The leaders of Eversource Energy have put the utility’s Aquarion water distribution business on the market as part of a plan to focus on their regulated electric utilities.

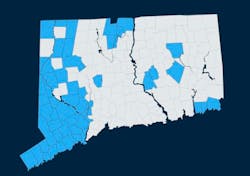

Aquarion has about 241,000 customers in Massachusetts, New Hampshire and Connecticut, with the last of those accounting for more than 90% of customers. The business has a rate base of about $1.3 billion and last year booked a net profit of $33.1 million, down from nearly $37 million in 2022.

Eversource executives in December 2017 paid nearly $1.7 billion for Aquarion. Chairman, President and CEO Joe Nolan and his team now say it “is likely of substantial value to another owner as part of a larger strategic water business or infrastructure platform.” But Eversource also needs cash—the company has taken big losses on its investments in offshore wind projects it is now selling—and an Aquarion sale will mean it won’t have to sell as much stock to fund investments in the coming years.

Speaking to analysts Feb. 14, Nolan said his team is confident that Aquarion’s scale will bring potential buyers to the table.

“This asset is very, very attractive,” Nolan said. “It’s a great business. It’s the seventh-largest water company in the country. But the fact of the matter is there are 50,000 water companies in the country. To try to assemble water companies, it takes time, it takes effort. But something of this magnitude certainly is attractive to many, many folks.”

Aquarion’s finances—and thus the prospects for its sale—should begin to look clearer this spring, when a court ruling is expected on Eversource’s appeal of a 2023 rate-case decision by Connecticut’s Public Utilities Regulatory Authority. Last March, PURA members turned down Aquarion’s request to raise rates by about $35 million to help it cover capital investments and higher operating costs, a decision Nolan said contributed to Aquarion’s drop in profits last year. A court heard oral arguments on the appeal in mid-January.

Offshore wind projects link: https://www.tdworld.com/utility-business/article/21282732/eversource-selling-last-offshore-wind-stakes-for-11b

About the Author

Geert De Lombaerde

Geert De Lombaerde is a Senior Editor for Endeavor Business Media. He is an at-large contributor covering economic trends and public companies' strategies, M&A and investment plans with a focus on IndustryWeek, Oil & Gas Journal, T&D World, FleetOwner and Healthcare Innovation. He also oversees a group of Market Moves newsletters that curate trends and analyses from across Endeavor. Learn more at:

https://intelligence.endeavorb2b.com/market-moves-newsletters/