Commercialising Desalination's Holy Grail Low Cost, High Flux Membranes

One firm in the United States claims to have changed the economics of desalination globally. It hopes to have reduced the price of desalinated water by a third by 2020 and become the leading supplier of membranes. And it was started a mere five years ago. Ambitious goals for a start-up? Tom Freyberg speaks to NanoH2O's CEO, Jeff Green, to find out.

The race is on. Membrane companies worldwide are investing millions into R&D efforts to increase flux rates, permeability and reduce fouling rates of their membranes. In Layman's Terms; produce drinking water cheaper and more efficiently.

Seawater Reverse (RO) desalination is growing in the momentum, particularly in the Middle East with utilities now switching to membrane desalination compared to former thermal processes. As a result, opportunities are clearly arising, with the market expected to grow from $1.5 billion in 2009 to $2.8 billion by 2020, according to data from Lux Research.

Game changer? The QuantumFlux membranes include the company's proprietary nanocomposite material which it says allow more water to pass through while rejecting unwanted materials such as salt

Yet, with major companies such as Dow, Hydranautics and Toray well established it would be easy to think this is one already crowded and competitive market. It would also be easy to question how a company could take what was essentially a university membrane research project only five years ago, fully commercialise the product and expect to become a leading supplier in the industry by only 2012. Yes, that's only next year. And that's five years to not only bring a product to market, but five years to claim to overtake the competition.

NanoH2O alleges to be doing just that. With the firm attracting $35 million worth of investment – one of the highest for a water company to date – just what is the California-based firm's secret?

"We demonstrated product capability relatively early in the technology's lifecycle," boasts CEO Jeff Green. "You can show a product off on the bench scale but being able to progress to the next stage and show it off on a capital efficient and commercial scale is usually the losing factor. We were able to overcome that."

Membrane commercialisation

Let's rewind a minute. Many of you will be asking just how the university project made it to the demonstration phase. As Green explains to Water & Wastewater International magazine (WWi), it was a quick process.

"We effectively started in the corner of a laboratory in the University of California, Los Angeles, where Professor Erik Hoek was leveraging nano technology," he says. "The professor was looking at the performance of RO membranes and introducing nano particles to the polymer film to affect the performance."

Membranes used by the Cayman Water Authority have helped save 0.98 kilowatt hours per cubic meter of water desalinated

Two parts of the research attracted the CEO: the ability to place this membrane technology into standardised modules (potential for retrofitting existing plants) and secondly, the latest polymer RO technology.

By 2007 the technology had been spun out of the university's laboratory into a commercial R&D facility of NanoH2O's. The Spring of 2008 brought not only the prospect of better weather and summer, but also a testing facility for the company. By then, Green says, the firm could demonstrate that it could make commercial scale flat sheeted membranes for 4" modules. These were tested with the U.S. Navy at Port Hueneme, California on a scale of 100 m3/day. Results included a 10% reduction in specific energy and 17% reduction in operating pressure, compared to "conventional membranes under the same operating conditions".

Since then the firm has not looked back. The majority of 2009 was spent building a manufacturing facility, which was commissioned in early 2010. "By the fourth quarter of 2010 we were delivering the highest flux seawater RO membranes in the industry," quips the CEO. "We now have over 35 installations and over 15,000 m3/day in capacity. We're starting to move from smaller plants to more medium sized plants. And recently we also started to deliver the highest saltwater rejection membranes as well. If 2011 was the year to introduce the technology then we feel that 2012 will be the year when we accelerate to become one of the leading suppliers of membrane technology."

Proving the technology

Ambitious goals, then. As with any new start-up, potential customers wish to prove claims and witness the technology working. One of these installations is on the Cayman Islands with the Cayman Water Authority, operating at a capacity of over 550 m3/day. Through a single train 2-pass SWRO plant, NanoH2O claims to have saved the authority 0.98 kilowatt hours per cubic meter (kWh/m3) of water desalinated.

"Here we were able to achieve a 28% energy saving and lowered the energy consumption of the plant," says Green. "Prior to the installation the facility was achieving 3.47 kWh per m3 and after the installation it was reduced to 2.49 kWh per m3. And we've been able to do this producing very good quality water. Cayman Brac has been a very nice reference site for us in the region."

He says the firm has completed trials in the Mediterranean, in Spain, as well as India and China and are "starting to see some traction and activity in South America and Australia".

When pushed, Green says in a non-committal statement that the Middle East is a key region being targeted by the company, with Saudi Arabia, the UAE and Egypt firmly within NanoH20's sight. "Saudi Arabia has to be one of the key markets for anyone in the seawater RO membrane business. It's still the single biggest invested water market in the industry," Green adds.

However, he adds that NanoH2O is being asked to "bid on larger scale plants earlier in our lifecycle than expected. We've got several ongoing conversations and I think several will prove successful in the first half of 2012."

Nano-nimbleness

Not known for its quick adoption of new technologies fresh out of the R&D stage, how is water industry being educated on NanoH2O's technology?

"Given the critical nature of water supply there is an inherent conservatism – I think in a good way – of adopting new technologies. If you invest too much in a technology that doesn't work, you have effectively ended your supply of fresh water, which is of course a major issue.

"As we can allow engineering firms to trial our technology quite easily without taking the risk of a full plant, it's easier for us to overcome that measured approached to new technology because they can touch it, see it operating and treating water in their region."

Clearly reducing the pressure required and subsequent cost to desalinate water is a major USP for the company. The brackish water and low energy markets have previously not proven as attractive for RO companies, due to the already lower costs of treating low salinity water. However Green still believes there are savings to be made.

"Our plan is to move into both the brackish water segment and low energy markets; wastewater reuse and reclamation and groundwater remediation. While the absolute dollars related to energy consumption are not as large as they are with seawater, energy consumption for lower energy solutions is related to membrane permeability as the osmotic pressure is quite low. So there's still the ability to push the energy savings in those applications. Also, with a better salt rejection and flow you also get longer life membranes because you're able to produce better quality water."

Protecting Copyright

With facility results in the bag, not to mention countless start ups eyeing up the lucrative water membrane market, you would assume NanoH2O would be keeping its technology secrets (see box out) well and truly hidden away and protected with patents. This is true but the firm also presents several details about its thin-film nanocomposite technology on its corporate website and video. Understandably details of the company's "proprietary nanocomposite material" are withheld but still, does the CEO loose sleep over companies replicating a similar RO membrane?

CEO Jeff Green predicts that the price of desalinated water could be reduced by 33% in as little as 20 years time. He says that "targeted selectivity" will mean membranes will be able to selectively reject certain pollutants and allow others to pass, depending on the application

"I'm always paranoid about copyright and any company should be rightly paranoid about copyright," he says. "The actual materials that we used and the process to manufacture our membranes are so much more complex than shown in the video. We're not concerned that we're giving anybody any additional information.

"I don't think that even from reading our patents or watching our video we're revealing enough information to enable someone to move faster. Manufacturing our membranes is a complicated process. It's next to impossible to reengineer the films once they are formed."

Green adds: "The nano-composite reverse osmosis concept is well protected from a patent perspective, not only in the United States but also internationally as well. In respect to work that we know is being done at companies like Dow, Toray and Hydranautics we look at their future R&D as important competition."

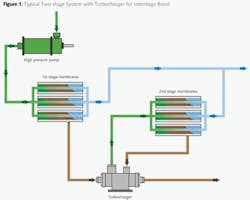

Rethinking Reverse Osmosis: Technology OverviewThe term "thin-film nanocomposite" is used to describe encapsulating benign nanomaterial into the thin-film polyamide layer of a traditional thin-film composite membrane. Thin-film composite membranes consist of a layer of non-woven polyester, a cast layer of polysulfone and a 100 to 200 nanometer thin-film layer. QuantumFlux membranes encapsulate benign nanoparticles into the polyamide thin-film of a composite membrane. The nanoparticles are introduced during the synthesis of a traditional polymer film and are fully encapsulated when the nanocomposite RO membrane is formed. These allow more water to pass through while rejecting unwanted materials such as salt. Branded QuantumFlux, the company said the membranes are 50-100% more permeable than conventional membranes. |

Technology predictions

The company predicts that in the next 20 years it should be able to improve the cost of desalinated water by 33%. Key to this cost reduction will be two improvements, notes Green, including more robust materials being used to reduce organic fouling and also "targeted selectivity".

Discussing the latter, Green says: "Ultimately, each time you have to go through a separation, it takes energy. If you are only separating the pollutants that you need then you have the potential to lower energy consumption. You are constructing the membrane chemistry so that it can selectively reject certain pollutants and allow others to pass, depending on the application."

The CEO has a vision for high flow membranes with fouling resistance, combined with targeted selectivity so you are only using energy on pollutants you want to reject. This will allow for the most efficient operation where you are able to build a small scale plant, with low energy consumption, bringing down the cost of water.

Moving forward

NanoH2O's success story of rapidly bringing a game-changing product from a laboratory to the field has not gone unnoticed. The firm has scooped numerous industry awards, including the Aquatech Innovation award, as well as being named in the 2011 Global Cleantech.

Proving its technology on a commercial scale merely one year after setting up its own R&D centre was a pivotal moment in getting to where it is today, not to mention attracting investors. In hand picking a team of recognised experts, including membrane veteran Randy Truby, the company has placed itself in a good position to roll out its technology globally.

If NanoH2O can really reduce the price of desalinated water by a third by 2020, and ultimately help deliver drinking water to those lacking access before due to price, this is no mean feat and should be applauded. Whether it can become a membrane market leader in the meantime and really overtake established, major market players, is another matter entirely.

Watch this space: the desalination market is changing, quicker than you think.

More Water & WasteWater International Current Issue Articles

More Water & WasteWater International Archives Issue Articles