Super Sludge

Industrial Chemicals Show Growth Potential

The industrial sludge treatment market is growing, adding to increasing sales of the amount of chemicals required. As a result, in 2011 the European industrial sludge treatment chemicals market was worth €785.8 million. Dr. Ing Anna Jarosik addresses market opportunities for conditioning, stablisation, coagulants and flocculants.

The European market for the industrial sludge treatment chemicals is one of the most promising and rapidly developing markets at the moment. Typically, industrial sludge contains both compounds of agricultural value (including organic matter, nitrogen, phosphorus and potassium, and to a lesser extent, calcium, sulphur and magnesium) and pollutants (such as heavy metals, organic pollutants and pathogens). In general, the sludge specification depends on the original pollution load of the treated water and on the technical characteristics of the wastewater and sludge treatments carried out.

The source of sludge

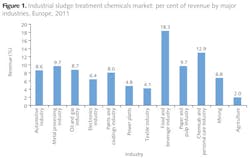

Industrial sludge can be divided into four main groups, based on the treatment stage and requirements consisting of primary sludge, activated sludge, mixed and tertiary sludge, where all typically require mechanical, biological, thermal, and/or chemical treatment. The treatment of activated sludge requires the largest amount of chemicals and in 2011 the activated sludge treatment processes accounted for 46.7% of the revenues generated by the total industrial sludge treatment chemicals market (Fig. 2).

It is crucial to know the origin of industrial sludge in order to employ the best, most efficient and cost-saving sludge treatment solution and hence the most effective chemicals. Europe (western as well as central and eastern) has a large number of well-developed industrial sectors that produce significant volumes of industrial sludge that require technologically advanced and environmentally safe chemical treatment.

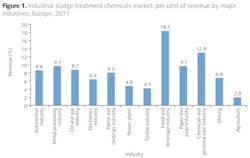

After large-sized wastewater treatment plants, the second-largest European industrial sludge producer and hence sludge treatment chemicals consumer was the personal care industry, which accounted for 12.9% in market revenues in 2011.

This was followed by the metal processing and paper and pulp industries, with both accounted for 9.7% respectively in market revenues. Regarding further utilisation of treated sludge (including industrial and municipal sludge) the most popular way, in Europe, is agriculture that accounted for 33.8% in 2011. However, this pattern is likely to change over the coming years because of increased health concerns and tightening requirements.

For example, the Urban Waste Water Treatment Directive 91/271/EEC increases the quantities of sewage sludge that requires disposal. Furthermore, the Sewage Sludge Directive 86/278/EEC seeks to encourage the use of sewage sludge in agriculture and to regulate the requirements for proper sludge valorisation.

Chemicals market overview

Industrial sludge production is expected to increase between 2011 and 2017. As the volume of industrial sludge that requires treatment is growing, the amount of chemicals required for treatment will follow a similar increasing trend. In 2011, the European industrial sludge treatment chemicals market was worth €785.8 million presenting a moderate annual growth rate of 5.8% and a volume shipment of 1,309.7 thousand tonnes.

In Western Europe, the countries that produced the highest amount of industrial sludge are those with well-established manufacturing where the dominant industries are chemicals processing, food and beverage production and automotive manufacturing.

In 2011 the largest industrial sludge producing countries were Germany, which held 25.6% market share of the Western European industrial sludge treatment chemicals market in terms of revenues. Then came the UK with 18.5%, Italy with 15.3%, Spain with 14.1% and France with 12.2%.

In 2011 the largest industrial sludge producing nations in Central and Eastern Europe were Poland, which accounted for 31.3% of the total Central and Eastern European industrial sludge treatment chemicals market in terms of revenues, followed by Romania with 15.1%, Czech Republic with 12.5% and Hungary with 10.7%. In 2011, the average industrial sludge production per capita in Europe was 7.3 kilograms of dry weight, which was higher by about 2.1% when compared to 2010.

Sludge processing

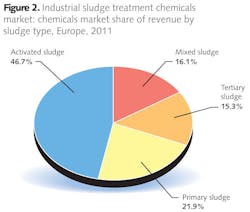

In 2011, the leading segment in the industrial sludge treatment chemicals market was the conditioning (initial treatment process) and stabilisation chemicals segment, closely followed by the dewatering and drying chemicals segment. These segments captured market shares of 38.2% and 31.3%, respectively (Fig. 3).

By 2018, the conditioning and stabilisation chemicals segment is likely to capture an increased market share of 39.7%, due to the increasing industrial production in the region and because of the tightened requirements affecting sludge treatment processes and disposal.

In 2011, the market was dominated by coagulants and flocculants, representing the main chemicals extensively used at industrial sludge treatment processes. These two groups of chemicals together with disinfectants and biocides are close to reaching their mature growth stage in sludge treatment. Typically flocculants are used in industrial sludge treatment processes to support coagulants in thickening and dewatering processes.

In 2011, flocculants (in Western Europe mainly aluminium-based and in Central and Eastern Europe mainly iron-based) accounted for 35.9% and coagulants constituted 35.5% of the revenues generated by the European industrial sludge treatment chemicals market.

The European region is characterised by high price sensitivity, which significantly affects the industrial sludge treatment chemicals market. As a result, sludge can be considered as a problematic by-product rather than valuable source of nutrients. Legislative requirements and environmental responsibility norms force most of the industries to treat the sludge that they produce, thereby adding to their operating expenditure.

The prices of sludge treatment chemicals are growing steadily due to the increasing costs of production and raw materials. Additionally, the price rise is attributed to the emerging global market imbalance between the growing demand for water, wastewater and sludge treatment chemicals and the decreasing supply. Furthermore, the chemicals' performance and sludge disposal requirements have become more demanding resulting in the need for optimised solutions and higher quality chemicals.

Manufacturer trends

One of the major trends in the industrial sludge treatment chemicals market is the required and in effect pursued product differentiation. Historically, the majority of the sludge producing industries had used chemicals with similar compositions without paying attention to improved effectiveness or customisation. Most of them mainly focused on new equipment and technologies instead of innovative chemicals.

Despite this, the key manufacturers of treatment chemicals, such as Kemira, SNF SAS, Nalco and Ashland are trying to attain a higher level of product differentiation. They introduced combined properties and therefore multifunctional and more-effective chemicals. These chemicals are closely associated with treatment equipment that improves the industrial sludge treatment processes, decreases treatment costs and increases environmental and health safety.

Moreover, investing in new compositions of industrial sludge treatment chemicals is another popular trend that is gaining market importance. This is also supported by the tendency to recycle industrial sludge to recover some products (for example noble metals and plastics) and, at the same time reduce the treated sludge amount before disposal. The sustainability in production is receiving growing attention in the chemical industry, making it an important element of the manufacturers' strategy.

Future opportunities

With the financial support from the European Union (especially in the case of Central and Eastern European countries) and the increasing need for advanced and effective sludge treatment solutions, the European industrial sludge treatment chemicals market will continue to present growth opportunities for chemical manufacturers and treatment technologies providers. Despite being a highly competitive market with high entry barriers, the industrial sludge treatment chemicals market in Europe is still characterised by a high demand for innovative products, technologies and solutions.

This is also supported by the requirements to minimise the sludge volume and the overall amount of chemicals utilised in wastewater and sludge treatment processes. Moreover, the high demand for novel treatment chemicals is dictated by the increasing requirements related to sludge recycling and product recovery.

Finally, the need to optimise and modernise the rapidly ageing wastewater and sludge treatment infrastructure in Europe is also expected to facilitate the growth in the industrial sludge treatment chemicals market.

Authors note: Dr. Anna Jarosik is industry analyst at Chemicals, Materials and Food at Frost & Sullivan. For more information, please contact: [email protected].