Turning Wastewater into Water Study Examines Growth of Water Reuse Market

Globally, the term “wastewater discharge” is being extensively replaced with “wastewater reuse”. A primary reason for this is that it is becoming advantageous to at least consider recycling options rather than adopting stringent disposal methods, which may not make economic sense for businesses or municipalities. In the last few years, zero-discharge, water reuse, and water recycling have become increasingly popular buzzwords in the environmental industry. “Zero-discharge” has different meanings depending on the source addressed, but it is a concept becoming more prevalent among industrial groups.

Considering water shortages globally, industries are forced to better invent newer production processes, which either produce zero-discharge or ensure recyclable effluent with minimum level of treatment. Manufacturers of recycling systems have tremendous opportunity with regard to this development if they are proactive in unearthing where target end users are and where they are in the permitting process.

Regionally within the U.S., it is becoming advantageous to at least consider recycling options rather than wastewater discharge or disposal. The reasoning behind this is the state-created “needs analysis or assessment” that is required prior to approval of discharge permits. The needs assessment simply requires end users to identify all the options available to them prior to receipt of discharge rights. This aspect of the permitting process is not Federally driven, and does not necessarily promote water recycling per se; however, it does encourage end users to at least consider the possibility. All states do not, currently, have this “needs assessment” in place; however, as natural resources for potable purposes continue to decline, there is increased likelihood of requiring them.

Making Used Water Usable

Water reclamation and reuse treats wastewater to a level that is safe for industrial, agricultural or residential uses. Recent statistics suggest that as much as 50 to 70 percent of residential water use is spent watering lawns and gardens; about 39,000 gallons of water are used to produce the average automobile; and almost 2,000 gallons of water are necessary to manufacture one barrel of crude oil. These, along with numerous other applications, could use non-potable or non-consumable water instead. To get this water, municipal and industrial treatment plants must develop ways to reuse or recycle their water, which means additional treatment must be applied to the dirty water. For many reuse applications, an advanced treatment process such as filtration or reverse osmosis is required.

US Market

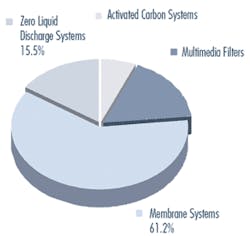

Water Recycling Systems predominantly fall into four categories, notably activated carbon systems, multimedia systems, membrane filtration systems and zero liquid discharge (ZLD) systems. The combined market for Water Recycling Systems in the U.S. touched $620 million in 2004. By 2010 the size is almost expected to cross the billion-dollar mark with growth rates touching double-digits.

Chart 1 gives a snapshot of revenue market shares for the aforementioned recycling systems. Membrane systems hold the lion’s share of the market with 61.2 percent. The growth of the multimedia systems market is directly dependent on membrane applications. As membrane applications increase, demand for multimedia filter systems are also likely to increase. Currently this category contributes 16.9 percent of revenues in the market. Third in line with a 15.5 percent revenue share in the recycling systems market is ZLD systems, which is a very healthy choice for industries wishing to improve community relations as well as costs. The effective implementation of a ZLD system is likely to allow the participating municipal or industrial facility to avoid the constant withdrawal of raw water resources, thus saving them for potable uses. Last but not the least is activated carbon systems (ACS). The most important driver associated with the use of ACS systems, both municipally and industrially, is the ability of the system to eliminate volatile organic compounds (VOCs) from aqueous solutions. This is the smallest segment with a revenues share of 6.4 percent

In the U.S., particularly in California, Florida, Texas and Arizona, water systems are steadily being influenced to implement some sort of recycling measures. However, there is also a growing trend in other states with large populations such as New York and New Jersey to implement recycling measures, even though they do not have an arid climate. In these regions, it has been observed that multiple barriers are being constructed to address water reclamation needs. This simply means that the demand for several different types of water recycling systems is growing and that an RO system by itself, for example, is not sufficient or acceptable, and that there should always be a back-up plan to ensure the protection of the general public.

Manufacturers in this market are likely to find a growing need to expand horizontally to accommodate the line of equipment desired in an effort to provide a one-stop shopping experience. Companies such as USFilter, Parkson, Severn Trent Services, F.B. Leopold, Pall, and AquaTech International have already begun to expand horizontally to meet the new demand.

Who’s Recycling Water?

Municipalities are viewing water reuse and recycling as a new avenue for revenues, and are expanding their efforts in this area. For instance, if municipal facilities treat to the secondary level, the water can be used for surface irrigation of orchards and vineyards, for non-food crop irrigation, for groundwater recharge of non-potable aquifer sources, and for wetlands and wildlife habitat augmentation. Tertiary or advanced treatment of gray water provides several additional uses such as home gardening, lawn maintenance, landscaping, food crop irrigation, and toilet flushing. Recycled water has been used for a number of years to irrigate vineyards at California wineries, and this type of use is growing.

Industrial facilities reuse their water to decrease the amount of wastewater being discharged to the municipal sewer, thereby decreasing costs for the industrial facility. The gray water from power plants treated to the secondary level can be reused as cooling water. Additionally, advanced wastewater treatment is likely to allow the gray water to be used as process water for paper mills and carpet dyers, construction activities, concrete mixing, and even artificial lakes. Industries reusing and recycling wastewater are also able to reclaim valuable products from the wastewater.

Agriculture is also a target market for water reuse. To make the wastewater reusable, equipment design is dependent on the type of reuse practices involved and the level of treatment required. They range from simple pond treatment systems prior to irrigation, to the use of reverse osmosis membranes or activated carbon systems. These systems are necessary to produce water of potable quality for discharge into water supply reservoirs, for reuse in agricultural settings or golf courses, or for injection into potable aquifers. Soil treatment systems are also used to polish pretreated effluents and recycle nutrients, and in some cases for recharging shallow groundwater aquifers.

Evolving Regulations

The most prominent of the reuse and recycling regulations is Title 40 CFR 122, which regulates treatment plant effluent, including industrial effluent. When NPDES permits become more stringent in response to other regulations, permittees will/are expected to be required to adjust their treatment facilities to meet the new criteria. Industrial facilities are more frequently deciding to treat their own wastewater rather than turn it over to a POTW, where very stiff surcharges and fines may be imposed. Due to this, industrial facilities are also expected to require NPDES permits, which again essentially require the purchase of treatment equipment.

Conclusion

The two main end-user groups in the water recycling systems market are municipalities and industrial facilities. The municipal market is growing substantially in comparison to industrial markets, mostly because of the current trend of upgrades within municipal facilities. There is a generation shift occurring: many of the facilities have systems that have been in service for 20 to 30 years and the time has come to install new equipment or modernize the existing ones. Further, the growing population and the tighter regulation surrounding wastewater promote the construction of new facilities, thus ensuring an upward potential for Water Recycle & Reuse.

Editor’s Note:

This article is a prelude to the upcoming market snapshot by Frost & Sullivan on the water reuse and recycling markets. The snapshot includes in depth and comprehensive analysis of water recycling systems in the U.S, capturing drivers, restraints, challenges market & technology trends, pricing analysis, and competitive landscape practices.

About the Author:

Sunitha Mysore Gopal works in the environmental technologies division of F&S and has 9 years of industry experience. At Frost and Sullivan she works on both consulting engagements and syndicated studies related to water, wastewater, air and residential water markets on a global scale and has specific expertise in the North American & Asian market in these sectors.