Water is the lifeblood of a power plant. Needed in vast quantities to produce steam and for cooling purposes, U.S. thermoelectric power producers use more than 70 trillion gallons of water per year. To effectively use water within a plant, it must be treated to meet each individual site's needs, which vary with the influent source water quality; type of boiler, discharge requirements and whether or not "used" water is recycled within the plant.

Globally, water treatment for the power generation industry, both utility and nonutility producers, is estimated at more than 30% of all industrial water treatment sales, or as much as $6 billion.

Historically, power producers have used a combination of coagulation, flocculation and ion exchange resin beds to create high purity water for making steam. But, more advanced water treatment methods including membrane technology, electrodeionization and some novel disinfection methods are gaining ground.

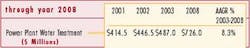

According to a soon-to-be-released report from Business Communications Company, Inc. (www.bccresearch.com) RE-129 Advanced Water Treatment for the Power Generation Industry, the U.S. market for advanced water treatments for power producers was estimated at $487 million in 2003. Rising at an AAGR (average annual growth rate) of 8.3%, sales are expected to reach $726 million by 2008.

Besides water quantity and quality issues, U.S. plans for constructing new generating facilities and making upgrades to existing operations are driving this market. The market size also takes into consideration the enormous replacement markets for consumable ion exchange resins and membranes, worth about $110 million in 2003.

With the economic slump post-September 11, however, much of the power industry has put off major capital investments. A number of planned projects for new plants or expansion of existing capacity have been cancelled or postponed. A further downturn in the economy could nullify these forecasts, which are based on a gradual recovery. If reaction to the recent East Coast blackout results in a plan for more rapid capacity expansion, however, growth rates will exceed these predictions.

Membrane filtration, especially reverse osmosis (RO), has been widely adopted by power producers, who use the fine filtration method for purifying boiler feedwater, makeup water, and in zero-liquid discharge applications. In addition to RO, power plant operators are spending more for ultrafiltration (UF) and microfiltration (MF) membrane processes used for pretreating water prior to the smaller pored, more fragile RO membranes.

Nanofiltration (NF) membranes, electrodialysis reversal (EDR) technology, and membrane contactors also have niche applications in treating power plant water. Ion exchange is well established in power plant water treatment. The technology offers excellent performance and is irreplaceable in some applications such as nuclear power production. Thanks to continuing improvements in the process, in systems and in resins, the method remains "advanced." But, the need to use costly and hazardous chemicals for resin regeneration has many users looking for alternative solutions.

Electrodeionization (EDI), a method that combines ion exchange membranes with ion exchange resins, is proving effective and popular for power plant water treatment. Capital costs are generally less than conventional mixed beds and operating costs are equal to or less than traditional ion exchange. Most importantly, EDI eliminates many chemical additives by regenerating resins with electricity. This technology will experience tremendous growth during the next five years, especially in new plant construction.

Ozone and ultraviolet light are two emerging methods for treating power plant water. Not currently in common usage, these non-chemical disinfection processes can minimize the use of chlorine, an increasingly more problematic water treatment additive. Both of the methods are particularly suited for cooling water applications and the control of macrofoulants at power plant water intakes. Use of the novel methods will increase as chlorine discharge standards become more restrictive.

While each of the advanced treatment technologies offers its own individual advantages, and drawbacks, none of the methods can be used as stand alone treatment for every water application necessary to a power plant's operation. Hybrid systems combining a train of advanced techniques provide the most comprehensive water treatment at the best price. Depending on the influent water and required product water purity, systems may include RO, other membrane methods, mixed-bed ion exchange, EDI, ozone, UV and various combinations of these technologies.

For more information on the report RE-129 Advanced Water Treatment for the Power Generation Industry, contact Business Communications Company, Email: [email protected].