MBR Technology Propels China into Water Reuse Era

A surge in water reuse technologies is expected in China, spurred by requirements for wastewater treatment plants in Beijing to become reclamation facilities by 2015. What role will Membrane Bioreactor (MBR) Technology play and how has it progressed in the country to date? Industry analyst Jennie Peng investigates.

The average urbanisation rate in China reached 46.6% in 2009. With this figure expected to increase up to 61.9% by 2030, the ever increasing urbanisation of China's cities and towns continues to accelerate water demand for agriculture and domestic uses.

Wastewater reclamation has become one of the focuses of the national environmental protection plan for the 12th five year period (2011-2015), set out by the Ministry of Water Resource. This includes the target municipal wastewater reclamation rate of 10% by 2015 (note the average was 8.5% in 2010). It also emphasizes the wastewater reclamation rate for recycling and reuse purposes, as well as increasing municipal and industrial wastewater treatment rates.

The benefits of wastewater recycling and reuse are clear: generating a valuable renewable stream of water resource for non-potable purposes. But this process isn't exactly new in the country. The northern part of China was the first to adopt wastewater reclamation technologies to recycle municipal wastewater. Being the capital of China, Beijing has highlighted its best practice in wastewater reuse with 6,500 million cubic metres of recycled water consumed in 2008, accounting for about 18.4% of the total water supply in the city. Eleven cities in China (including Beijing, Tianjin, Tsingtao, Ningbo) issued more than 20 local policies to regulate the water reclamation market. Furthermore, the 11th five year plan has targeted the daily reclaimed water treatment capacity to reach 6.8 million tons/day by 2010.

For the past six years, MBR applicability in China posed tremendous growth with the municipal sector being the dominant end-user segment. Large scale municipal wastewater reclamation and upgrading projects started to boost in early 2007 with Beijing Wenyu River Wastewater treatment plant (100,000 m3/day) and Hubei Water Reclamation Plant (165,000 m3/day) being the signature projects in the region.

Successfully holding three events - Olympic Games in Beijing in 2008 and both the Shanghai Expo and the Guangzhou Asia Games in 2010 - provided another important growth driver for the MBR market. Also, MBR technology was part of a successful tender for an ancillary water treatment facility for reclamation and reuse purpose, which went very well with the theme of 'Green and Future in Now'. As a result, installed capacity of the MBR market in 2010 worked out at around 1.1 million m3/day, according to estimates from Frost & Sullivan.

Government actions and resolutions

Before these three pivotal events, the Chinese government realised the serious water crisis in North and East parts of China, and issued technical policy as well as reclaimed water standards for different applications to further regulate the reuse market of reclaimed wastewater. This was referred to as the 'Technical policy on municipal water reclamation (2006)'.

This provided technical policy on research and development, marketing and promotion of the technologies as well as the engineering practices. It pointed out the overall goal for municipal wastewater reclamation for reuse is to fully utilise the municipal wastewater resources, reduce the load of water pollution, conserve water and increase the utilisation rate of water.

It also set out that by 2010, the direct reuse rate of reclaimed municipal wastewater should be 10-15% of the municipal wastewater discharge for Northern water scarce cities. The same criteria is 5-10% of the municipal wastewater discharge for Southern coastal cities. And these two criteria will rise to 20-25% and 10-15% for Northern and Southern cities respectively by 2015.

Besides the technical aspects for water reclamation (referenced on page 22), national and regional plans helped to further translate the increase of wastewater reclamation rate into detailed targets.

According to 'Municipal wastewater treatment and reclamation facility construction plan for 11th five year plan', the wastewater reclamation rate aimed to reach 20% for northern water scarce cities by the end of 2010.

Furthermore, the Beijing Water Authority says that all of the wastewater treatment plants in Beijing are required to be upgraded into wastewater reclamation plants by 2015, meeting the reclaimed water discharge quality for reuse purpose. Some of the plants are even required to upgrade their discharged water quality to meet the standard for surface water quality of Grade IV. This trend is likely to spread out to other parts of China where water stress level is high and demand for recycled water grows rapidly. One example is Tianjin city, which planned to increase the wastewater reclamation rate to 30% by 2010, and build up separate water supply systems for municipal water supply and reclaimed water supply for all newly built resident communities. Shenzhen city's wastewater reclamation rate was 11% in 2009. It plans to increase the wastewater reclamation rate to 80% by 2020, in which 20% will be the substitute for municipal water supply.

Preferential Status for MBR technology for wastewater reclamation

The 'Catalogue of Environmental Protection Industry Equipment (Products) Encouraged by the State' listed MBR as the first technology in the 2010 edition. It is no longer based on the influent water quality but focuses on the treatment capacity and energy consumption of the treatment system.

The quality of treated effluent also rose to another level with emphasis on reuse and recycling applicability. It can be anticipated that the future focus of MBR technology would be more on cost-effective energy efficiency application. This document plays an important role in consolidating the adoption of MBR technology over other wastewater reclamation technologies in the field.

Government investment planning

Industrial experts estimate that the total investment requirement for wastewater treatment facilities and construction is expected to be around the equivalent of USD$22.63 billion for 12th five year plan (2011-2015), in which, the wastewater reclamation for both municipal and industrial sectors is likely to call for a funding of the equivalent of 3.68 billion USD to achieve the planned wastewater reclamation and recycling rate.

For the industrial sector, the water recycling rate reached 83.1% (Source: National Bureau of Statistics) in 2010. On top of that, the Chinese government concentrated efforts on industrial water conservation and reduction.

To comply with the government target, the industrial end users will need to push forward more investment to reduce the unit production water consumption and increase the recycling rate further to achieve the zero-discharge target for certain industries (power generation, etc.). For the municipal sector, there is a growing consensus that the water transfer project is not the ultimate solution to solve the water scarcity in Northern China. It is believed that water reclamation is the sustainable solution to reduce the water stress for water scarce regions.

Chinese government encourages the development of wastewater reclamation and reuse projects by compensating 50% of the build and construction cost for municipal treatment facilities. This policy helps to fuel up the development of water reclamation industry and install the confidence of technology and service providers.

Understanding China's MBR market: Key players and production capacity

Among all the active players in China's MBR market, Beijing Origin Water Technology Company demonstrates best practice. Relying on its strong government background in Beijing, Origin Water successfully sought the opportunities of the pilot MBR projects in Beijing Olympic Village, the Grand National Theater and major upgrading projects of municipal wastewater treatment plants in Beijing. It also has the highest installation capacity of MBR systems, as a result of its dominance in large municipal projects in parts of China.

Recycled water quality standards for specific applications (2002-2007) clearly specify the treated water criteria of COD (chemical oxygen demand), BOD (biochemical oxygen demand), SS (suspended solids) and NTU, etc. for the targeted application areas. Users of the reclaimed water are to be charged a special reclaimed water tariff from 1.0 to 5.7 RMB/m3 which is about 25%-76% of the drinking water tariff. Ratio varies from different regions of China.

• National Standards of People's Republic of China – Reuse of Recycling Water for Urban Water Quality Standard for Industrial Uses GB/T 19923-2005

• National Standards of People's Republic of China – Reuse of Recycling Water for Urban Water Quality Standard for Urban Miscellaneous Water Consumption GB/T 18920 – 2002

• National Standards of People's Republic of China – The Reuse of Urban Recycling Water – Water Quality Standard for Scenic Environment Uses GB/T 18921 – 2002

• National Standards of People's Republic of China – The Reuse of Urban Recycling Water – Water Quality Standard for Agriculture Uses GB/T 20922-2007

• National Standards of People's Republic of China – The Reuse of Urban Recycling Water – Water Quality Standard for Supplementary Water Resource GB/T 18919-2002

Following Origin water, other key multinational players including GE Water Technologies, Asahi Kasei, Siemens Water Technologies, Memstar, Mitsubishi, Toray and Norit. Some other well established Chinese local membrane and engineering companies such as Litree, Sinap and Motimo also found themselves in the key technology and service supplier tiers in China.

The MBR market in China is relatively concentrated with Origin Water currently dominating the market and numerous small suppliers and engineering companies making up for the remaining market share. It is expected that the market is going to be even more concentrated with turnkey projects and Build-Operate-Transfer (BOT) projects dominating the business mode in municipal sector.

As more and more competitors move heavily into this market, it is likely to become less concentrated with decrease in market share for key dominants like Origin Water. Natural water reclamation and rehabilitation is likely to be the next opportunity for MBR technology.

Cost analysis

Costs of imported international MBR systems are still much higher compared to local suppliers in China. The perception is that the imported products are of a much higher quality, longer life span and much more effective in terms of treatment. However, some of the MBR systems supplied by overseas suppliers are faced with challenges in China due to the difference in water quality, system operation and upstream and downstream requirements of MBR systems.

The cost of hollow fiber membranes is about 20% lower than the flatsheet membrane. Therefore, the majority of project developers prefer hollow fiber membrane over flatsheet membrane for many of the advantages, in addition to its relative low cost.

Overall trends tend to be cost-reduction. It is believed that along with the innovation of MBR technology, both the investment and operation cost (energy cost, labour cost and materials) are expected to decrease by about 15-20% within the next five years.

Technology trend and business models

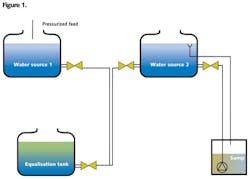

MBR system technology is yet to be improved for longer membrane life span and longer cleaning frequency, to realise on-line cleaning of membrane elements and enhance energy reduction and tolerance capability to handle fluctuation in feed water quality. Optimised module design is the key to ensure maximum delivery of MBR system functions. Therefore, experienced design institutes or companies are expected to set up guidelines for system design that best fit the pre-treatment and bio-treatment of MBR unit.

Unlike desalination or conventional water and wastewater treatment plants, MBR projects are now being operated on a turnkey business mode. EPC companies only provide solutions for project owners but do not have the ownership to operate and trade the treated water.

It is expected that the practices of BOT/TOT/DBO (Build-Operate-Transfer, Transfer of Technology and Design-Build-Operate) mode of business would be the possible trend for MBR large scale municipal/industrial project developers to fully take control of the long-term ownership of the projects, and integrate them into their overall water business area.

The Ministry of Housing and Urban-Rural Development is planning to continuously and gradually increase the water tariff for industrial end-users as a way to control the overuse of water resource. It is expected that when the water tariff for industrial users is high enough than the water price of regenerated water, the conditions for water trading would be mature enough for industrial customers to buy high quality reclaimed wastewater from municipal wastewater reclamation plants for economic sake. Water trading is likely to be the future trend for a water recycling economy.

Market outlook

The MBR market is considered to be the major technology for wastewater reclamation for reuse purposes. Chinese government is working on establishing more comprehensive reclaimed water supply, usage and tariff system to enhance the implementation of reclamation. The requirements for higher reclaimed water quality, pro-longed module lifespan, and reduced energy of MBR system call for long-term cost-effective modification/optimisation of the current technology.

Exponential growth in the last few years and the strong local drivers give it a potential of closing in on the $1billion dollar market value by 2015. China is on its way to embrace the era of water reuse with remarkable market to be addressed. WWi

Author's note:Jennie Peng is a consulting analyst in the Frost & Sullivan Environment (Water) Practice based in Beijing. For further information on the study please contact Frederick Royan, research director for Water Markets at [email protected].

More Water & WasteWater International Current Issue Articles

More Water & WasteWater International Archives Issue Articles