Water Lessons from the US to Europe

Water and energy have always had a close relationship, but shale gas and water are particularly intimate. Water is integral to shale gas and there is a growing market, estimated to be worth up to $100 billion in the United States, for wastewater treatment. Tim Probert explores the opportunities in Europe.

There is no question that shale gas has been a 'game-changer' in the US. From virtually nothing ten years ago, shale gas now accounts for around a quarter of domestic natural gas production.

Could the same happen in Europe? According to the US Energy Industry Administration, Europe has up to 480 trillion cubic feet (tcf) of "technically recoverable shale gas resources", compared with 862 tcf in the US. This would be enough to meet current consumption levels for approximately 25 years, but getting the gas out of the Earth's crust is a heavily industrial process and will be more tightly regulated in the European Union than in the US.

In contrast to conventional gas extracted from porous rock, shale is relatively impermeable, meaning gas cannot easily move through the shale in which the well is drilled. In order to release the gas, operators use a method called hydraulic fracturing, also known as fracking, essentially pumping water, sand and chemicals into the rock at high pressure. Shale gas developers use a technique called pad drilling, with up to ten drill wells radiating horizontally for distances of up to six miles from a single site, or pad.

This technique has been used for decades, but the improved ability to steer drill bits using off-the-shelf technology has made horizontal fracking cost-effective. The facility to perform surface data acquisition to locate gas in the rock, rather than drill right through the shale as previously, has also reduced costs.

A controversial practicE

Fracking, however, is highly controversial and there are bans in France, Bulgaria and in some regions of the US, Australia, South Africa and Canada. Most of the opposition to fracking centres on the use of water.

Numerous scare stories emanating from the US, of inflammable water supplies, polluted ponds and exploding houses, not to mention seismic activity in the UK, have added fuel to the environmentalists' fire. However, there is growing, robust evidence of ground and surface water pollution in the US due to poor practice and slack regulation; fracking is exempted from federal Clean Water and Safe Drinking Water Acts.

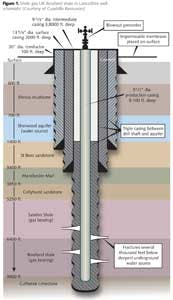

Cuadrilla Resources, which last year caused shockwaves by claiming that a 500 square mile area of northwest England held enough shale gas for more than 50 years consumption, is operating a number of exploratory wells in the UK. It aims to use ten fracking methods that are "fundamentally different" from the US.

These include the use of steel tanks to store flowback water rather than in a bare pit dug out of the earth; an impermeable plastic sheath 18 inches below the top gravel layer onsite to prevent leakage of flowback water and facilitate easy capture of spills; and monitoring wells to detect methane leaks in shallow water supplies used by farmers.

Cuadrilla will also use surface and intermediate cement casing of boreholes to a depth of up to 1000 feet to protect contamination of aquifers. Regulations in New York State, for example, require casing to a depth of just 50 feet to preventing contamination of gas in water supplies.

Water goes in

It is estimated that a shale gas well requires between 9,000 m3 – 29,000 m3 of water per well. A report by the UK's Tyndall Centre for Climate Change estimates 2580-3000 wells would be required to produce 9 billion cubic metres per year of shale gas, equivalent to 10% of national annual consumption.

This volume of gas implies a total annual water requirement of up to 87 million m3. To the uninitiated this sounds an awful lot of water, but the figure is dwarfed by the 1.2 billion m3 lost in the UK in 2011 from pipe leakage.

Added to the water, equivalent to around 0.25% of total fracking fluid used, are three additional ingredients: a friction reducer called polyacrylamide; a biocide to purify water; and a weak hydrochloric acid (E507) to help open the perforations to initiate frack fluid injection. These chemicals are another source of controversy, but the European Commission and the Environment Agency (EA), which regulates water usage in England and Wales, have declared these chemicals safe.

Water comes out

With respect to water usage, pumping fracking fluid into the well is the easy part. Approximately 10-40% of the fluid returns to the surface. This flowback fluid is lucrative yet pretty nasty stuff, and yet another source of controversy.

As well as the target natural gas (mostly methane plus propane, butane, and ethane), the flowback water contains other gases such as carbon dioxide, hydrogen sulphide, nitrogen and helium; naturally-occurring brine, trace elements of mercury, arsenic and lead; naturally occurring radioactive material (radium, thorium, uranium); and volatile organic compounds that easily vaporise into the air, such as benzene. Herein lay the challenges and opportunities for water and wastewater companies.

Flowback rates during first two weeks of fracking average 3,000-5,000 barrels/day (bpd) (357,000 to 595,000 litres), declining rapidly to a few 100 bpd. Further decline is gradual, estimated at 10-20 bpd after a few months.

There are four primary options for dealing with flowback. The first option is the also easiest and cheapest: reuse it without treatment. Reusing untreated water is frequently performed in the US, but continued reuse will lead to problems as the high level of contaminants may plug the gas wells with residual chemicals, precipitates or shale fines.

The second option is deep well injection. Simply drilling another well to store the water, however, is not without problems. In March, Ohio state regulators said a dozen earthquakes in the state's northeast were almost certainly induced by injection of gas-drilling wastewater and analysts say this option will be almost impossible in Europe due to stricter legislation.

The third option is on-site treatment for reuse. This option is used to remove most TSS (total suspended solids), acid-producing bacteria and scaling materials like barium, calcium, iron, magnesium and strontium, which are likely to clog the well if returned to the gas reservoir. Typical capacity for this option is 2,400-14,000 bpd. Having removed most TSS, typically from 500-1000 mg/l to 50 mg/l, this treated water is then mixed with fresh water and re-used for fracking. As everything is done on site, this option has negligible transport costs.

The fourth choice is on- or off-site treatment for discharge as fresh water, which can, of course, be used for fracking. The main objective is to remove TDS (total dissolved solids) in flowback, which can reach extremely high levels of both concentration and variability. Flowback from fracking operations in the Haynesville shale, which covers southwestern Arkansas, northwest Louisiana and East Texas, has been found to contain anywhere between 500-250,000 mg/l.

TDS removal, which must be reduced to 500 mg/l to meet US Environmental Protection Agency standards, is done on-site by using or mobile units or off-site at central treatment plants. Typical capacity of off-site treatment would be 12,000 to 48,000 bpd. Due to the large volume of water, transportation becomes a cost factor.

Karim Essemiani, business & marketing manager of Veolia Water Solutions & Technologies' oil and gas division, estimates the costs of TSS removal in the US at between $3-6/bbl, rising to $20/bbl for TDS removal including equipment, operation, labour, chemicals, sludge handling etc.

Flowback treatment technologies

For on-site TSS treatment, the process typically involves a five-step process. The first is chlorine dioxide oxidation, which breaks oil/grease emulsions; destroys friction reducers and other chemical additives; and kills bacteria. Step two is dissolved air flotation which floats oil, grease and TSS to the top of the chamber. Liquid-phase activated carbon then removes most hydrocarbons and other organics, before chemical precipitation removes the scale‐forming compounds. Finally, a conventional sand filter removes the TSS.

There are two viable options for TDS removal from shale gas flowback: thermal distillation and membrane filtration. A commonly-deployed method for flowback water desalination uses an integrated three-stage mobile reverse osmosis (RO) system. The first phase is pre-treatment using chemical flocculation, clarification and oil removal; phase two is cold lime softening; and the third stage uses micro-, ultra- and nano-filtration, as well as reverse osmosis.

Energy costs of RO are one-tenth of mechanical evaporation, but inadequate pre-treatment can result in significant fouling and scaling leading to costly membrane replacement. Furthermore, RO is unsuitable for treating flowback with TDS greater than 50,000 mg/l.

The most common method to remove TDS is thermal distillation via a mobile vapour recompression (MVR) evaporator unit, offered by a number of leader water technology companies such as GE Water, Veolia and Aquatech.

Here, the incoming flowback water is boiled to produce steam, while all dissolved solids remain in the concentrate. The resulting steam is then condensed into pure water. While energy costs are higher than RO, MVR units are able to cope with high TDS concentrations of 50,000-250,000 mg/l.

Once RO or thermal distillation is complete the brine concentrate has to be treated, usually through an off-site crystallizer. A 1 million gallon a day crystallization plant will generate approximately 400 tons a day of salt waste, which will require disposal in a solid waste landfill.

Opportunities for the water industry

Michael Coffey, managing director of water consultants Aquastrat, says shale gas offers several revenue streams for the water and wastewater industry. This is not only from supplying freshwater and treating flowback, but also water data management and laboratory analysis. Treated brine could also be sold for road de-icing.

Coffey is confident water utilities can cope with waste materials in flowback water, but they may not want to, despite the opportunities.

"At the moment, they don't see anything that differs from other industrial activities, but they are slightly concerned about the concentrations of chemicals." The consultant notes the US state of Pennsylvania has issued a decree preventing any flowback water from being treated at wastewater treatment plants because of high levels of bromide, which when disinfected creates a compound called brominated trihalomethanes linked to several types of cancer and birth defects.

"There are issues over the interplay of bromides used in fracking fluids and chlorine in water treatment plants," he says. "I'm not saying it can't be dealt with but the shale gas industry needs to be upfront as part of its water strategy."

Another concern is radiation. Analysis by the EA in the UK of Cuadrilla Resources' Preese Hall exploratory well found significant levels of radium-226, which has a half-life of 1,620 years, above legal limits.

Although the concentration of radioactivity is low, the total volume of return fluids is large; large enough to require an environmental permit for disposal at its intended destination, United Utilities' Davyhulme treatment plant in Greater Manchester. Nearly a year on from the EA's visits, however, Cuadrilla has still yet to attain a permit, which requires a full radiological impact assessment, and the flowback water remains in steel tanks on the fracking site.

South East Water has expressed concern over fracking and is working with Water UK for water companies to be included as statutory consultees on planning applications.

A spokesperson said: "We accept the risks to water supplies do exist. In particular, the risks to drinking water supplies need to be addressed to ensure the safety of our customers' water quality is maintained."

Stricter regulation means higher costs

Lucy Field, of energy consultants Pöyry, who has authored a report for the UK Department of Energy and Climate Change about shale gas, says water usage and disposal is the single biggest most prohibitive factor in shale gas development.

"The UK is in the middle of a drought and supplying water to fracking sites could be difficult in certain regions," she says. "We have enough trouble supplying water for our everyday needs.

"But the main issue is water disposal: the flowback water can only be recycled at most three times before it has to be disposed. In US they truck the water in and out, but in the UK they may have to build pipelines, which costs." Field says if best practice is followed, fracking can be done safely, but following the UK's strict water regulations correctly will be expensive. "Due to the population density and relative shortage of land, plus the cost of meeting more stringent regulations, I expect the costs of production will be at the very least 50% higher than in the US," she says.

Europe has the advantage of learning from good practice and the mistakes made by first-movers in the US. Shale gas offers excellent potential for wealth and job creation, but if it is to be a game-changer in Europe as in the US, it is fundamentally important the water industry is fully engaged with any fracking operations.

More Water & WasteWater International Current Issue Articles

More Water & WasteWater International Archives Issue Articles