Survey Results Highlight Infrastructure Need

Aging infrastructure, regulations, population growth and security concerns are all major drivers for construction and rehabilitation projects in the municipal drinking water and wastewater industries in the United States, according to a recent informal survey conducted by WaterWorld.

Drinking water and wastewater utility executives were questioned about their capital improvement budgets for the current fiscal year and projected out for five years. Other questions dealt with such subjects as treatment plant improvements, pipeline main repair and replacement, metering and automation projects, and the impact of security concerns.

Utilities responding to the survey ranged in size from very small, with fewer than 3,300 customers, to very large, with more than 100,000 customers. In some cases, responders reported their department budgets instead of the entire capital budget for their utilities, which skewed dollar figures downward.

While security continues to be a hot topic in the industry, the amount of money being devoted to security pales in comparison to spending forecasted for basic infrastructure repair and replacement.

"We've got all of our areas locked and secured with fences, and we are looking at closed circuit TV for our water plant, storage facilities, etc. Security is something we're concerned with, but there are lot of people in the county that need water service, and that is our main goal," said Paul Lashbrooke, Superintendent of the Webster County Water District in Kentucky.

For more than 90 percent of responders, security represented less than 10 percent of their current and projected 5-year capital improvement spending plans. In the survey, 0-10 percent was the lowest category listed. Of those responders contacted with follow-up questions, security typically represented 5 percent or less of their budgets now and projected.

Approximately 76 percent of the utility executives responding reported that they plan to spend less than $50,000 on security in the current fiscal year. Even for large utility responders, serving populations of 10,000 to 100,000, 85 percent projected spending less than $50,000 this fiscal year and under $500,000 projected out over five years.

It should be noted that the survey was aimed at capital expenditures only. The figures cited might not include the cost of security assessment surveys, and don't include ongoing personnel and O&M costs. Also, in some cases, security spending could be rolled into other expenditures, such as SCADA system upgrades or treatment process improvements.

Drinking Water Treatment

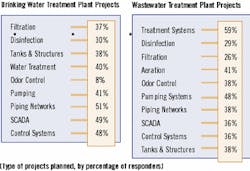

When asked about their plans for drinking water treatment plant upgrades, responders sited piping network improvements most often, followed by SCADA/control systems, pumping systems, and water storage facilities. Also mentioned in descending order of frequency were tanks & structures, filtration and disinfection improvements.

"Treatment facilities tend to wear out faster than lines do," said Charles Raab, Manager of Planning for the Water Services Department of Kansas City, MO. "It might seem like they get more attention, but their needs for attention are higher because of their nature."

Spending levels for this year and the next five years varied dramatically, both by system size and as a function of projects planned. For large system responders, current fiscal year capital budgets for drinking water treatment ranged from less than $100,000 to more than $50 million. Some 34 percent projected spending between $1 million and $10 million. When projected out five years, those numbers grew substantially, with some large utilities planning to spend more than $50 million for the period on water treatment plant improvements.

Five-year spending projections for the medium size system responders, with systems of 3,300 to 10,000 customers, were typically under $10 million. For very large systems, the projections ranged from $50 million to more than $1 billion for water plant upgrades.

Wastewater

For those responders planning wastewater plant upgrades, 69 percent said they were planning treatment system improvements. Pumping system upgrades were the next most mentioned improvements, followed by aeration and a three-way tie among piping, odor control and tanks & structural upgrades. Also mentioned in descending order of frequency were SCADA and control systems, disinfection and filtration.

The majority of large systems reported plans to spend more than $1 million on their wastewater plants this fiscal year. Interestingly, 28 percent reported plans to spend less than $100,000. Five-year projections for spending at the large-facility level ranged from $100,000 to $100 million. The bulk of the spending estimates fell with the $1 million to $10 million range.

Drinking water pipe

While treatment plant upgrades have a high profile, many of the utilities responding to the survey cited pipeline repair, replacement and installation as their biggest challenge.

An example is the Bartow County Water Department, Cartersville, GA. That utility faces the challenge of replacing large portions if its aging and inadequate pipe network, much of which was installed to serve what was once a rural area.

"We are moving from a rural system to urban. We've got a lot of PVC pipe and products with a short lifetime simply because that's what they could afford," said Bartow Superintendent Gene Camp. "We are rebuilding the whole system starting with transmission mains and distribution lines based on our growth management plan, which runs through 2030."

Since large utilities, serving from 10,000 to 100,000 customers, made up the bulk of responders for the WaterWorld survey, the following information focuses on data from large systems only.

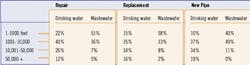

The survey asked for information on utility plans for the repair, replacement or installation of new pipe for drinking water mains, this fiscal year and over the next five years, in linear feet. Repair projects were cited more often, but tended to be slightly smaller in scale, with 87 percent of falling under 10,000 linear feet for the year. At the same time, 5 percent reported plans to repair more than 50,000 feet of mains.

Pipe replacement projects were sited slightly more often. Some 85 percent of the projects fell under 10,000 feet, while 11 percent were in the 10,000-50,000 foot category. Three percent of responders reported projects over 50,000 linear feet.

For new pipe installation, 58 percent of the projects were in the 1,000-10,000 foot range, while 23 percent were in the 10,000-50,000 foot range. Three percent were above 50,000.

Projected out five years, the numbers increased substantially, with a significant percentage of large utilities planning projects over 50,000 feet: 12 percent for repair, 16 percent for replacement and 19 percent for new installations.

Wastewater Pipe

Wastewater pipe main projects were cited often as a challenge, but tended to be smaller in scale. More than 80 percent of projects for repair, replacement and new installs for the current fiscal year fell under 10,000 feet. Even projected out for five years, 60-70 percent were under 10,000 feet.

While aging wastewater pipe networks was a concern, Combined Sewer Overflows and Separate Sewer Overflows were often cited as a driving force behind capital improvement plans.

CSOs and SSOs were both a challenge for Kansas City, according to Raab.

"We will have to scrutinize our sanitary sewer overflows further, especially if new SSO policy is implemented. The CMOM program that goes along with it is another challenge to meet," he said.

"We are also a combined sewer city as well."

The city will have to examine the cost of wet weather treatment versus constructing wet weather storage facilities, he said. Additional inflow and infiltration remediation on the sanitary sewer system will be a must as the district works to control SSOs, he said.

Some 11 percent of survey responders report plans to repair more than 50,000 feet of sewage mains over the next five years, compared to 6 percent planning more than 50,000 feet of pipe replacement and 7 percent expecting more than 50,000 feet of new pipe installation.

AMR/Scada upgrades

Many of those surveyed were planning to upgrade their meter reading systems with automated systems. Even so, the numbers were relative small when compared to other infrastructure spending. The vast majority of projects fell under the $500,000 range, even when projected out five years.

Just over 50 percent of those planning AMR projects were planning drive-by radio read systems, with 31 percent considering walk-by radio systems. Only two percent respectively were planning telephone, cellular and cable based systems.

Of those who responded to the question on automation technology projects, 75 percent said they were planning SCADA projects, while 59 percent were planning GIS systems. Another 30 percent were planning maintenance management software projects.

The bulk of responders reported plans to spend between $50,000 and $500,000 this year, and between $500,000 and $1 million over the next five years.

It should be noted that the survey was aimed at capital expenditures only. The figures cited might not include the cost of security assessment surveys, and don't include ongoing personnel and O&M costs. Also, in some cases, security spending could be rolled into other expenditures, such as SCADA system upgrades or treatment process improvements.

Drinking Water Treatment

When asked about their plans for drinking water treatment plant upgrades, responders sited piping network improvements most often, followed by SCADA/control systems, pumping systems, and water storage facilities. Also mentioned in descending order of frequency were tanks & structures, filtration and disinfection improvements.

"Treatment facilities tend to wear out faster than lines do," said Charles Raab, Manager of Planning for the Water Services Department of Kansas City, MO. "It might seem like they get more attention, but their needs for attention are higher because of their nature."

Spending levels for this year and the next five years varied dramatically, both by system size and as a function of projects planned. For large system responders, current fiscal year capital budgets for drinking water treatment ranged from less than $100,000 to more than $50 million. Some 34 percent projected spending between $1 million and $10 million. When projected out five years, those numbers grew substantially, with some large utilities planning to spend more than $50 million for the period on water treatment plant improvements.

Five-year spending projections for the medium size system responders, with systems of 3,300 to 10,000 customers, were typically under $10 million. For very large systems, the projections ranged from $50 million to more than $1 billion for water plant upgrades.

Wastewater

For those responders planning wastewater plant upgrades, 69 percent said they were planning treatment system improvements. Pumping system upgrades were the next most mentioned improvements, followed by aeration and a three-way tie among piping, odor control and tanks & structural upgrades. Also mentioned in descending order of frequency were SCADA and control systems, disinfection and filtration.

The majority of large systems reported plans to spend more than $1 million on their wastewater plants this fiscal year. Interestingly, 28 percent reported plans to spend less than $100,000. Five-year projections for spending at the large-facility level ranged from $100,000 to $100 million. The bulk of the spending estimates fell with the $1 million to $10 million range.

Drinking Water Pipe

While treatment plant upgrades have a high profile, many of the utilities responding to the survey cited pipeline repair, replacement and installation as their biggest challenge.

An example is the Bartow County Water Department, Cartersville, GA. That utility faces the challenge of replacing large portions if its aging and inadequate pipe network, much of which was installed to serve what was once a rural area.

"We are moving from a rural system to urban. We've got a lot of PVC pipe and products with a short lifetime simply because that's what they could afford," said Bartow Superintendent Gene Camp. "We are rebuilding the whole system starting with transmission mains and distribution lines based on our growth management plan, which runs through 2030."

Since large utilities, serving from 10,000 to 100,000 customers, made up the bulk of responders for the WaterWorld survey, the following information focuses on data from large systems only.

The survey asked for information on utility plans for the repair, replacement or installation of new pipe for drinking water mains, this fiscal year and over the next five years, in linear feet. Repair projects were cited more often, but tended to be slightly smaller in scale, with 87 percent of falling under 10,000 linear feet for the year. At the same time, 5 percent reported plans to repair more than 50,000 feet of mains.

Pipe replacement projects were sited slightly more often. Some 85 percent of the projects fell under 10,000 feet, while 11 percent were in the 10,000-50,000 foot category. Three percent of responders reported projects over 50,000 linear feet.

For new pipe installation, 58 percent of the projects were in the 1,000-10,000 foot range, while 23 percent were in the 10,000-50,000 foot range. Three percent were above 50,000.

Projected out five years, the numbers increased substantially, with a significant percentage of large utilities planning projects over 50,000 feet: 12 percent for repair, 16 percent for replacement and 19 percent for new installations.

Wastewater Pipe

Wastewater pipe main projects were cited often as a challenge, but tended to be smaller in scale. More than 80 percent of projects for repair, replacement and new installs for the current fiscal year fell under 10,000 feet. Even projected out for five years, 60-70 percent were under 10,000 feet.

While aging wastewater pipe networks was a concern, Combined Sewer Overflows and Separate Sewer Overflows were often cited as a driving force behind capital improvement plans.

CSOs and SSOs were both a challenge for Kansas City, according to Raab.

"We will have to scrutinize our sanitary sewer overflows further, especially if new SSO policy is implemented. The CMOM program that goes along with it is another challenge to meet," he said.

"We are also a combined sewer city as well."

The city will have to examine the cost of wet weather treatment versus constructing wet weather storage facilities, he said. Additional inflow and infiltration remediation on the sanitary sewer system will be a must as the district works to control SSOs, he said.

Some 11 percent of survey responders report plans to repair more than 50,000 feet of sewage mains over the next five years, compared to 6 percent planning more than 50,000 feet of pipe replacement and 7 percent expecting more than 50,000 feet of new pipe installation.

AMR/Scada Upgrades

Many of those surveyed were planning to upgrade their meter reading systems with automated systems. Even so, the numbers were relative small when compared to other infrastructure spending. The vast majority of projects fell under the $500,000 range, even when projected out five years.

Just over 50 percent of those planning AMR projects were planning drive-by radio read systems, with 31 percent considering walk-by radio systems. Only two percent respectively were planning telephone, cellular and cable based systems.

Of those who responded to the question on automation technology projects, 75 percent said they were planning SCADA projects, while 59 percent were planning GIS systems. Another 30 percent were planning maintenance management software projects.

The bulk of responders reported plans to spend between $50,000 and $500,000 this year, and between $500,000 and $1 million over the next five years.