Ballast Water Treatment Market Remains Buoyant

Driven by international regulations, the market for ballast water treatment systems is predicted to grow to over $34 billion. Tomasz Zagdan looks at the costs involved in purchasing a system, how companies such as Veolia Water Solutions & Technologies are getting involved and the separation and disinfection process.

Cumulative investments of over $30 billion are expected to be made into ballast water treatment systems (BWTS) over this decade, according to a study recently conducted by Frost & Sullivan. Investments will concern more than 57,000 maritime vessels that will require a ballast water treatment system to be installed during the period 2009-2020, driving massive requirement for system orders.

Demand for BWTS has emerged following the adoption of the International Convention for the Control and Management of Ship’s Ballast Water and Sediments in 2004. This convention aims to address the issue of the so called ‘invasive marine species’- aquatic organisms carried around the world in the ballast water tanks of ships.

Invasive marine species discharged into a new environment may become invasive and endanger the native ecology, threaten the local economic activities such as fisheries or even bring about diseases or human fatalities. According to the International Maritime Organization (IMO), maritime ships transporting over 80% of world’s commodities could carry between three and 12 billion tonnes of ballast water around the world each year. Losses incurred by economy as a result of the invasive species are equally staggering and in the USA alone it is estimated by the IMO to be as high as $138 billion annually.

In order to address this enormous environmental challenge, the IMO Convention adopted in 2004 set an obligation for the ship owners to meet strict water quality standards referred to as D2 standard in the legislation and determined the maximum volume level of invasive organisms allowed in the discharged water. Since ships have not been designed and equipped to treat ballast water, installation of an additional ballast water management system onboard is necessary to ensure conformity with the standards.

To ensure effective implementation of the legislation, the IMO Convention has set a roadmap for the ship owners to achieve compliance. Specific timelines have been provided for the new build and existing ships, additionally differentiated depending on the capacity of the vessel’s ballast water tank. Importantly, the agenda outlined in the IMO Convention will influence the timeline for investments of ship owners to install BWMS over the next ten years.

Although the IMO Convention was adopted in 2004, it needs ratification by 30 states representing 35% of the world’s merchant shipping tonnage to be effective. The current status of the Convention is that it has been ratified by 21 states representing about 23% of the merchant fleet tonnage.

Until the D2 standard becomes compulsory, ship owners are encouraged but not required to install a ballast water treatment system onboard their ships. As an interim means ship owners without installed equipment need to perform ballast water exchange, referred to as the D1 standard in the legislation. This does not ensure the same performance as treatment but serves as a temporary solution to minimise the impact of alien invasive species.

The Convention adopted by the IMO is not the only piece of legislation compelling ship owners to treat ballast water before discharge. Several European countries, Australia, the USA or even certain US states (e.g.: California) are also in the process of developing or enforcing similar legislation. Some regulatory bodies (e.g.: the US Coast Guard) are considering to impose stricter standards than the IMO. However, the IMO Convention is the only piece of legislation that has a truly global coverage and is used as a reference point for the remaining regulators.

Pricing challenge

One of the key questions both for the ship owners and system suppliers on the market is the pricing of ballast water treatment systems. System suppliers surveyed by Frost & Sullivan admitted that rather than a cost plus calculation model, they aim to adjust prices to systems that are already available. The analysis carried out by the company has also shown that the price level is still very unstable and reflects the early stage of the market development.

Compared to the data indicated in some of the commonly available publications (e.g. the Ballast Water Treatment Technology Guide by Lloyd’s Register from September 2008), prices have increased substantially. Capital costs associated to purchasing a system dedicated for a pump capacity of 200-250 m³/h range from $175,000 up to $490,000. Estimated price for larger systems with a pump capacity of around 2000 m³/h, range from $650,000 up to nearly $3 million.

Frost & Sullivan believes that the price levels will continue to fluctuate in the short-medium term and reach some level of stabilisation by 2015 when the market gains momentum and competition becomes more intense.

More than $7 billion in revenues a year at the peak of market

The total market potential for ballast water treatment systems of $34 billion is not evenly spread across the whole forecast period (2009-2020). As the legislation is yet to become effective, the overall market demand is on hold as the overall market awaits the legislative driver that will get the ship owners to purchase and install ballast water treatment systems.

Business opportunities

In response to the challenge of treating ballast water for a broad range of ship types and sizes, suppliers of treatment technologies have started to develop and commercialise treatment solutions. The scale of potential opportunities from sales of the ballast water treatment systems has already attracted close to 50 vendors with solutions at various stage of development or commercialisation with close about 100 component suppliers.

The competitive environment of ballast water treatment suppliers comprises companies with varying industry backgrounds and includes: traditional suppliers of marine equipment (e.g.: Alfa Laval), system suppliers originating from the water and wastewater industry (e.g.: Veolia Water Solutions & Technologies), shipbuilders (e.g.: Hyundai Heavy Industries) and even the ship owners (China Ocean Shipping Company, COSCO).

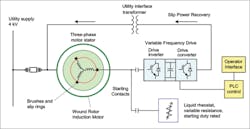

Ballast water treatment systems are largely customised to the requirements of the shipboard conditions. Technology combinations applied in the system vary but typically include two stages: physical solid-liquid separation (e.g.: disc and screen filtration, hydro cyclones) and disinfection (using chemicals, UV, ozone, ultrasound and heat treatment and others).

Certification and potential entry barriers

Prior to commercialisation, systems need to undergo a testing and certification process which proves its effectiveness in line with requirements specified in the Convention and ensures that the adverse implications on the environment are minimal. The approval procedure includes a land based and a shipboard testing of the equipment, typically done by one of the classification societies. The process is both costly and time-consuming (up to two years) and constitutes a major market entry barrier for the potential suppliers.

As of December 2009, only seven of nearly 50 suppliers have finalised their type approval process. Given the early stage of the market development with only few type approved systems commercially available and the actual number of working installations being scarce, it is risky to evaluate the market prospects for specific solutions. However, taking into the account the diversity of the world’s maritime fleet, comprising vessels of varying construction, purpose and size, it is unlikely that a single best available solution will meet the universal requirements of all ships.

After years of sluggish progress, the ratification process has witnessed significant acceleration in 2009. This is anticipated to be finalised over the next one to one and a half years followed by enforcement 12 months after the completion of the ratification process. Frost & Sullivan expects the market to gain momentum from 2012, once the legislation is ratified and enforced.

Future growth

The global ballast water treatment equipment market presents a massive growth potential for system vendors. Opportunities on the market exist for existing equipment and component suppliers or companies in the process of the product development. Among the existing system, suppliers may include small companies established specifically for the purpose of developing and commercialising ballast water treatment equipment.

A couple of companies have already acquired venture capital financing, which can be a good indicator of the market potential for ballast water treatment systems. In addition, the majority of system suppliers, including the medium and large players, are still in the process of establishing their sales and distribution networks and also looking for partners with established position and strategic geographic presence in the global marine industry.

Companies will need to extend best practices beyond their product design set-up and take the necessary strategic initiatives of selecting and establishing strategic partnerships and setting up effective distribution and servicing channels. This will be critical in order to be ready to scale up, especially during the peak of the market for a few years during 2015-2020.

Author’s note:Tomasz Zagdan is an analyst (environment markets) at Frost & Sullivan. For further information please contact Fredrick Royan, research manager (water markets) at Frost & Sullivan at: [email protected].

More Water & WasteWater International Current Issue Articles

More Water & WasteWater International Archives Issue Articles