As in many industries, the food processing industry has undergone a period of change. In a tight economy, company consolidations, budget cutbacks and stiff competition have hit hard. But the desire to expand into new markets and product lines may prompt an influx of new facilities.

Large manufacturing facilities no longer characterize this market. Today, manufacturing facilities with efficient production lines and accommodation of a variety of product types are growing in popularity.

The market for water and wastewater treatment equipment in the food and beverage industry was valued at $195.7 million in 2000. Frost & Sullivan reported revenue in this market was about $248.2 million in 2004 and estimated to grow at a compound annual growth rate of 7.0% through 2010.

A Central Ingredient

The food and beverage industry traditionally uses large volumes of water with a manifold of purposes. In addition to being a constituent of products, the water is a convenient, clean, relatively inexpensive resource, as well as an essential method for conducting cleanups and other production needs. Since the food and beverage company is only cleaning food debris, its wastewater isn’t considered hazardous generally by the generator.

Serve Yourself

At the same time, with the increasing expense of infrastructure support for water and wastewater service delivery, there’s increasing pressure on the municipality to cover its real costs of operation. Obviously, the cost to food and beverage companies then is twofold, namely rising water charges and increases in wastewater surcharges. Plants are therefore increasingly pressured to treat their own water and wastewater supplies.

Frost & Sullivan carried out structured interviews with over 100 food and beverage water and wastewater plant managers. It plotted customer satisfaction against expectations with various factors to evaluate both total market trends and more importantly, performance of individual suppliers.

Customer satisfaction was based on a blend of core elements of the supply (product quality, reliability and technological skills) and more value added elements (customer service, price and delivery times). The performance of individual companies varies dramatically across each factor; however, illustrating that while some are developing a competitive advantage, other incumbent suppliers need to rapidly address critical issues to build customer loyalty. Additional profiling of service market trends further reveals the nature of demand and competition.

According to customers’ purchasing criteria and highest satisfaction levels, the critical success factors for suppliers are reliability, output quality and safety of the system. In terms of service, the legislative compliance, CAPEX (capital expenditure) and OPEX (operational expenditure) of the system are imperative. Customers also rely on industry experience and referrals before considering a new supplier in this market.

Emerging strategic priorities are sources of differentiation and competitive advantages that lie in the rising importance of pricing and servicing. According to reasonable satisfaction levels, competitiveness in customer service is clearly on the rise. Although customers have commented that prices are generally high throughout the market, they’re willing to incur higher costs if the quality of the product can match the price.

Main Purchasing Criteria

The respondents were asked to state what they thought were their main purchasing criteria when choosing a water and/or wastewater treatment system or piece of equipment. Investment decision observations are supported by additional customer analysis, when directly asked to identify the most important purchasing criteria. The following trends and quotes summarize the most common unprompted purchase factors. Clearly, the key purchasing criteria in this industry is reliable quality in terms of legislative requirements, price and servicing. This, though, often is reflected in compound answers:

• “We look at reliability, cost and efficiency”

• “I look for reliability; cost and ease of maintenance; the cost has to be inexpensive; the product has to last”

Legislative compliance and being a good environmental citizen are key issues:

• “We must meet compliance issues”

• “…I also take the environmental effect to the community into mind”

Quality is important:

• “I think quality and affordability are the most important criteria for my company”

Cost issues are not to be underscored:

• “I guess how often it could need parts and how quick I could get those; what would be the expense”

Measuring Factors

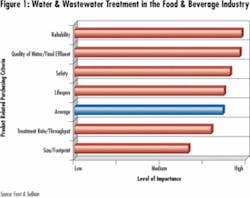

Each of the respondents were asked also to estimate the degree to which each of the following product related factors would affect purchasing decisions:

• Reliability

• Quality of Water/Final Effluent

• Treatment Rate/Throughput

• Safety

• Size/Footprint

• Life Span

Figure 1 presents the average customer ratings given to product related criteria on a scale of 1 to 5, where 1 is of low importance and 5 is of high importance.

Product suitability in terms of quality and more specifically purity of output is one of the most frequently stressed purchase factors according to water and wastewater treatment equipment customers in the food sector. In terms of a product’s durability, quality demands reflect the central product reliability concerns. Such demands go hand in hand with the most critical needs for legislative conformance, particularly within the wastewater treatment sector, which is fundamentally driven by intentions to meet minimum requirements.

In the food industry, product-related criteria scored a high average rating. This speaks of how important all product-related factors are to the customer when considering a supplier in the market. Of particular importance in this industry are reliability and quality of water/final effluent. In a highly regulated industry that consumes large amounts of water, it comes as no surprise that these two factors rate so highly.

Serviceability is also reflected as tailoring to customer specific requirements, such as product size or footprint. Size, though, is most dependent on location and plant specifics and therefore variable in its importance to different customers. As such, views on size are some of the least unanimous of all prompted factors and score the lowest rating among product factors. Nearly half of customers rate size as reasonably if not very important. On the whole, a compact product is most likely to act as a competitive advantage only.

New Market Entrants

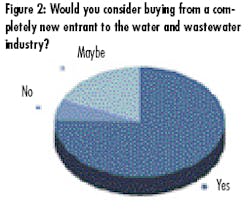

Frost & Sullivan prompted the question “Would you consider buying from a completely new entrant to the water and wastewater industry?”

Figure 2 illustrates the customers’ responses to this question - illustrating that over three-quarters of customers would consider such a situation.

Shown below are sample responses according to their answer:

• “Yes, newer technologies, faster reaction, competitive pricing”

• “Yes it would depend on the product and if we could get some testing done to show that it works, may be less expensive or has a new twist on a technology.”

• “Yes, if the price is right and has good credentials I’m open to buying from someone new”

A number of customers responded they would “maybe” consider purchasing equipment from a new entrant to the market, though several concerns needed to be addressed. Sample responses include:

• “I would have a lot of questions”

• “Maybe. You have engineers that can design, but they cannot always make it work... so they may not have the bugs ironed out”

• “Just depends on price, service and reliability - and location”

Only a small percentage of customers wouldn’t consider purchasing from a new entrant:

• “I’d rather have someone with a history”

• “No, what I need to have done I know who they are and I’ve used them before”

• “No, reliability [is an issue]”

Conclusion

There are major findings and strategic implications of the current market climate and customer experiences that companies in the market need to be aware of to succeed and grow in this sector:

• The market is in the growth-to-maturity stage.

• Increasingly aging infrastructure is driving the repair and replacement market growth.

• Regulations and legislative compliance are driving the technology upgrade and update markets.

• Interest in full outsourcing in this market is still relatively undeveloped, with many food and beverage companies having in-house teams to handle much of the day-to-day running and maintenance of the plants.

• Specific technology interests lie in newer technologies such as UV and membranes and lower cost sludge treatment technologies.

Sources of differentiation and competitive advantages lie in the rising importance of pricing and servicing that are now identified as the emerging strategic priorities. According to the reasonable satisfaction levels, competitiveness in customer service is clearly on the rise. Although customers have commented that prices are generally high throughout the market, they are willing to incur higher costs if the quality of the product is able to match the price.

If companies are able to focus on, and exploit these market and customer factors then they should be able to succeed in the market.

About the Author: Matthew Barker is a senior industry analyst and program manager for the Water & Wastewater Treatment Unit of Frost & Sullivan. With a bachelor’s degree in environmental science from the UK’s Lancaster University, Barker has spent over five years analyzing the markets for technologies, plants and services within the water and wastewater industries sector. He initially worked from the company’s London office, before transferring to the San Antonio office in May 2003. Contact: [email protected].