By Glenn Oliver

Media reports have produced numerous stories showing that the water and wastewater infrastructure industry is facing serious challenges due to crumbling infrastructure, new regulations, lead leaching in water pipes (e.g., Flint, Michigan), and population growth. The American Society of Civil Engineers has documented that $45 billion is invested in water and wastewater infrastructure today and this amount is going to rise significantly in the future.

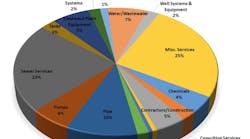

Water and wastewater utilities are mostly publicly owned and are required to use the public bidding process to award infrastructure contracts. A review of water and wastewater bidding activity over the last 3 years by H2bid shows a clear trend: bidding activity is growing significantly. Between 2014 and 2016, water and wastewater infrastructure bid activity increased by 30%. There are seven areas where the growth in bid activity has been particularly pronounced: chemicals, consulting services, laboratory and field testing equipment, meters, process control and data management systems, pumps, and tanks. A brief overview of the growth in these sectors is shown below.

Bids for Chemicals: 38% Increase

Utilities buy a lot of chemicals, and the need to address new regulations and the demand from new facilities are contributing to the increase in chemical bids. Chemical contracts are often multi-year agreements and there have been many agreements that have come up for re-bid over the last 3 years. Chemical bids cover purchases for such chemicals such as calcium hypochlorite, activated carbon, aluminum chlorohydrate, chlorine, aqua ammonia, caustic soda, and sulfur dioxide.

Bids for Consulting Services: Modest Increase in Previous Years But Growing Rapidly in 2017

Bid activity for consulting services saw modest increases in 2015 and 2016, and a slight decrease in 2016. However, this category is included because it is experiencing a significant increase in 2017. At the current rate, bid activity for consulting services in 2017 reflects a 44% increase over 2014, driven by the growing need for utilities to rely on consulting services to help them grapple with the increasing complexity of how to incorporate new technologies into their infrastructures, how to develop the right specifications, and how to improve operational efficiency. Consulting services bids cover a broad range of services, including bids for engineering services (of various kinds), health and safety consulting services, IT implementation services, IT support services, rate studies, budgeting, conservation, cathodic protection system monitoring and design, and real estate consulting services.

Laboratory and Field Testing Equipment: 35% Increase

Utilities are challenged to improve their ability to detect and analyze more and more items that are showing up in our drinking water and wastewater, including prescription drugs, industrial chemicals, and various other substances that are consumed and passed though the human waste system. This is driving the need for new and better testing equipment. This category includes bids for laboratory services, ion chromatograph systems, wastewater toxicity testing services, water quality testing services, and pre-treatment influent & effluent sampling.

Meters: 22% Increase

Utilities are continuing to add meters to their networks to capture the ability to track and bill for actual usage. Yet, there are still sections of communities that are not metered and more projects to address the gap in metered services are being placed out for bid. Also, a recognition of the long-term benefits of automatic meter reading has contributed to the increase in meter bids. Bids related to meters include bids for meter replacements, meter upgrades, water meter software, water meter reading services, meter data collection systems, meter reading services, and meter installation services.

Process Control & and Data Management Systems: 30% Increase

This sector is directly related to the trend towards using technology to more efficiently monitor, manage, maintain, repair, and replace infrastructure assets. The majority of bids in this category are for supervisory control and data acquisition (SCADA) systems. Higher growth rates are expected in this sector as new technologies are brought to market and adopted. This category includes bids for new SCADA systems, SCADA system upgrades, SCADA alarm and notification systems, SCADA system servers, and SCADA system master plans.

Pumps: 30% Increase

Utilities require large pumps to push treated and untreated water and wastewater large distances to its intended destination. Many pumps are reaching the end of their useful lives and require total replacement or major repairs. Given the size of most infrastructure pumps, this is often a major investment that can require additional infrastructure work (e.g., a pump station, which can easily exceed $500,000 in total cost). This category includes bids for pump stations, pumps and generators, pump repairs, and chemical feed pumps.

Tanks: 29% Increase

Tanks are required to store water and wastewater. Elevated water storage tanks can be seen often from miles around. Some municipalities use them for promotional purposes by placing the municipality’s name and slogan on the elevated tank. This category also includes underground storage tanks. This category includes bids for new tank construction, tank painting, tank rehabilitation, tank coating, tank testing and maintenance, and tank demolition.

These are just a few of the areas where water and wastewater bidding activity is on the rise. With $1 trillion in infrastructure investments needed to meet the nation’s water and wastewater infrastructure needs, we should continue to see growth in the water and wastewater utility industry, which presents long-term opportunities for utility suppliers and contractors.

About the Author: Glenn Oliver is the CEO of H2bid (www.h2bid.com), a leading source for water and wastewater utility contract opportunities. He has over 15 years of public and private experience in the water industry, including formerly serving as a Commissioner for the Detroit Water and Sewerage Department. Under Oliver’s leadership, H2bid has grown to provide information on water utility contract opportunities from all 50 states and Canada, and has a database of over 350,000 water and wastewater utility bids and RFPs (and growing daily).