A recent bill proposes to extend the maximum term of the Environmental Protection Agency’s (EPA’s) Water Infrastructure Finance and Innovation Act (WIFIA) loans to 55 years. That could be a useful change for many stormwater systems planning long-lived projects.

The ‘‘Water Infrastructure Finance and Innovation Act Amendments of 2022’’ (H.R. 8127) was introduced in Congress in June 2022.

Most of the amendments are intended for large-scale Western water management projects, especially those where the Army Corps of Engineers is involved (the Corps recently began the process of utilizing its own allocation of WIFIA funding). However, a loan term extension to 55 years included in the bill would apply to all WIFIA projects with a useful life at least that long. Obviously, that’s relevant for Western dams and canals – but it would apply to many local stormwater projects, too.

The Value of WIFIA Loans

Ideally, the financing term of an infrastructure project should match the project’s useful life. That way, annual debt service is minimized, and the project’s capital cost is appropriately spread over time and generations.

This is especially true when the source of the financing is a state or federal infrastructure loan program that offers subsidized interest rates. The maximum possible term will result in the highest present value of savings compared to market alternatives. No mystery there.

The WIFIA loan program offers an interest rate based on the United States Treasury yield curve when the loan is executed. In effect, it’s the federal government’s cost of borrowing to fund the loan, without any mark-up. For private-sector borrowers, that’s always a great deal. For public-sector borrowers, especially highly rated ones, the situation is more complicated. They can access another, federally subsidized alternative, the tax-exempt municipal bond market. Rates in that market are often at —or even below— the U.S. Treasury’s.

For water infrastructure projects with a large proportion of mechanical equipment (e.g., water treatment plants), WIFIA’s current maximum loan term is completely adequate to match the project’s overall useful life.

That’s not necessarily the case for projects with a high proportion of non-mechanical assets, like concrete structures and site modification. These projects often have an overall useful life well beyond 45 years. Obvious examples include large-scale water management systems involving dams and canals, which are very long-lived. But it’s also applicable to many local stormwater projects where the primary assets, conveyance systems, have useful lives of 50 to 100 years, according to American Society of Civil Engineers. Shouldn’t the financing needs of these types of projects be on WIFIA’s radar screen?

Extending WIFIA’s Maximum Loan Term

Successful federal programs aren’t cast in stone at inception. They evolve over time, expanding and modifying their capabilities to reflect experience and needs.

Currently, WIFIA loans to stormwater projects total about $700 million — only 4.5 percent of the program’s $15.4 portfolio, by far its smallest percentage. From a U.S. water infrastructure policy perspective, WIFIA should seek a more balanced mix. Extending WIFIA’s maximum loan term for very long-lived infrastructure projects will make the program more useful to the stormwater sector, increasing application and loan volume.

A statutory amendment will be required for this change, but it’s not difficult to make the case for implementing it.

Long-term lending is a federal strength, relative to the private debt markets. Extending WIFIA’s loan term is a simple amendment. There’s a direct recent precedent in the 2021 Infrastructure Investment and Jobs Act. In that law, the U.S. Department of Transportation’s TIFIA loan program, WIFIA’s predecessor in the transportation sector, amended its maximum loan term to 75 years.

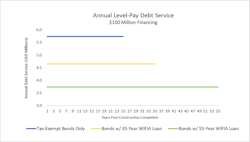

What would a 55-year WIFIA loan term look like for long-lived project? The chart below shows one important aspect: annual debt service after construction completion.

Its underlying model is highly simplified. Assumptions include a $100 million project financed with a 51 percent/49 percent combination of tax-exempt bonds and a WIFIA loan, both with a Treasury-like 3.0 percent interest rate and a level-payment debt service payment schedule over the post-construction term.

For clarity, some other WIFIA features are excluded. But even with these simplifications, the chart accurately reflects the significant magnitude of lowered payments. Apart from annual debt service, the discounted present value of additional savings for a 55-year WIFIA term are about 5 percent of project cost. That’s on top of the other benefits of a WIFIA loan compared to market alternatives.

The Bigger Picture

The simple change of extending WIFIA’s maximum loan term should also be considered in the context of the program’s bigger picture, especially for the stormwater sector. WIFIA has been remarkably, albeit somewhat narrowly, successful in the past few years, becoming an important resource for relatively large and highly rated drinking water and wastewater utilities.

That success is an excellent foundation for future growth. WIFIA growth is usually understood in term of more funding for greater loan volume, but it's equally important for its loan capabilities, which can be refined to meet the specific needs of many areas of water infrastructure financing.

Extending WIFIA’s loan term, either by the current bill or through other legislative paths, is a way to begin this process, which still has a long way to go. The stormwater infrastructure sector, with its specific funding challenges and asset types, can be engaged from the start by supporting an extension of WIFIA’s maximum loan term.