Eight Water Trends to Watch in 2018

By Reese Tisdale

It’s hard to believe but it’s already time for us to look ahead to 2018. This past year was an interesting year for water: we saw an uptick in mergers and acquisitions (M&A), more fallout from Flint, a focus on smarter water technologies, lack of government investment in water, and an increasing number of weather events impacting on water infrastructure.

Heading into the new year, a multitude of questions about the outlook for the water sector remain. On the one hand, the water industry has been around forever; on the other, we are on the cusp of change, turning toward smarter, Internet of Things (IoT) solutions to address age-old infrastructure issues.

As a market research firm, part of our job at Bluefield is to help forecast trends to come. Our team of water experts is laying the groundwork for our own research calendar, identifying the themes we see as most important going forward. We have put together some thoughts on the key trends that will further reshape business strategies for companies in the water industry (and water-intensive industries).

Our team is more convinced than ever about opportunities for improvement, investment, and positive change across the water industry value chain. After all, there is no substitute for water. The breadth of capital and infrastructure demands, globally, will continue to draw in new technologies, companies, and business models. Expectations from utility customers and companies are extremely high. The water sector is known to be conservative, and sometimes rightfully so, but the status quo is unsustainable.

President of Bluefield Research Reese Tisdale appears on the Dec. 26, 2017, edition of the WaterWorld Weekly newscast to discuss water trends to watch in 2018.

Indeed 2018 could prove to be a very exciting year for the water industry. Looking ahead, here are eight key trends to consider:

1. Resiliency, as a strategy, moves to the forefront

Hurricanes Harvey, Jose, and Maria slammed the U.S. in the third quarter, highlighting both longstanding and acute needs to improve water and wastewater infrastructure resiliency. As high-intensity storm events like these become more common, there is a growing need for utilities to be able to manage extreme stormwater flows and to resume normal operations quickly after a catastrophic event.

Spending on emergency situations like these can cause utilities to push off investments in less critical projects, like upgrading to more efficient pumps or smart water solutions, which can ultimately provide greater operational savings in the long term. Just recently, heavy storms wiped out power supplies to a community north of Boston. The impact was a powerless wastewater treatment plant discharging untreated waste into surface waters.

Beyond storm events other disruptive, but less dramatic, catastrophes demanded the industry’s attention in recent years. Algae blooms, like that in Toledo, Ohio, in 2014, are also throwing water utilities into crisis mode. The National Oceanic and Atmospheric Administration (NOAA) is increasingly looking to track and forecast harmful algae blooms (HAB) in impacted waterways. As the impacts of climate change remain to be seen, we expect resiliency to remain a key aspect of utility strategies going forward.

2. Water to play a leading role in the transformation of commodity exploration

A new wave of drilling activity in the hydraulic fracturing sector has kick-started demand for water management solutions in a sector that was lagging less than a year ago. With a rebound in drilling activity underway, energy sector spend on U.S. water management is forecasted to rise 47 percent by the end of 2017 (see Fig. 1).

The rebound of horizontal drilling activity particularly in West Texas, continues to drive a wave of midstream water investments and new business models focused on the hydraulic fracturing sector’s critical ingredient: water. The energy sector is coming to terms with new commodity pricing levels (~US$50 per barrel of oil) and has increased scrutiny on water availability, distribution and costs. As long as energy markets remain stable, opportunity is there for the taking.

The mining sector is also seeing a resurgence. Commodities prices, including hard rock metals, have exhibited a clear rebound in 2017. The sector is undergoing its own transformation, as demand for rare earth metals for smart phones, automobiles, and battery applications, among others, scale in an increasingly digital world. On the heels of this demand, mining companies are deploying more advanced water management solutions.

3. Water reuse provides a key opportunity for a long-term supply option

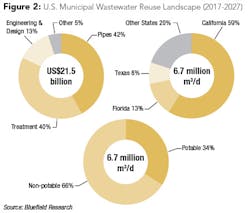

From craft brewers to utilities to industrial companies, we’re seeing more companies invest in recycled wastewater. Eight percent of reuse projects are in four key states, but we expect more states to invest in water reuse in 2018. Industrial applications for water reuse will grow 72 percent. By 2027, potable applications will account for 19 percent of total reuse (see Fig. 2). Across the power, energy, and food and beverage markets, long-term risks and opportunities for efficiencies (e.g., energy, water supply costs, liability) are happening.

Geographical hot spots, such as California, Texas, and Florida, as well as industrial verticals including power, data centers, and food and beverage, will continue to be epicenters for demand for growth in water reuse systems. Companies winning projects in this space are adopting a range of strategies, from developing and promoting new technologies to partnering with municipalities and industrial off-takers.

4. Where’s the money for municipal utilities? Lack of infrastructure investment from government opens door for private sector

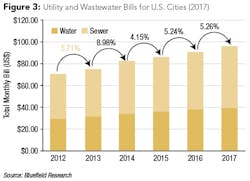

U.S. water utilities are struggling under growing capital expenditure (CAPEX) investment burdens coupled with a limited ability to recoup operating costs through revenues. Among the 50 largest cities in the U.S., water and sewer rates are growing by an average 7 percent per year (see Fig. 3), outpacing average income growth (5 percent per year) and inflation (2.5 percent per year). Rising costs and public pushback will force utilities to move beyond traditional practices to keep pace, like Philadelphia’s income-based water rates.

The role of private players in the municipal water sector continues to evolve, as evidenced by Eversource’s acquisition of Aquarion and Severn Trent divestment from the U.S. market. The addressable market for private players will continue to grow, including roles in ownership, third-party operation and maintenance contracts, and public-private partnerships in the water industry. These are not new solutions, but are rather being driven by need. The challenge for outsiders looking in, however, will be the identification of a beachhead with scale.

5. It’s not your mother’s pipe industry

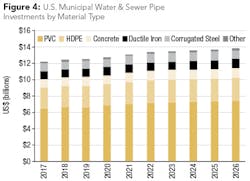

Pipe and hardware companies are poised to benefit from heightening concerns about U.S. municipal water infrastructure and $300 billion worth of forecasted capital expenditures over the next decade. Bluefield forecasts that new and replaced pipe and hardware infrastructure will make up more than 57 percent of municipal utilities total capital spend through 2026. New spending on pipes is showing the strong preference by utilities and engineering firms for plastic pipes — PVC and HDPE — which account for US$97 billion of the ten-year total (see Fig. 4). This trend highlights the continued growth of these materials, largely because of cost.

The scale of investment going into upgrading pipe networks is already driving more innovative, smarter solutions to stay ahead of rising costs. Over US$2.7 billion will be directed towards asset condition assessment and pipeline monitoring through 2026, while operating expenditures on leakage management alone will total $1 billion through the forecast period.

Replacing water pipes is extremely labor intensive and costly, so utilities will increasingly be forced to look for ways to squeeze costs with more cost-effective materials, installation techniques (such as trenchless technologies), and network analysis.

6. Water for agriculture to become more advanced

The agriculture sector’s demand for water is not secret. The impact of climatic events, such as the recent California drought, are reshaping the water landscape, driving smarter irrigation solutions and reuse applications, and groundwater management.

At the forefront of this change is the marijuana sector. Making up an estimated 13 percent of the total market, legal marijuana sales in the U.S. totaled approximately US$7.1 billion in 2016 and are forecasted to reach US$22 billion by 2020. At this growth rate, legal marijuana sales will become the 4th largest agricultural crop in the U.S., behind corn, soybeans, and fruit and nuts.

In response, Bluefield anticipates smarter irrigation. The global market for advanced irrigation solutions are consolidated largely among five key players with combined revenues for irrigation totaling US$2.3 billion. Interest in the burgeoning segment is highlighted by the range of recent bidders for Netafim, including Mexichem, U.S.- based Fortive Corp (a recent spin-off from Danaher), Singapore’s Temasek Holdings, U.S. tool maker Stanley Black & Decker, Chinese investment fund Primavera, and Chinese pipe maker Ningxia Qinglong.

7. Asset management is a crucial aspect of the ‘Utility of the Future’

Water utilities are under increasing pressure to optimize operations and capital spend. Meanwhile, consumers will continue to push back on rising water rates, up 4 percent this year. These pressures, which include a confluence of competitive, regulatory, and cultural factors, are pushing firms to reduce non-revenue water and power consumption on aging infrastructure, while managing flat or decreasing levels of demand and revenue. Asset management has emerged as the key battle ground, where players from across the utility operating spectrum are extending their offerings to incorporate asset-centric products and services.

Approaching asset management from the modeling and network management segments, competitors Innovyze and Bentley Systems position with product offerings covering similar operating niches. From asset reliability and performance management to visualization of sensor and asset historical data, to optimization of asset replacement through condition-driven risk profiling and better design optimization, municipal water utilities have never had such a wide commercial offering of solutions to improve how they plan, monitor, and manage their critical water infrastructure.

8. More M&A in 2018, as new players look to water for opportunity

Since the start of 2014, Bluefield Research has tracked almost 650 M&A deals with a total transaction value of US$93 billion, globally. This does not even include the several hundred deals with undisclosed values. This deal flow reflects the growing interest across the industry value chain. The breadth of opportunity for improvement of water and wastewater infrastructure is significant and driving M&A activity in three key areas: technology, equipment and services; U.S. utility asset ownership; and global asset ownership.

So far in 2017, 246 water-related transactions have totaled US$32 billion. Of these deals, 172 are in the technology, equipment and services segment, and the remaining in utility and network assets segments. The technology, equipment and services segment has so far yielded US$26.9 billion in transaction values in 2017, up from US$23.4 billion throughout 2016. Of these, twenty transactions led by several outsized acquisitions like GE, CH2M, and MWH skew the average. When excluding these, the average deal falls to approximately US$37 million and in line with ALLETE’s US$10 to US$50 million target range. Competition for these assets is heavy as larger players seek to build out more local positions. Looking forward, 2018 promises significant M&A and partnership announcements related to municipal and industrial water sectors, globally.

At Bluefield, we’ll continue to track these key trends and more. Water infrastructure, cost of water, water resiliency, water reuse, and water-energy nexus are key themes that we will continue to address in our data and analysis. We look forward to continuing to support the water industry in 2018. WW

About the Author: Reese Tisdale is president of Bluefield Research and has an extensive background in industry research, strategic advisory, and environmental consulting in the power and energy industries. Prior to co-founding Bluefield, Tisdale was research director for IHS Emerging Energy Research, a leading research and advisory firm. He also has demonstrated experience in groundwater remediation for oil and gas companies as an environmental scientist and as an international market analyst for Thermo Fisher Scientific. Learn more about Bluefield Research at www.bluefieldresearch.com.