Piping the Future For Australia's Renewed Water Sector

Water – the lack of it and at times the excess of it – has shaped Australia socially, culturally and economically. Fears of drought in the country may have been appeased by extended periods of rainfall but now community concerns over rising prices are a key challenges for the industry. Tom Mollenkopf reports on findings from a State of the Water Sector report.

Sadly for the water sector, just as rain started to fall freely from the sky, the cost of the many large investments to augment supplies (like desalination, recycling and water grids) were being reflected in water bills. Add to this the fact that the national economy was feeling the (delayed) impact of the Global Financial Crisis – with consequent pressure on household budgets – and one has a 'perfect storm' of tension in the sector.

This year's Australian Water Association (AWA) - Deloitte 2012 State of the Water Sector report finds that the sense of crisis engendered by drought has dissipated and the industry is returning to more bread-and-butter issues, particularly the challenge of maintaining and improving infrastructure. There is also more concern about consumer perceptions of pricing, along with the other new issues such as desalination and the potential impact of coal seam gas extraction.

The Report is based on analysis of a survey of almost 2,000 water industry professionals in Australia. This is the second time we have surveyed the industry to identify key issues facing the sector, and participants' attitudes towards them. These are the people who know if a system is well managed or not, is being maintained properly or is being allowed to run down, is performing to specifications or is at risk, is financially sound or is costing the community more than it should.

This year's report was compiled against a backdrop of a sector – indeed a nation – that continues to contend with a dynamic environment in every sense of the word.

Sector 'Soundness' & PRIORITIES

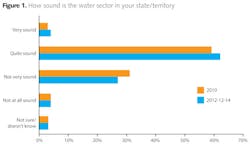

In 2010, 62% of respondents thought the sector was 'very sound' or 'quite sound'. The industry should be pleased that despite persistent drought in the west, catastrophic floods in many other areas and controversy over rising prices and the value of desalination plants, in 2012 66% of respondents believe the sector is sound (see Figure 1).

Since 2010, there have been some significant changes in the circumstances surrounding the water sector. The most important of these is the drought-breaking rain that has been received over much of Australia. However, the persistent dry conditions in most of Western Australia and parts of South Australia and the Northern Territory have also been significant. It is perhaps because water security concerns have been alleviated, particularly in the east, that respondents feel that it is now time to stick to what we know.

Whereas the problem of ageing infrastructure was considered the fourth most important issue facing the sector in 2010, in 2012 'Maintaining and improving infrastructure' is cited as the most important issue. It is also expected to be the second most important in five years' time. While such a focus will be welcomed by many, it is of some concern that system maintenance is one of the issues respondents feel is being dealt with least effectively.

Water supply security has not, however, disappeared from the list of major concerns. It is seen as the second most important issue nationally, with 36% of respondents describing it as a priority. It must be acknowledged, however, that this result is skewed by the very high priority given to water security by respondents in Western Australia, South Australia and the Northern Territory where drought has not broken.

Those in other states and territories that have experienced heavy rains ranked supply security significantly lower than maintaining and improving infrastructure. Respondents nevertheless clearly consider respite from drought to be only temporary, as the issue re-emerges as a priority nationwide in five years' time. Concern about the long-term environmental impact of the water industry (an aspect of sustainability) was ranked as only the seventh most important issue nationally, while 'Managing Catchments Effectively' – another aspect – is concerned the third most important.

Notwithstanding these results, 85% of respondents believe climate change poses a significant or moderate risk to the sustainable management of water. Encouragingly, 50% believe the sector is responding to the effects of climate change very well or quite well. This compares favourably to the results in 2010, when only 36% held this view.

The issue of community concern over rising prices has arisen almost from nowhere over the past two years. The 2010 Survey asked only about water prices rather than community concern over price increases, with the issue not rating highly. In 2012, the issue was divided into 'community concern' and 'setting prices at levels that fully cover costs'. The latter is still seen as a minor concern, possibly because respondents feel it is being addressed effectively.

However, respondents feel that community concern about prices is being addressed with only moderate effectiveness – for now. It appears, however, that respondents believe this issue may be transient, and rank it as one of the least important issues in five years' time.

Respondents may feel that the pain of cost pass-through associated with new infrastructure, notably desalination plants, will have passed by that time. With sector leaders expecting a significant reduction in capital expenditure over the next three years, there may also be an expectation among industry figures that future water price rises will be more moderate.

Desalination, pricing and regulation

In the past five years, significant investments have been made in desalination plants in coastal areas around the country. It is concerning, then, that 67% of those surveyed believe such investment has been not very, or not at all, cost-effective. Delving deeper into this issue, a majority believe the construction of desalination plants was timely, but 29% believe the plants were too large or costly. A further 30% believe their construction was ill-advised or occurred too soon.

That said, 69% of respondents believe water prices are about right or too low. Only 22% believe they are too high, although many also feel it is important to respond to community concern over the rising price of water (an issue that was not mentioned at all in 2010). The idea of increasing water prices when water is scarce is supported by 42% of respondents, while 53% believe this approach would not be beneficial.

One notion that appears to have strong support within the industry is that of a more 'light-handed' approach to regulation, an idea recently put forward by the Productivity Commission. Around 68% of survey respondents would prefer regulators to review prices periodically to ensure monopoly power is not abused, compared to 14% who believe economic regulators should set prices.

So what does all this mean?

This report acknowledges that there continue to be challenges ahead. Pressure on the sector as a result of the economic downturn, community expectations on standards and 'value' from their water authorities and uncertainty associated with climate change are but a few. Importantly however, the survey reveals a water industry that is confident of its capabilities and achievements, as well as mindful of the legitimate needs of its stakeholders.

Above all, the survey reinforces that, for a resource so fundamental to life and prosperity, the sustainable management of water is a very complex thing indeed. It's a story that water professionals understand only too well; and which our communities are now beginning to appreciate.

Author's note: Tom Mollenkopf is the chief executive of the Australian Water Association (AWA). The State of the Water Sector report is available on the AWA website at www.awa.asn.au/State_of_the_Water_Sector_Survey.