Water treatment is quickly emerging as one of the most significant challenges facing the offshore oil industry. As the sector responds to pressure to increase oil recovery from existing reserves, novel water-based technologies are gaining acceptance. Lisa Henthorne looks at the case for standalone vessel-based desalination units.

With discoveries moving farther offshore, the price of oil, exploration and production have increased. As a result there is heightened focus in the oil and gas sector on increasing production from existing reservoirs. With large volumes of water used in the production process, water is increasingly moving from an operations issue to one of strategic significance.

The oil and gas industry also faces increasing pressure to manage its environmental footprint – including water management offshore. This is even more critical in deeper waters, where water treatment can be extremely expensive – due to footprint and platform weight requirements – and logistically difficult, with limited options and flexibility. As a non-core capability for oil producers, water treatment is often considered the weak link in oil production, in both upstream and downstream operations.

These drivers, as well as increased water scarcity, have pushed oil companies to use water more sustainably, driving the concept of water reuse across the industry. As a result, innovative, environmentally focused and reliable methods of meeting water treatment demands capable of operating in a highly challenging water treatment environment must be developed to meet the growing demand. The goal: minimise operating costs, maximise footprint and energy efficiency, while maintaining production and/or increasing oil recovery rates.

Seawater for Injection and sulfate reduction

The majority of water use offshore is related to waterflooding into reservoir formations to maintain pressure and to force oil out of the production wells. The general term Improved Oil Recovery (IOR) is used to describe waterflood management and any more sophisticated methods aimed at improving recovery. The purpose of IOR is not only to restore formation pressure, but also to improve oil displacement or fluid flow in the reservoir. The term Enhanced Oil Recovery (EOR) is a subset of IOR, and includes tertiary methods to increase recovery of oil, ranging from thermal methods, waterflood based chemical and microbial addition and gas injection.

Out of all the IOR methods currently in use in offshore oil and gas operations, the most common is waterflooding. Historically, there have been two key areas where water treatment has been critically important in waterflooding. Namely, seawater flooding filtration and sulfate reduced flooding including filtration and membrane treatment.

Seawater is widely used as an injection fluid despite being recognised as having potentially value eroding properties. The most widely recognised problem is scale formation from chemical incompatibility of the injected seawater (high sulfate) and the original formation brine (barium, strontium). In reservoirs, which contain a substantial barium or strontium content, seawater injection will cause the naturally occurring sulfate contained in the seawater to precipitate with the barium and/or strontium, and can eventually diminish the output of the production wells. Also, sulfate-reducing bacteria in some reservoirs can feed on sulfate in seawater, thereby producing hydrogen sulfite and 'souring' the well or reservoir.

As a result, a mitigating trend in waterflooding is the removal of sulfates from seawater to prevent souring and scaling, referred to as the sulfate removal process (SRP). This process involves desulfating the seawater using specialised nanofiltration (NF) membranes, while maintaining a high salinity.

DOW Filmtec and Marathon first introduced this membrane system in 1991 and by the end of 2008, over 44 SRP systems were brought online on offshore production facilities around the world. Despite this success, a major challenge remains with SRP systems - the significant capital investment for platform space and weight which are required for installation. Furthermore, to retrofit a platform to include SRP is extremely expensive.

Produced water

The oil and gas sector also has substantial wastewater treatment needs, related to the produced water brought to the surface along with the oil or natural gas. Growing environmental restrictions in some areas of the world is driving treatment and reinjection of produced water. At a minimum, produced water has to be separated from the oil, and the oil often has to be further cleaned before it can be offloaded or transferred into a pipeline. The produced water will also undergo several treatment steps before it is discharged to the sea or reinjected.

As oil fields age, the water cut, that is, the amount of water volume produced per oil volume, increases. Therefore the economics are one of diminishing return as less oil revenue is generated and more operating costs are incurred from increased water treatment needs.

IOR/EOR and the push to improve oil recovery

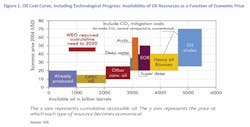

IOR will play a critical role in tomorrow's oil production, as existing asset production dwindles and exploration capital is further stressed. Adoption and further development of EOR will be strengthened by oil price stability, now a commitment by Saudi Arabia and OPEC at the recent G20 Summit. Figure 1 demonstrates the oil price point at which EOR becomes viable, at between $20-50/bbl in 2004 dollars. It is important to note that offshore EOR is primarily limited by facility constraints. As the industry responds to pressure to increase oil recovery from existing reserves, novel water-based methods of EOR are gaining acceptance, including low salinity water flooding.

Figure 1. Oil Cost Curve, Including Technological Progress: Availability of Oil Resources as a Function of Economic Price

Low Salinity Waterflooding

Since the late 1990s, there have been numerous laboratory tests and field studies where injection of low salinity water has resulted in increased oil recovery. This was demonstrated by BP on core samples and in the Alaskan North Slope fields. Shell Oil Company has also progressed the concept under the trademark Designer WaterTM. Further testing and reviews are being undertaken by a number of other national and international oil companies.

In many cases, low salinity water could result in more effective oil recovery both in terms of the oil production profile (the rate of oil production) and the ultimate recovered volumes (higher recovery factor). Pilot data for low salinity water injection shows results which vary from 2% to 40% increases in waterflood efficiency and recovery, depending upon the reservoir and composition of both the injection and connate water (natural reservoir water).

Figure 2. The Water Treatment and Recovery Vessel (WTR) for Applications in the Offshore E&P Sector

In concept, low salinity injection changes the wettability characteristics of the reservoir rock. In reservoirs with high salinity formation water, injection of low salinity water will generally shift the properties of the reservoirs to a state of water wetness, increasing the microscopic sweep efficiency, and thereby increasing the potential oil recovery. But injection of water too low in salinity will destabilise the clay minerals, which act to bind the oil to the reservoir rock, resulting in clay deflocculation and formation damage.

Furthermore, the salinity of the injection water greatly impacts the viscosity, or thickness, of polymer floods used in CEOR applications. According to recent studies, when low salinity water is used instead of seawater, five to ten times lower polymer concentrations are required to achieve the same enhanced recovery, making polymer CEOR a more cost effective EOR process by reducing the polymer, storage, handling and facilities cost.

As important as CEOR is likely to be to offshore oil production, treatment of the resulting produced water is just as important. Emulsions must be broken down in order to treat and discharge the produced water. Chemicals and technologies that accomplish emulsion treatment are sophisticated, requiring a level of treatment expertise not presently existing with producers. Currently, there are no offshore low salinity systems online but the market is moving rapidly to embrace this technology because of the economic impact of the potential additional recovery that can be achieved.

Meeting the new demand

In recognition of the possible economic impact of the additional recovery over the life of the field, some recent offshore developments are now incorporating low salinity membrane technology and making provision for water injection facilities at the initial design stage.

However, the pressures to reduce initial capital costs, combined with the intrinsic uncertainties in predicting oil field response to the low salinity injection scheme over decades can result in decisions being made not to invest in such facilities upfront. In such cases, retrofitting platforms or floating production units may not be viable due to weight, space and power constraints on existing platforms and stand-alone vessel-based desalination offers economical benefits.

Although water is an over-arching issue for our planet in the 21st century, water supply for drilling, production, IOR, and treatment of produced water are critical challenges for the oil and gas industry, driven by new demands and environmental stewardship. The industry is recognising that it needs to improve the handling of water-related issues and minimise its operational water footprint.

The concept of outsourcing water utilities, chemical storage, power generation and other services, to assist oil producers enhance or maintain recovery of reservoirs, is new and novel. However the challenges associated with offshore implementation of innovative water-based recovery methods and other water treatment needs is requiring outsourced, turnkey solutions.

These solutions must address footprint, capex, and environmental requirements, as well as water treatment management, a non-core capability for producers.

Author's note:Former president of the International Desalination Association, Lisa Henthorne is senior vice president and chief technology officer at Water Standard, a water treatment and services provider.

More Water & WasteWater International Current Issue Articles

More Water & WasteWater International Archives Issue Articles