies can reduce cost and prevent switching supplier in a liberalised sector - but this crucially depends on the regional overlap of service areas for different products. Hence, municipal multi-utilities, although being seen as old-fashioned, seem to make the most of the multi-utility advantages and thus could prove to be successful even in the future.

Author's note

The next issue of WWI will feature an assessment of pros and cons of the MU strategy from the regulators' viewpoint. Author Dieter Rothenberger of the Centre for Innovation Research in the Utility Sector (CIRUS) in Kastanienbaum, Switzerland will also discuss the applicability, risks and benefits of multi-utility organisations in developing countries.