A $927 million construction of a 140-mile pipeline slated to begin this year for the San Antonio Water System (SAWS) in Texas is believed to be one of the water sector’s largest-scale public-private partnerships (P3), notes Ginger Elbaum, director of operations for E3 Consulting (E3).

The project symbolizes a growing trend toward the use of P3s in addressing the nation’s infrastructure challenges.

E3 president Paul Plath says the continued emergence of P3 projects in the US is rooted in the fact that the American infrastructure “in general is in pretty bad shape. President Trump spoke about the need for massive spending on infrastructure. This is a model of how we’re going to have to pay for it, because public funding isn’t there to support it. We’re talking trillions of dollars of potential infrastructure improvements.”

Water security is a driving factor for the San Antonio project.

“Texas has one of the stronger economies in the US,” says Plath. “Its population is growing. It’s an area of the US that still has significant industrial growth, particularly in the oil and gas industry. The state is seeing a continuing increase in water demands and has suffered a couple of severe droughts in the past few decades.”

Additionally, demand is increasing as San Antonio anticipates one million additional residents by 2040.

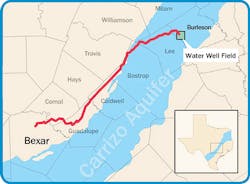

The Vista Ridge pipeline is expected to expand San Antonio’s water supply by 20% by transporting water from the Carrizo-Wilcox aquifer system to San Antonio and decrease pressure on the Edwards Aquifer, which is subject to federal, state, and regional pumping regulations.

Long-term water supply was the driving factor in locating the best water supplies and comparing them to other options—such as San Antonio developing its own water supply without a P3—says Donovan Burton, SAWS’ vice president for water resources, conservation, and governmental relations. In evaluating all options, the P3 was in the city’s best interest, he adds.

SAWS has about 10 different water supplies online, says Burton.

“We are diversifying from the Edwards Aquifer,” he says. “In that diversification, it also gives us flexibility in our water supplies. The Carrizo-Wilcox Aquifer provides a very drought-resistant water supply on which we can rely for our future.”

That’s because the Edwards Aquifer is highly porous.

“It leaks at the springs and recharges through fissures throughout the region,” he says. “Carrizo-Wilcox recharges as well, but it is a highly sand-based aquifer, so it doesn’t discharge at the springs anywhere close to what the Edwards does.”

The Carrizo-Wilcox also is significantly larger, Burton adds.

Speaking to the importance of P3s, Plath notes the old model of financing water and wastewater projects focused on a municipality or a utility district raising debt to finance the infrastructure projects through general obligation bonds, revenue bonds, or other avenues.

“There are few communities or utility districts that could finance something of this massive scale at more than $900,” he says. “We’re going to see many more of these private-public partnerships in the future.”

The P3 financing model brings in private entities to arrange the financing and take the risk, with the municipalities or utility districts becoming customers, Plath notes.

“They become the off-takers for either the water supply or discharging their wastewater to a P3 facility,” he adds.

The P3 financial model is common in the energy sector with its independently owned power projects, Plath points out, adding it also is a common practice in Europe.

Burton notes that every water utility has different reasons and methods of opting for a P3.

“In our case, we have a different type of regulatory and legal system for groundwater,” he says. “Our approach was to primarily transfer the groundwater and regulatory risk to the private sector, as well as the risks in building the pipeline such as endangered species and permitting. It’s a way to approach financing ability and benefit for the governmental entity.”

In the case of Vista Ridge, SAWS is responsible for buying the water being produced and delivered to them.

“They had to establish the need for the project,” says Plath. “In these P3 projects, the utility needs to secure that long-term revenue source, which means the customer is essentially guaranteeing that they are going to take the water at a prescribed contract price.”

The key role of the public entity is to be a project advocate, pushing it through all of the necessary regulatory and political approvals, notes Plath.

The private partner is a consortium that includes companies financing the project, doing the design work, acquiring all of the right-of-ways and easements, acquiring the water rights, and ultimately building and operating the project, Plath points out.

E3 serves as the independent engineer for the Vista Ridge Regional Supply Project. Its team, led by Elbaum, addresses the project’s technical and commercial aspects on behalf of the financing parties.

Plath notes that his company works primarily for financial institutions financing or investing in large energy sector infrastructure projects.

Missouri-based Garney Holding Company, through its subsidiaries, led the project development team and will complete the project’s design and construction. The company has experience as a water and wastewater contractor for SAWS on several projects.

Garney was given the green light by SAWS after financial close in November 2016, entering into a 30-year concession agreement with the City of San Antonio through SAWS to deliver 16.3 billion gallons of water to the city annually.

The engineering firm Pape-Dawson in San Antonio—which has also done work for SAWS—is also involved in the project.

“Garney is one of the largest water pipeline project contractors in the US, so they’re very experienced and competent in building projects at this sort of scale,” says Plath. “That’s what you look for in a partner: somebody who knows how this model works and has the resources to assemble the necessary financing.”

In the case of Vista Ridge, project financing for the non-recourse loan was arranged through Sumitomo Mitsui Banking Corporation, which led an international bank group.

“The financing side is a different model,” says Plath. “Instead of traditional rated bond issuers, they’re dealing mostly with commercial banks, which in this case are more accustomed to lending to traditional infrastructure projects.”

Burton concurs, adding that a quality project manager is critical in determining what supplies and materials are used so that no one cuts corners.

“In any P3 arrangement, projects are going to change as you go along,” he says. “You need flexibility within your contract, your planning process, and during the implementation phase and you need to be actively engaged in the process to be able to adapt to any changes.”

Construction is expected to last through 2019, with water flowing in early 2020. In 2050, SAWS will own the pipeline.

One of the challenges with a project of this magnitude was dealing with nearly 500 property owners along the 142-mile pipeline length.

“Getting public and private right-of-ways and easements was a significant challenge,” says Plath. “Even though water projects are considered benign, there are many issues with people not wanting pipelines going through their backyards or ranches.”

The project involves three large pump stations along the pipeline route, adding complexity, says Plath.

“The project is tapping two different aquifers at two different depths,” he says. “There is a large wellfield and collection system that have to be integrated and work together.”

That will be accomplished through a SCADA system, he adds.

The pipeline runs through hilly Texas country with many elevation changes and significant changes in the hydraulic gradient along the route, necessitating various pipe types and pressure classes, says Plath.

The pipeline construction has efficiency requirements focusing on energy consumption and complementing SAWS’ continued conservation efforts and development of other water resources.

Burton says SAWS plans new water supplies on an ongoing basis against the backdrop of future growth and demand. The Vista Ridge process began in 2010 with a Request for Information, followed in 2011 with a Request for Competitive Sealed Proposal before further refinements led to contract negotiations for what became Vista Ridge.

“Conservation is not just some feel-good green thing for us. It’s a business model,” says Burton. “The less water you use, the less water you have to develop and treat from a wastewater perspective. Had we not had the water conservation programs in place and the aggressive conservation ethic in this community, we would have probably needed a couple of more Vista Ridge-sized projects. That would cost our community well into a billion dollars to develop additional supplies.”

Burton points out that utilities need to plan for their water supplies well in advance and have an abundant supply going forward for their communities.

“You can’t just plan for a just-in-time water supply so that water gets there just when the population does,” he says. “Many communities are planning for reservoirs and groundwater supplies that take 10 to 30 years to get online. It’s a matter of finding the water supply and getting it online well in advance of when you actually need it.”