By Jeff Gunderson

Vehicle manufacturing processes, including both assembly plant and parts and component operations, require significant quantities of water. In the automobile assembly lines, water is used throughout a number of different process and production stages where vehicles are treated, washed, rinsed and painted, generating wastewaters contaminated with metals, oils and grease, and paint residuals. According to industry estimates, upwards of 40,000 gallons can be required to produce a single vehicle, making the automotive sector one of the heavier industrial users of water.

Based on the water-intensity of vehicle production processes and factoring in mounting concerns and operational risks associated with water stress, automobile manufacturers are implementing sustainable measures and advanced technologies to reduce process water usage and increase water efficiency. Such efforts not only reflect a commitment to embracing responsible water practices but also help mitigate present and future risks associated with water supply limitations.

Fred Wiesler, global director of sales with QUA, a manufacturer of advanced membrane products for the industrial market, said with source water expenses and wastewater disposal costs increasing — and environmental discharge regulations becoming stricter — automobile assembly plants and parts manufacturers alike are increasingly driven to find ways to decrease these outlays and are adopting different technologies and solutions for reducing water usage and minimizing discharge volumes.

“This is evident across the greater automotive industry but most prevalent in assembly operations where vehicle painting, surface rinsing, and phosphate treatment processes have traditionally relied on tremendous amounts of water, producing significant volumes of process wastewaters that need to be managed,” Wiesler said. “The sheer size of the parts drives this higher water usage.”

With closed-loop strategies attracting greater interest for tightening water usage and decreasing discharge, Wiesler said more plants are implementing water recycling or turning to zero-liquid discharge (ZLD). “A key requirement with these solutions includes the need to concentrate wastewaters,” he said. “One of the more effective ways to accomplish that is by utilizing membrane bioreactor (MBR) technologies.”

Ceramic membranes, which offer broad chemical compatibility, are another effective option for treating automotive wastewaters, according to Wiesler. “Ceramic membranes are well-suited for automotive process applications where harsh chemicals are present in the wastewater streams,” he said. “These products are also cost-efficient for removing oil from process wastewaters and enabling for reuse.”

Corporate water strategies

Corporate initiatives that aim for greater water stewardship are also driving the integration of process-level water-saving technologies and solutions at vehicle manufacturing plants.

As an example, Toyota has implemented a number of water-efficiency strategies across its North American manufacturing facilities as part of its overall commitment to environmental stewardship.

At the Cambridge, Ontario, manufacturing facility, Toyota engineers helped develop a reverse osmosis (RO) concentrate recovery system that utilizes brackish water membranes for treating RO reject concentrate water from the facility’s water treatment plant. The system provides 50 percent recovery from concentrate water that was previously discharged to a local water treatment facility. Toyota has since installed more RO concentrate recovery systems at plants in the U.S., Canada and Mexico, enabling for 73 million gallons of water savings annually.

Also at Toyota’s Cambridge operations in the Lexus South paint shop, over 12 million gallons of rinsing cycle water is being treated and reused every year in further rinsing stages, saving 4.3 million gallons annually, and at Toyota’s motor manufacturing facility in Huntsville, Alabama, cooling tower compressor condensate water is recycled back to the cooling tower for reuse, saving 300,000 gallons per year.

Ford is another major vehicle manufacturer that has embraced water conservation and continues to invest in water-saving technologies and process improvements across its global operations. The company has made substantial progress in cutting process water use, having adopted global water management practices as far back as 2000 and, in 2014, launched a formal corporate water strategy that builds on prior efforts and achievements in enhancing water efficiency.

“For our company, water conservation is a strategic priority,” said Andy Hobbs, director of the Environmental Quality Office at Ford Motor Company. “Many of the areas we operate in are water stressed, and as a company, we strive to eliminate potable water use for vehicle manufacturing to the greatest extent possible,” he said.

A centerpiece of Ford’s water strategy includes increasingly stringent, multi-year water-reduction goals for its own operations. In 2009, Ford set a water-use-per-vehicle reduction objective of 30 percent by 2015 and reached that goal two years early. Since 2000, the company has reduced its per unit water consumption by about 62 percent, according to Hobbs.

In achieving these targets, Ford evaluates and invests in innovative technologies with demonstrated performance for reducing water use in manufacturing operations. Among them, water recycling is a driving aspect, with MBR and RO processes utilized at assembly plants to treat on-site wastewater for reuse.

“We are really focused on increasing the amount of recycled water that we use for process manufacturing, especially in water-stressed areas, so that our impact on water resources is minimal,” Hobbs said. “For making this strategy work, it is vital to use very robust methodologies to ensure that reclaimed water is suitable for process operations. Many of our processes that use water are extremely sensitive to contaminants and the worst thing that can happen at an auto plant is for production to stop.”

Other process technologies employed by Ford include minimum quantity lubrication or “dry-machining,” which lubricates cutting tools with a very small amount of oil instead of using large amounts of fluids and water; 3-wet paint technology which enables for painting activities to be consolidated, potentially eliminating a booth water wash section; and dry paint overspray systems, eliminating water usage from the painting process.

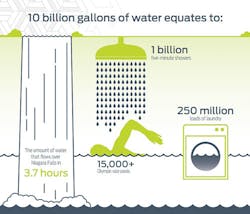

“It can be difficult to justify the expense of water-efficient technologies — especially in areas where water is relatively inexpensive,” Hobbs said. “Often, after making a pitch, it was common to hear that it didn’t make business sense. But when we look back and evaluate the return on investment, we have saved over 10 billion gallons of water since 2000, which equates to a cost avoidance of hundreds of millions of dollars. So these investments have made business sense as the significance and cost of water has continued to increase.”

About the Author: Jeff Gunderson is a correspondent for Industrial WaterWorld. He is a professional writer with over 10 years of experience, specializing in areas connected to water, environment and building, including wastewater, stormwater, infrastructure, natural resources, and sustainable design. He holds a master’s degree in environmental science and engineering from the Colorado School of Mines and a bachelor’s degree in general science from the University of Oregon.