Petrochemicals can be defined as a large group of chemicals derived from petroleum and natural gas and used for a variety of chemical purposes. Petrochemical plants are in the business of developing substances such as hydrogen, carbon monoxide, synthesis gases, chemicals such as ethylene and its derivatives, benzene and toluene to name a few.

Wastewater treatment in petroleum refineries is a complex process, with demanding environmental management challenges as byproducts can be both volatile and toxic. Petrochemical wastewater often requires a combination of treatment methods to remove oil and other contaminants before discharge. Issues such as groundwater contamination; aromatics; oil, grease and organic removal, and VOC control have to be addressed in order to comply with environmental regulations and maintain a good customer image.

A typical wastewater system may include neutralization, coagulation/flocculation, floatation/sedimentation/filtration, clarification and biodegradation (e.g., trickling filter, anaerobic treatment, and aerated lagoon, rotating biological contactor and activated sludge). A final polishing step using filtration, ozonation, activated carbon, or chemical treatment may also be required.

An increased understanding of requirements of the petrochemical end-user is gaining importance as industry needs change due to stricter regulation and environmental laws. It’s important equipment manufacturers keep abreast of these requirements to capitalize on future opportunities. End-users are forced to become more aware of what types of waste they’re creating and discharging, and how they can adjust their current treatment equipment to meet new demands.

Catalyst for Change

The petrochemicals industry has recently undergone a period of change. Company consolidations, budget cutbacks and stiff competition have hit hard - and many players are consolidating or diversifying. Very little new petrochemical capacity is planned in North America despite the slowdown of several plants during 2000-2003. The changes in that period were highlighted by mergers, acquisitions and joint ventures in an effort to meet the nation’s growing needs for various commodities such as oil and gas.

Growth opportunities will present themselves in the form of development of new product lines and additional M&As, whereby new business combinations will acquire the shares of other market participants in an attempt to create more efficient players. Industry consolidation has been an answer to maturing markets for several years in wastewater treatment market across both the municipal and industrial segments as well.

Critical success factors in the market include competitive pricing and ability to meet customer’s requirements as specialist knowledge grows. With increasing specialization, technological evolution and complex customer demands, larger turnkey operators are increasingly dominating the market.

Market Scenario

The market concentration of the players in the wastewater treatment market is likely to rise as the market shares of dominant players such as USFilter and Infilco Degrémont increase due to M&As, technological innovation and strategic emphasis. Technological options are numerous providing opportunities for treatment equipment manufacturers, niche technology suppliers and turnkey plant operators alike.

Smaller equipment manufacturers continue to participate actively in this market though it is anticipated these companies will have to examine various strategic options, including development of niche technologies to continue to remain profitable in this business.

The U.S. wastewater treatment equipment revenues in petrochemical sector recorded estimated revenues of $89.5 million in 2004. It’s expected those might reach $131.5 million by 2010. A compound annual growth rate is expected to be 6.6% for the forecast period. Figure 1 gives the annual forecast for wastewater treatment equipment revenues in the petrochemical sector.

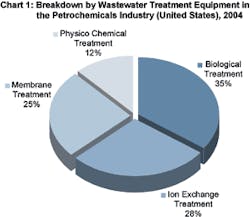

Chart 1 gives a split of the different equipment categories for petrochemical wastewater treatment. It’s interesting to note advanced biological treatment methods still form a sizable portion of wastewater treatment equipment for petrochemical applications. This is because there’s a growing preference in the industry for non-chemical treatment processes. This upward trend provides growth opportunities for suppliers in advanced biological systems such as membrane bioreactors in the petrochemical wastewater segment.

Some of the leading names in the petrochemical wastewater management market include USFilter, Andritz, Infilco Degrémont, Bechtel, Jacobs H&G, Pall Corp., Millipore, Koch Industries Inc., Severn Trent Services, GE and ITT - to name a few.

According to customers purchasing criteria and highest satisfaction levels, the critical success factors for suppliers are: Reliability and output quality, as well as safety in the post 9/11 era, and most importantly servicing, such as general quality of service, after sales support and proactive services such as good product training. Customers also rely on industry experience and reference from others before considering a new supplier.

With more specialization, technological evolution and complex customer demands, it’s often large turnkey operators who are able to dominate the market. Companies like USFilters and Infilco Degrémont do this by providing integrated waste management solutions. The market concentration is likely to rise as market shares of dominant players increase. Tier 1 companies have made increasing gains in this market due to geographical expansion, technological innovation and strategic emphasis on service in the growing petrochemical wastewater treatment market.

The market is extremely competitive and without product differentiation features it becomes extremely difficult to distinguish one company’s products from another. Tier 1 companies have in particular sought differentiation based on value-added services and brand name development. USFilter is an example of such a company, that with its wide product line is able to provide one-stop shopping as well as engineering and operating services.

Another example of a successfully operation company is Severn Trent Services (STS). Severn Trent Plc identifies the U.S. market as offering the biggest opportunity for businesses under STS. To capitalize on this, STS began a series of key acquisitions to ensure a solid position in the market. Each acquisition symbolized a new product line or an enhanced version of a service already offered.

Tier 2 companies often have smaller financial backing than Tier 1 companies, so instead of offering every type of product, they improve the products they do have. Product differentiation is very important for Tier 2 companies because there are typically a large number of players in this segment often offering similar products. One such company, Aqua-Aerobic Systems Inc. has developed several product differentiations including brand name development, quality improvement and value added services. The company has invested heavily in supplying product representatives with proper tools to develop brand name recognition.

Environmental Dynamics Inc. (EDI) offers several different varieties of aeration products. This company has primarily concentrated on its diffuser technologies, the flexible membrane type in particular. EDI, though, also offers cheaper coarse-bubble diffusers as well as some relatively inexpensive mechanical aeration devices. It markets these products to encourage end-users with every wallet size. It also offers convenient financing options to customers with short, medium and long term financing to equip buyers otherwise short on funding.

Customer requirements

The performance of water and wastewater treatment equipment suppliers can be analyzed on the basis of several factors as shown in Chart 2. Customers today demand the industry provide them with a wider range of services such as quality, reliability and cost analysis. Identifying and meeting these needs is the key to continued success of any business supplying water and wastewater equipment to this industry.

Conclusion

The petrochemicals wastewater management market remains in a state of flux as petrochemical industries respond to both external regulatory pressures for clean discharges. Innovative strategies and proactive solutions will clearly assist the market. Overall the market therefore promises to offer challenging yet innovative growth possibilities for turnkey plant suppliers, equipment manufacturers and service providers.

About the Author

Shilpa Tiku is a research analyst in the North American Environmental Group of Frost & Sullivan, a market research and growth and management consulting firm based in San Antonio, TX, and with offices worldwide. It released a report, “Water & Wastewater Management in the Petrochemicals Industry,” in the first quarter of 2005. For more information, contact Tolu Babalola at 210-477-8427, [email protected] or visit www.environmental.frost.com.Challenges Facing the Market

Point source efficiency decreasing potential revenues: Many facilities are choosing to alter their manufacturing processes; thereby eliminating potential point source pollutants and a significant quantity of wastewater that otherwise would require treatment before discharge. Water use has declined due to recycling and more efficient water use in manufacturing processes.

Maturing market demands increasingly innovative solutions: The market for petrochemicals water and wastewater treatment is experiencing an increased level of maturity with many industrial sites having met treatment capacities. It’s looking for innovative solutions including diversified products (technological options) and processes (such as outsourcing contracts). Water outsourcing contracts have come into prominence because of a felt need by petrochemical industries to reduce long term operational costs as well as dependence on an external water/utility provider. The challenge lies in being able to cater to the changing needs of the petrochemical end-user, such as the shift in investment toward replacements, upgrades and services with greater focus on cost efficiencies.

Competition enables dominance of large players: The market has demonstrated a clear trend toward consolidation of large companies. While it continues to offer possibilities for a range of treatment equipment suppliers as well as emerging opportunities for service providers, success is largely based on innovative technology and strategic partnerships. Consolidation has created a small number of industry giants that dominate the entire market. This type of growth has created one-stop shopping, allowing end-users to purchase all product lines they might have been missing. This is a challenge for those smaller niche-marketing players that cannot compete with lower prices or extensive product lines offered by larger companies.