Environmental rollbacks, coal plant retirements to bring investment in water treatment, delay spend

By Erin Bonney Casey

The U.S. power sector is undergoing its own transformation — more wind, solar, natural gas, and less coal. At the same time, environmental policy rollbacks will impact the power sector and, in turn, the water industry.

The 79 percent decline in natural gas spot prices since 2008 have emboldened U.S. independent power producers and utilities to expedite retirement of 20.4 GW of coal-fired power plants to rely more heavily on natural gas. The retirement of coal-fired power plants and subsequent investment in natural gas-fired plants is leading to investment in water reuse and advanced water treatment systems. Fuel switching is a critical opportunity for water solutions providers to penetrate the power sector at the design phase.

The power sector is currently the largest industrial user of reclaimed water with 67 power plants tapping water sourced from municipal wastewater treatment plants in 22 states.

Proposed thermal power plants in key, water-stressed states represent the largest opportunity for reuse rather than retrofits of existing plants. Between California and Texas, which represent almost 20 percent of the announced power project pipeline, risks to water supplies are forcing project developers to evaluate wastewater reuse as an alternative source.

As independent power providers and utilities distance themselves from coal, wastewater solution providers are beginning to benefit from closures of coal ash storage facilities. This, in turn, benefits technology suppliers, engineering firms, and wastewater reuse specialists.

As the fuel mix evolves, the policy landscape is also changing. Curtailment of Environmental Protection Agency (EPA) regulations will no doubt have a profound impact on water for power spend. The Trump administration has already reversed more than 25 environmental rules (and another 27 in process), which, overall, is not good for the water sector supply chain.

In October, the EPA announced plans to repeal the Obama administration’s 2015 policy, the Clean Power Plan, to curb greenhouse gas emissions from power plants. Forced improvements in water quality controls and water management — from supply to discharge — are critical in driving new technology adoption, innovation, and resilient infrastructure investment. Without a coherent plan, companies are even more challenged to scale new solutions, such as wastewater reuse, in an already fragmented industrial landscape.

Another rule the administration is planning to roll back relates to wastewater that’s allowed to be discharged from coal-fired power plants into rivers and lakes. The Steam Electric Effluent Limitation Guidelines (ELGs) haven’t been updated since the 1980s so a change in policy would have far-reaching implications for water.

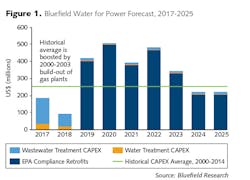

Over 82 percent of Bluefield Research’s US$2.9 billion water-for-power forecast from 2017 to 2025 is currently driven by compliance costs at 206 coal-fired plants (not designated for retirement) to meet the ELGs by the original effective date of November 1, 2018. However, given the rollback, power plant owners have possibly been granted a reprieve and now will likely push back, or avoid altogether, near-term capital expenditure decisions on water treatment. The bulk of spend, which is slated to take place from 2019 to 2023, may be replaced by the widespread transition towards more water-efficient and cost-effective fuel sources.

The trajectory of the power sector, impacted by fuel switching and deregulation, will have ripple effects for investment in water management. The biggest opportunities for water solutions providers will come from management of coal ash ponds, and development of new systems at gas-fired power plants to take advantage of new, inexpensive and reliable gas.

Municipal water and wastewater utilities can also participate in the water-energy nexus by embracing new technologies to reduce power use and begin generating power onsite. The change in fuel mix could potentially lead more water and wastewater systems to gain from improved onsite power management through solar or biogas systems and power purchase agreements with electric utilities in key markets. IWW

About the Author: Erin Bonney Casey is research director for Bluefield Research. She has extensive background in water reuse and the water-energy nexus, and helps lead Bluefield’s U.S. industrial water practice. She can be reached at [email protected].

Circle No. 141 on Reader Service Card