By John Cheslik

In March 1998, Milwaukee Metropolitan Sewerage District (MMSD) awarded an operation, maintenance, and management contract for its facilities to United Water. The 10-year contract will result in $140 million savings over the term and has already contributed to a 16 percent rate decrease.

A portion of the operation savings came from improvements made in the procurement of energy (natural gas, electric, propane, and fuel oil) needed by these systems. Before United Water, the MMSD had implemented a sound approach in providing energy to the facilities at an annual cost of $9.2 million. United Water has reduced the facilities energy cost by more than 20 percent annually and will recognize even lower costs as the innovative strategy more fully evolves.

Background

The Milwaukee Metropolitan Sewerage District (MMSD) is a special purpose municipal corporation charged with the collection and treatment of wastewater in the metropolitan Milwaukee area. MMSD's service area encompasses more than 420 square miles of drainage in all or parts of five counties. The MMSD owns two treatment plants, 320 miles of interceptor sewer including 17 miles of 32-foot diameter storage tunnel, multiple collection and pumping structures, and power generating and biosolids production facilities.

Both wastewater treatment plants (WWTP), the Jones Island WWTP and South Shore WWTP, use activated sludge processes for the treatment of waste streams. The Jones Island WWTP treats an average daily flow of 125 million gallons per day (MGD) with a maximum capacity of 390 MGD. The South Shore WWTP has an average daily flow and maximum capacity of 125 MGD and 390 MGD, respectively. However, solids processing and, therefore, energy needs and supply strategies are quite different between the plants.

Solids Processing

MMSD has a rich history in beneficial reuse of biosolids. In the 1920's, the Jones Island plant pioneered the transformation of solids into a useful, marketable product under the brand name Milorganite. Milorganite is a dry, Class A, granular fertilizer rich in nitrogen and iron that continues to be the leading natural organic fertilizer in the US and Canada. Each year, from 50,000 to 60,000 tons of the product are shipped throughout the country. Milorganite is processed from a mixture of primary, secondary, and digested solids.

In recent years, MMSD has continued the development of beneficial reuse through an agricultural soil enhancer. Agrilife, a liquid Class B biosolid, is used by farmers in Southeast Wisconsin to fertilize crops and enhance soil condition. Agrilife is processed at the South Shore plant from digested primary and secondary solids. Between 14 and 20 million gallons of Agrilife are applied annually. This reuse focus has resulted in beneficial application of over 95 percent of the plant solids.

Energy Needs, Strategy

The drying and pelletizing system that produces the Milorganite requires a significant amount of energy - nearly 1,500,000 pounds of water need to be driven off every day. In the early 1970's, MMSD evaluated optimal energy delivery methods for the Jones Island facility, looking carefully at its combined electric (300 megawatt-hours (MWh) per day on average) and heat needs. A cogeneration system consisting of two 15 MW natural gas combustion turbine generators and waste heat ducting to the sludge dryers was installed and operating by 1975. A diesel fuel system was also installed as a secondary feed system to the turbines.

At the South Shore WWTP, the digestion process generates methane gas. The gas is used in 1.4 MW reciprocating engines directly coupled to blowers to provide the biological process air. The methane is also used, in part, to supply boilers that heat buildings and the sludge entering the digesters. Additional engine generators were installed in the early 1980's to use methane to provide electric power to the facility.

Before deregulation of the natural gas industry in the 1980's, the natural gas and electric supply for these facilities were supplied from regulated utilities. One electric utility served both plants, while two, separate gas utilities served each plant. The South Shore plant was served by a gas company affiliated with the electric utility.

Energy alternatives to the use of tariff gas were explored in the late 1980's and an alternative, lower cost supply method developed. The MMSD selected the following gas supply strategy via a natural gas supplier/marketer:

- The upcoming month's gas commodity supply was purchased for delivery to an interstate transporter at market closing rate,

- Interstate transportation was purchased on a firm basis,

- Intrastate transportation was provided by the local distribution company (LDC) at tariff established rates,

- Balancing, daily supply/injection and administration was done by the gas marketer

Although no alternative electric supplier was possible, MMSD was able to enter into a standby generation contract with the local electric supplier in the early 1990's. These agreements allowed a monthly capacity payment and energy payments for power generated. Overall, the combination of cogeneration and gas supply strategy had resulted in large savings over alternative approaches. The largest benefactor from these savings was the Jones Island WWTP.

United Water Operating Plan

When United Water began operation of MMSD's facilities in 1998, considerable attention was given to the cost of energy (electricity, natural gas and other fuels). Despite the sound economics and practices of the past, the $9.2 million annual energy cost at the MMSD still represented a significant portion of the operation and maintenance cost.

The complex energy requirements gave rise to a multi-tier fuel supply plan that ensured reliable fuel availability on short notice while reducing operating costs. United Water Services' fuel strategy focused on the following areas:

- Restructuring the gas commodity supply contracts to establish tiered supply levels,

- Rationalizing the firm transportation service on the interstate pipeline system,

- Using natural gas futures contracts and call options to help stabilize commodity prices,

- Optimizing Gas-Fuel Oil pricing spread opportunities,

- Optimizing electric power supply pricing, and

- More active management of the energy supply and sales.

Fuel Needs

At the Jones Island WWTP, a gas-fired turbine is used to reduce energy costs. During electric off-peak periods, the turbine is operated at 7-8 MW to provide heated air to match the solids drying need. During electric on-peak hours the turbine output is increased to match plant load (12-13 MW) thus avoiding electric demand charges. A standby turbine is able to be dispatched under a power sales agreement and provides power during rain events to the deep-tunnel pumps. Natural gas use is further dependent on building heat needs. Without dispatch, deep tunnel, or heat needs, routine natural gas needs are 4200 decatherms (DT) per day. Dispatch, deep tunnel or building heat requirements can increase this base use by 25 percent to 100 percent.

The South Shore plant normally purchases 200 DT per day of natural gas and 1.6 MW of electricity. Electric demand varies slightly based on building heat needs and plant flows. Natural gas requirements can be 100 percent to 200 percent higher depending on digester gas production.

Fuel Supply

United Water did not believe that the existing supply arrangements optimized gas pricing at the point of use. For example, the gas supply contracts in force when United Water began operation had 5800 DT per day of firm, interstate supply transportation. Under these transportation contracts, full transportation fees were paid on days when the full volume of gas was not needed. Although this provided guaranteed deliveries in the winter months when gas transportation may have been constrained, transportation capacity was not a concern the rest of the year.

A new supply agreement was sought using a formal, well-defined Request-For-Proposal (RFP) process. The key components of this RFP included details of historic daily gas consumption, supply pricing based on published, market-based indexes, disclosure of fees for administration, tiered supply pricing, and billing requirements. Additional services such as balancing and hedging contract prices were solicited separate from the commodity supply.

A commodity supply approach that varied pricing with stability of gas use resulted in the lowest cost natural gas supply. Since the plants routinely used 3800 DT/day, this supply was provided on firm interstate transportation at a price indexed to the New York Mercantile Exchange (NYMEX). The firm transportation service allowed the lowest transportation cost on the gas that was fully utilized. This minimized or eliminated payments for unused transportation.

Winter gas commodity needs were supplied by secondary firm transportation contracts for only the winter heating season (November through March). Summer gas needs were transported either by the gas marketer's transportation or on released-firm transportation contracts. Additional winter or summer gas commodity above the base load could be pre-purchased at monthly NYMEX prices or purchased daily from the gas marketers pool at a regional daily index price.

In addition to selection of a new gas marketer and gas supply strategy, different commodity purchase strategies were implemented. These included the purchase of futures contracts to lock-in commodity prices during low price cycles and collars during times of price instability.

Other Supply, Energy Changes

Several other changes that improved the delivered price of energy were implemented.

Since the Jones Island WWTP had back-up fuel facilities, additional economic value was obtained by selling options to use the 3800 DT per day firm transportation and supply for short periods of time. These economics are driven by facilities that can only use natural gas and periods of high demand. By selling the natural gas and using fuel oil and propane, the plant needs can be reliably met while lowering overall energy costs.

Concurrent with the selection of the new gas marketer, the local distribution company that serves the major collection facilities announced an alternative supply program for a limited number of customers. The 10 largest collection facilities were selected to participate in the alternative supplier program.

While the Jones Island WTP had historically focused on matching gas nominations with use, the South Shore plant had not paid as much attention to the costs resulting from these imbalances. United Water centralized use-monitoring to match prior day gas nominations and reduce balancing charges. Additionally, both plants benefited from the implementation of intraday nominations that allowed changes to predicted gas use during the use day.

New power sales agreements were negotiated that increased the capacity and energy payments for electricity exported from the Jones Island facility.

Results

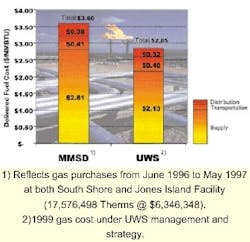

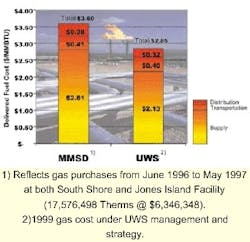

The success of the revisions to the energy strategy is reflected in lower energy costs to the facilities. In 1999, the cumulative aggregate energy cost at the facilities was $7.2 million. Specific results of these current changes show the following:

- For the plants, the burner tip price can be divided into three components: the commodity price, the intrastate transportation cost, and the local distribution costs. For the sake of this comparison, balancing and administrative charges are included in the intrastate component. For the year ending 1999, the new strategy resulted in a 21 percent unit fuel cost reduction. Additional savings are not fully reflected for the firm commodity reduction since they began in November 1999. An additional $0.05 per DT annual reduction is expected to the intrastate transportation on an annual basis.

- Natural gas costs for the collection system facilities under the alternative energy supplier have been 20 percent below the gas company rates.

- Revenues from electric power sales have increased by 100 percent for capacity payments and 64 percent for dispatched energy with no increase in operating costs.

About the Author:

John Cheslik is Assistant Project Manager for the United Water Milwaukee Project. Cheslik has more than 18 years experience in the field of civil engineering and operation of water and wastewater systems. His experience and expertise includes: facility planning, design, pilot testing, operator training, process optimization, and operations and maintenance support. He has worked as senior and chief engineer for privately-owned water and wastewater utility companies, senior operation and maintenance engineer for combined 250 MGD wastewater facilities, and provided process design, testing and application on a wide variety of industrial and municipal applications.