Water Treatment Chemicals Market Faces Slow Growth, Tight Competition

By Suchita Chaudhari

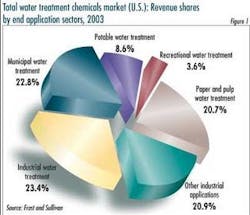

The municipal market for water treatment chemicals in 2003 was estimated to be 22.8% of the total demand for water treatment chemicals in the U.S., according to a report from Frost & Sullivan. Water treatment chemicals are likely to continue to play an important role in the face of growing populations that put great pressure on available water resources and require improved wastewater treatment processes.

Since the treatment of the supply water and sewage is subject to regulatory standards, the use of water treatment chemicals is projected to increase as the regulations become stricter with respect to contaminants, suspended solids and organic content.

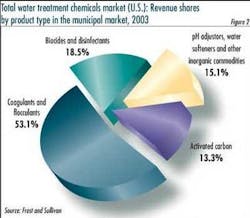

In the Frost & Sullivan report, the various water treatment chemicals are based on specific functions hence are segmented as Biocides and Disinfectants, Activated Carbon, Coagulants and Flocculants, and, pH Adjustors, Water Softeners and other Inorganic commodities.

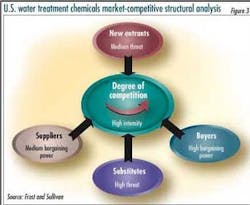

The municipal market is mature and a commodity business. It suffers from severe price pressures and hence faces low volume growth. Municipal contracts are awarded on "contract" and "sealed-bid" basis. The products with a strong hold on the market are the ones that are large volume, basic chemicals. These are well established products with very competitive prices. One way of differentiating products in this market is by offering substantial price discounts or giving a better cost-performance ratio.

The water treatment chemicals market in the municipal sector like most other end applications suffers from overcapacity, and in recent years, competition has become quite fierce - driven mainly by price and technology. This has led to many joint ventures, acquisitions, and mergers, enabling organizations to combine their financial resources and technical expertise.

On the flip side, consolidation in the customers segment also adds to the competitive pressure as the customers become more powerful in bargaining, thus demanding higher technical service at highly competitive prices. Consequently, many smaller companies have been forced to improve their competitive edge and remain strong in the market by expanding their portfolio of products and environmental services. This has resulted in many suppliers being able to offer a "one-stop shopping" experience to the customers.

Given the highly price sensitive nature of the market coupled with intense competition, suppliers face tight profit margins in this industry. In recent years the trend has seen suppliers concentrate increasingly on process efficiency since municipal expenditures have been kept low recently. Consequently, much of the research and development efforts are targeted toward improving existing technologies rather than introducing new ones. Maximizing the efficiency of treatment by improving the ease of operation, improving reliability, reducing maintenance or dosage amounts and, offering a wider range of services have become particularly important.

About the Author: Suchita Chaudhari is a Research Analyst, Chemicals and Materials, for Frost & Sullivan.