Sustainability and asset management are key solutions to the financial puzzle facing the U.S. municipal water market, but new thinking is needed to boost investment in water infrastructure, according to a new report issued in mid-June.

Black & Veatch's first "Strategic Directions in the U.S. Water Utility Industry Report" was released during ACE12 in Dallas, TX. The report identifies top challenges in the water and wastewater industry and is based on a comprehensive survey of U.S. utility leaders.

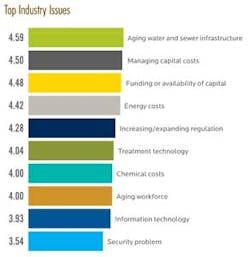

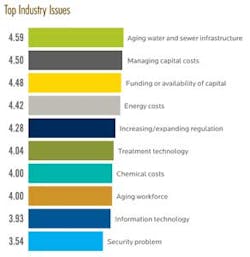

"First and foremost the survey confirms that financial issues, and all issues that drive investment or costs, are front and center with water utility leaders," according to Cindy Wallis-Lage, President of Black & Veatch's global water business. "When asked to rate the importance of major industry issues, survey respondents considered aging water and sewer infrastructure as the most important issue facing our industry, with managing capital costs, funding or availability of capital, and energy costs following closely behind."

Key findings from the water report include:

- More than 75 percent of respondents have taken measures to reduce energy consumption within their utility operations. Electricity used to produce water can account for as much as 30 percent of water utility budgets.

- More than half of survey respondents stated they are implementing asset management improvement programs.

- 85 percent of respondents said average water consumers have little-to-no understanding of the gap between rates paid and the cost of providing water and wastewater services.

- Nearly half of utility leaders believe that customers will probably be willing to pay higher rates needed to pay for capital improvements.

- Despite funding concerns, the majority of utilities are not considering other forms of financing such as public-private partnerships.

"Overcoming today's challenges requires a significant change in how utilities develop and implement strategic and capital plans," said John Chevrette, President of Black & Veatch's management consulting division. "At the same time, consumers must better understand that water and wastewater services are not free or low cost. Rather, these are services that must be paid for in an equitable and responsible manner."

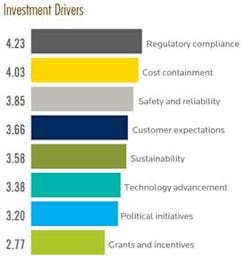

Even though aging infrastructure and funding were the top issues facing the water industry, when asked how specific issues are driving ongoing infrastructure investments, survey respondents indicated that regulatory compliance was by far the strongest driver, with cost containment emerging as the next strongest factor. In recent years, wastewater utilities have been hardest hit by regulation, due to increased wet weather, nutrient reduction and disinfection regulations.

While many utilities have relied on growth and use-based revenue models in the past, that may not be possible going forward. The survey found that growth has slowed for much of the water industry, with the majority of respondents expecting growth of less than 2 percent per year. Expected system growth varied by utility type and area of the country. For example, more utilities in the Northeast expect no change in system size, while some areas have experienced significant population loss.

In an interview at ACE12, Wallis-Lage said water utilities need to broaden their thinking as they search for creative solutions for funding. Those may include tapping in to public private partnerships, other private funding sources, and increasing rates to pay for infrastructure improvements.

"I think the public is more than willing to pay for those increases when they understand why they are needed," she said. "We haven't necessarily sent that message out there with clarity and purpose to help the end users, whether that's businesses or private households, understand the part they need to play and why they need to be part of the solution as we identify funding."

The Strategic Directions in the U.S. Water Utility Industry Report is available at www.bv.com/survey.

More WaterWorld Current Issue Articles

More WaterWorld Archives Issue Articles