By Renee Chu

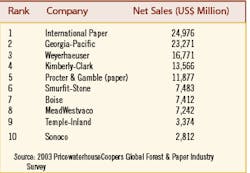

The United States is one of the world’s largest consumers of paper. In 2002, the total volume consumed by Americans reached an estimated 97.3 million tons, a 15% increase from its 1990 level. It also operates four of the largest pulp and paper companies in the world, supplying about 30% of the world’s paper products. These companies include International Paper, Georgia-Pacific, Weyerhaeuser and Kimberly-Clarke, which had combined sales valued a over US$78.5 billion in 2002. Figure 1 lists revenues generated by the top 10 pulp and U.S. paper companies in 2002.

The growth in pulp and paper production, however, inevitably results in elevated levels of waste generation. Most notably a large volume of wastewater is generated at the end of the pulping process. Failure to provide proper treatment to pulp and paper effluent not only poses immediate threats to the surrounding ecosystem, but may also invite legal nightmares for pulp and paper companies in the long run.

The tragedy at the High Desert town of Hinkley, Calif. - made famous by the blockbuster “Erin Brockovich” - where high levels of hexavalent chromium in the town’s drinking water sickened hundreds of residents as a result of industrial waste mishandling, serves as an example of the potential environmental and legal consequences that may result from any incident of a similar nature.

Being one of the largest users of industrial process water, pulp and paper manufacturing is the third most polluting industry in North America, and is, as such, arguably a prime candidate for civil liability. It’s therefore crucial to understand the characteristics of pulp and paper effluent and how to minimize its impact on the environment through proper management.

Effluent Limitations

Among the procedures involved in pulp and paper manufacturing, bleached kraft pulp processing is especially notorious for its process water and energy consumption. This process may require up to 12,000 gallons of water and 20 million BTUs of energy per ton of pulp produced. According to the American Forest and Paper Association, the kraft pulping process produced more than 80% of total U.S. pulp tonnage in 2000.

Along with other chemical inputs from the pulping and bleaching processes, industry participants must deal with a plethora of contaminants that may be present in the pulp and paper effluent. Common concerns expressed by manufacturers include biochemical and chemical oxygen demand (BOD/COD); levels of total suspended solids (TSS); presence of filamentous bacteria and fiber in wastewater; effluent temperature; pH level; odor, as well as phosphorous concentration.

At present, major contaminants of concern to the pulp and paper industry are biochemical oxygen demand (BOD) and the amount of total suspended solids present in pulp and paper processing effluents. Due to the large volume of wastewater generation, the majority of pulp and paper mills in North America currently utilize primary and secondary wastewater treatment on-site to manage these contaminants. Such treatment technologies commonly include primary clarifiers, settling ponds, sedimentation basins, as well as activated sludge treatment systems and aeration basins.

These systems may also be capable of removing significant amounts of other contaminant parameters such as adsorbable organic halides (AOX) and chemical oxygen demand (COD). Tertiary treatment, which usually involves removal of color present in effluent, isn’t yet a prevalent practice. In addition, many technology-based effluent limitation guidelines for the control of toxic releases consist of process changes that substitute chlorine dioxide for elemental chlorine, thus resulting in complete elimination of elemental chlorine in the bleaching process.

Regulatory Requirements

With increasing demand for pulp and paper products and resulting elevation in processing activities, the need for effective effluent management is greater than ever. In the past decades, discoveries of adverse health effects associated with chlorinated organic compounds such as dioxins and furans generated from chlorine-based pulp bleaching has led to regulatory amendments to control further release of such toxins.

In response to various environmental and health concerns associated with dioxin, the majority of U.S. pulp mills have replaced elemental chlorine-based bleaching agents with elemental chlorine free (ECF) or total chlorine free (TCF) bleaching technologies.

Generally, effluent treatment targets of pulp and paper processors reflect regulatory requirements mandated by corresponding governing bodies. Accordingly, the U.S. Environmental Protection Agency has set effluent limitations for toxic pollutants in the wastewater discharged directly from the bleaching process and in the final discharge from the mills.

The development of the pulp and paper cluster rule in 1998, which is an integrated, multi-media regulation to control the release of pollutants to two media (air and water) from one industry, allows mills to select the best combination of pollution prevention and control technologies that provide the greatest protection to human health and the environment.

Key Equipment Suppliers

A number of U.S. wastewater treatment equipment manufacturers such as Andritz, Aqua Aerobics, Gould, EIMCO-Dorr Oliver, Infilco Degremont, Nalco, Severn Trent Services, as well as USFilter (acquired by Siemens in 2004) are among the top effluent treatment equipment suppliers to the pulp and paper industry.

Pulp and paper mills rarely rely on a single supplier to fulfill their needs for treatment systems, spare parts and treatment chemicals. Typically, these items are purchased from multiple equipment vendors, especially when an engineering contractor is involved in system construction and operation.

End users generally prefer to purchase equipment from original equipment manufacturers (OEMs) to take advantage of a manufacturer’s warranty. Other end users strive to improve time and cost effectiveness by purchasing from OEMs and eliminate charges from contractors. This phenomenon may limit potential opportunity for outsourcing pulp and paper effluent treatment within the industry.

Purchasing Criteria

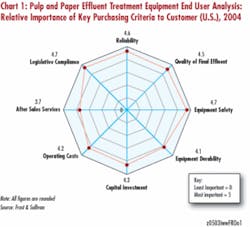

According to Frost & Sullivan’s recent end users analysis on the pulp and paper effluent treatment equipment market, the most essential criteria expressed by pulp and paper mills when purchasing effluent treatment are equipment safety, reliability and the ability of equipment to meet or exceed legislative requirements.

Under the Clean Water Act, mandates that are specific to the pulp and paper industry require facilities to comply with effluent standards in accordance with National Pollutant Discharge Elimination System (NPDES) permits issued to individual facility. In addition, effluent treatment plans must now be pre-approved by regulators under the new source performance standards (NSPS). As such, the ability of treatment systems to meet required effluent quality standard has been ranked the principal purchasing criterion.

Other criteria such as capital investment requirements, operating costs, as well as durability of wastewater treatment equipment have also been ranked as essential factors influencing purchasing decision. Chart 1 shows the relative importance of wastewater treatment equipment purchasing criteria ranked by pulp and paper industry participants.

Vendor Selection

To select the most appropriate vendor, industry end users often opt for equipment suppliers familiar with the pulp and paper industry as a supplier’s reputation is rated as a critical vendor selection criterion. Yet, a large number of pulp and paper mill operators indicate they would be open to purchasing treatment equipment manufactured by new vendors with quality comparable to well established vendors, especially when suppliers are able to meet end users’ specific needs and expectations. This trend is expected to encourage new market entrance and provide healthy competition to boost technological innovation, and perhaps more competitive pricing among equipment vendors in the marketplace.

Conclusion

As with other industrial processes, the ideal solution for wastewater management in the pulp and paper industry is to minimize waste generation. A number of pollution prevention techniques to reduce water use and pollutant releases (BOD, COD, and TSS) are currently being implemented, such as dry debarking, recycling of log flume water, improved spill control, bleach filtrate recycle, closed screen rooms and improved storm water management.

With availability of new pollution control technologies, more stringent regulatory framework and the fact end users are open to purchasing from new suppliers - along with nationwide recycling effort which has reached recovery rates of nearly 50% in recent years - the pulp and paper industry is well on its path to clear its name from being one of the nation’s most polluting industries.

Pulp & Paper OnlineFor additional resources on the Internet:

• EPA–NPDES–Industrial and Commercial Facilities: http://cfpub.ipa.gov/npdes/homew.cfm?program_id=14 (enter "pulp and paper" in search box for specific regulations)

• TAPPI–Technical Association for the Pulp and Paper Industry: www. tappi.org

• American Forest & Paper Association: www.afandpa.org

About the Author:

Renee Chu is a research analyst specializing in environmental technologies with Frost & Sullivan, a market research and growth and management consulting company based in San Antonio, TX, and with offices worldwide. A report on this topic, “U.S. Pulp & Paper Wastewater Markets - An End-User Analysis,” was published by Frost & Sullivan in late 2004. For more information, contact Melina Gonzalez at 210-247-2440, melina.gonzalez @frost.com or visit www.environmental.frost.com.