Water Sector Outlook for Russia Rough 'n Ready

By Tomasz Zagdan

• Frost & Sullivan analyst notes investment of $459 billion required over next decade, a figure not likely to be realized due to economic downturn but one that encourages limited public-private partnerships.

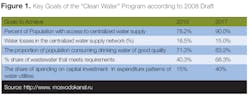

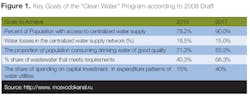

The global economic crisis is having an impact on the already poor performances of the water sector in Russia. Existing infrastructure is largely outdated resulting in frequent breakdowns and also relatively inefficient with high energy consumption and substantial water losses. It has been estimated that a staggering sum of $459 billion (15 trillion rubles) is needed to complete the necessary upgrade, refurbishment and new build for water and sanitation infrastructure in Russia by 2020, according to Duma Chairman Boris Gryzlov. With the downturn affecting the market, the massive capital requirement for the implementation of the "Clean Water" programme is going to be a big challenge. Current statistics and goals for the sector are underscored in Figure 1.

Frost & Sullivan research analyst Tomasz Zagdan, who has been conducting extensive research on the water sector in Russia to gain a full understanding of the market and what the future is holding, explains: "The plunge in manufacturing output translates into a decrease in consumption of water by the industrial sector, which accounts for over 60% of water use in Russia. The crisis also hit average Russian households by influencing their income level and stretched their ability to pay for the water bill. Also, the slowdown of the residential construction impacts water utilities as some of the previously planned investments have been cancelled and initiated projects were put on hold".

Turmoil in the banking sector has stamped its influence on the availability of financing for water companies. Difficulties with access to financing also encompass loans for key investment programmes.

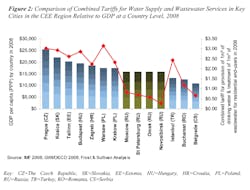

"The poor condition of the Russian water sector is less of a surprise", comments Zagdan. Neither is the magnitude of investments required to address the essential needs and improve the water & wastewater infrastructure up to the required standards. The fact water tariffs in Russia are very low and also substantially below those of most other countries of the Central & Eastern European (CEE) region highlights a major money crunch. Figure 2 compares tariffs in key cities of the CEE region to GDP per capita at a country level. Tariffs in Moscow, the most affluent city in Russia, are 30% lower than the tariffs in Bucharest, nearly three times lower than in Istanbul, and more than three and a half times lower than in Warsaw or Prague. Thus, Russian authorities will have a tough nut to crack trying to find the money to finance the Clean Water programme. It's evident the $459 million mentioned by the Duma's Gryzlov is a sum that will stretch the Russian government, particularly given current economic conditions.

Involvement of the private sector isn't an option to consider but rather a necessity to ensure even a partial realization of the programme. It's hoped public-private partnerships may offer some succor to the financial needs, but this has been restricted to limited management contract options to date due to a general reluctance to foreign ownership of what's referred to as "critical assets". "Structural changes need to be initiated at the federal level to provide a framework endorsing public-private cooperation", continues Zagdan. "Plans to amend the concession law are the first, but a very important step towards achieving the goal. Last but not least, the water tariff policy in Russia will require revision. The current level of tariffs is insufficient to cover the necessary capital costs associated to the implementation of the programme".

Russian authorities have demonstrated an increasing understanding of this challenge and aim to encourage more private sector involvement into the water business. Talking to Frost & Sullivan, Mikhail Nikolskiy, executive director of the Rosvodokanal Group, one of the leading Russian utilities, confirms: "Right now local authorities will be interested in finding a good partner for these difficult years. With economic growth it was easy to solve problems in the water sector. Right now it is necessary to work on a different level – the anti crisis level. This first of all means the managerial level and in this situation we [privately managed operators] are more effective than municipal companies".

With a higher involvement of the private sector, the perspectives for the Russian water sector for the coming years are promising in the long term. Water utilities already demonstrate increasing interest in managerial privatization. Construction and rehabilitation of infrastructure in 2010-2017 is expected to create new opportunities for equipment suppliers, engineering firms as well as for construction companies. Even with all the gloom and doom around the economic climate for Russia, the water sector has the potential to be better off within the incoming decade than it had in the past decade.

A more in depth "Market Insight" from Frost & Sullivan for the "Water Market in Russia" is available at www.wwinternational.com. Author Tomasz Zagdan is a research analyst covering the environment and building technologies in the Europe, Middle East and Africa (EMEA) region, working from the market analysis and global growth consulting firm's offices in Warsaw, Poland. For more information, contact Chiara Carella in Frost & Sullivan's London office: +44 (0) 20 7343 8314, [email protected] or www.frost.com

More Water & WasteWater International Issue Articles

More Water & WasteWater International Archived Issue Articles