Living within your means

By Andrew Walker

Government investment in infrastructure may be key to a global economic stimulus, but a steady, frugal approach helped position the Asia Pacific region as one particularly adept at making the most of its abundant and limited water resources.

[Source: PUB Singapore]

During the IWA World Water Congress in Vienna last September, a dear friend quickly put his finger on the root of our current economic woes while we were discussing what was then just called a credit crunch: “When I was younger, we simply would not buy a house that cost more than a year–and–a–half’s salary. You might end up deferring on the mortgage if you went beyond your means”. Back then, when almost–free credit was still our life credo, this struck me as being a little old–fashioned. Well, living within your means is back, not least because the days of easy finance are over. But what implications does this have for the water and sanitation industry, a sector that traditionally hasn’t had excessive resources at its disposal? With 60% of the world’s population but only 36% of its freshwater, we explored Asia for some answers.

Agendas getting wetter

In WWi’s February/March “Creative Finance” column, we asked “How green is blue?” In it, we discussed how creating a sharper image and building awareness of water and sanitation issues would help the sector climb in importance on the world’s agenda.

Just after going to print, the World Economic Forum in Davos, Switzerland, convened world leaders from politics and business to define and discuss this agenda. It was highly encouraging to see that water — finally — played a prominent part. A report written by Dominic Waughray, head of the Forum’s Environmental Initiatives, issued a stark warning that “The Bubble is Close to Bursting”. Water and sanitation were given the status of a superglue for humanity, intricately linking health, energy, food, economics, the natural environment, and climate change — as well as being a potential powder keg for social and political conflict. Davos participants heard that the world is facing water bankruptcy if we continue in our excessive ways, which would have serious implications for all aspects of life. Singapore’s Minister of the Environment and Water Resources, Yaacob Ibrahim was a panel guest in the Politics of Water debate held there, and highlighted the difficulties in convincing people that water is a valuable commodity, worth paying a fair price for. By giving Singaporeans a sense of ownership, and creating business opportunities, his country has become a leading example of urban water management. Consumption has been reduced to 156 litres per person per day (three times less than in the USA), and Singaporeans can rely on the safe supply of good water, including recycled used water branded “NEWater.”

Regulation is stimulation

Experts believe the pace of enforcement of policy through regulation isn’t likely to be slackened by economic problems. Mark Lane from London–based Pinsent Masons — legal advisers specialised in the water sector — and editor of Pinsent Masons Water Yearbook, said about China: “Over the next couple of years, continuation of the development of regulatory standards by the Ministry of Environmental Protection may in turn help to foster further growth of private sector participation in the China water sector — provided that a robust enforcement regime develops alongside such standards, and provided also that liquidity returns to the project finance capital markets.”

“It’s likely that (regulatory bodies) will be more active rather than less active in the future.” wrote Christopher Gasson, publisher of Global Water Intelligence recently. Indirectly, he agreed with Lane: “Rather than fall victim to the credit crunch, expenditure on higher environmental standards may turn out to be a conduit for ‘the Stimulus’.”

Gearing up, without over–revving

In building a regional innovation hub, Singapore fostered R&D as a key element in the island state’s ability to harness technology in landmark projects like the Marina Barrage and Deep Tunnel Sewerage System. Khoo Teng Chye, CEO of the Public Utility Board (PUB) and director of the Environment & Water Industry Development Council, said: “We remain fully committed to promoting R&D and growing into a hydrohub of solutions and technologies for the world, despite the economic downturn.” Beyond financial incentives and co–sponsorship projects, Singapore also provides scholarships to train the next–generation of water experts in what he termed a “sunrise industry.”

Solving its water and sanitation challenges has given Singapore an enviable export product: technologies and urban water management expertise. PUB is an active supporter of Singapore–based water companies, with projects and alliances elsewhere in Southeast Asia, China, India, Australia and the Middle East.

One company that’s benefited is Hyflux Ltd. Sam Ong, its Group deputy CEO & CFO, attributed its achievements to pricing, managing costs and sustainable business models. But “a vital part of our success,” he said, “is not overstretching ourselves.” By levering the Hyflux Water Trust, which invests Hyflux and other private funds in water assets, it has moved concertedly into operation and maintenance of municipal water facilities, with over 40 plants under 20–30 year contracts in China alone. He described how Hyflux hasn’t been lured by big headline deals, but concentrated on “bite–sized” projects in progressive provinces and robust economic zones (e.g., the northeast). “We’ve been able to consistently meet or exceed expectations in these diverse projects through successful public–private–partnership approaches in China.” By living within its means, Hyflux has been able to grow at its own pace. Still, record financial results for 2008 — with revenue of S$554m nearly three times that of 2007 — indicate a comfortable pace in Singapore is by no means just a Sunday stroll.

Engineering companies bullish

On the desalination front, Black & Veatch has completed projects with a total capacity of 2,000 MLD (million litres per day) of water and over 7,300 MW (megawatts) in power generation over the last decade. “We’re finding more effective technology and processes to reduce the investment cost for desalination. And if commodity and energy prices continue to fall, the cost of operations will also be reduced.” said Black & Veatch CEO Dan McCarthy.

With massive governmental plans to expand desalination capacity in some countries in Asia (China made this a pivotal point of its current 5–year plan), McCarthy sees a mixed pace of development in the region: “Investments in water infrastructure are being affected as the cost of capital has gone up and capital inflows have decreased. Governments with large cash reserves like China and Saudi Arabia have been able to cushion the blow and can fund investments directly. But economies that rely on commodity exports will be hardest hit by the fall in market prices for those exports, and, unfortunately, there are many of those in the Asia–Pacific region.” Nevertheless, he predicts a net gain in investment in water, but “it’s still not going to be enough.”

Another global engineering services firm, MWH, sees the water industry faring better than others. “We expect a sizeable portion of stimulus dollars to be allocated toward infrastructure projects, including water and wastewater projects,” said its Australian managing director John Darmody. “Research has shown that each dollar invested in infrastructure improvements creates a four–fold positive return in terms of job creation and the fostering of economic growth.”

Financial resource prospects

The level of means available for the water sector to live humbly within has typically been way below what is needed to do the job. Right now, outcomes on how this will develop are as easy to predict as they are on the economy as a whole. Some foresee short–term nervousness with credit hard to come by, and belts being tightened. But several indicators give cause for hope over the medium–term.

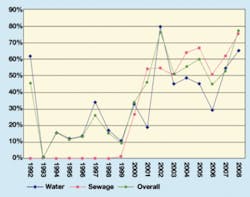

Firstly, the Asian water/sanitation market is huge (some say US$120 billion) and growing above GDP. A report by BCC Research published in December 2008, estimated the Chinese market for the treatment of polluted water alone will increase by 21% per annum from today’s $6.5 billion to $16.8 billion in 2013. The Pinsent Masons Water Yearbook, published last October, shows that during the current decade, China has accounted for at least 50% of global contract awards in population terms for several years (see Chart 1). It has become the powerhouse of the global market and that picture doesn’t look like changing in the immediate future.

Secondly, development financing is, if anything, being stepped–up. In early March, the Asian Development Bank (ADB), called for regional governments and the private sector to do more to help the 1.8 billion people in Asia who lack access to adequate sanitation. During a recent Sanitation Dialogue in Manila, ADB’s President Haruhiko Kuroda described how it had increased the proportion of funding going into water and sanitation from 8.5% to 17% since 2007.

Furthermore, the U.S. Agency for International Development (USAID) Environmental Director for Asia Winston Bowman said the agency’s work is largely unhampered currently. USAID states that a $1 investment in water and sanitation can bring about as much as a $30 return in economic prosperity. “We anticipate having more budget resources available for environmental development in low and middle income countries in Asia”, he said from Bangkok. “Greater funding from the new U.S. administration and the Paul Simon ‘Water for the Poor Act’ both help us catalyse investments from America in water and sanitation here”. With many of its activities involving private sector investment as well, he was pleased to report USAID has seen no serious disruptions other than a project in Vietnam that has to be re–designed due to a dry–up in funding locally: “But this fortunately remains an exception”. He summarized, “While many countries have made progress in achieving the UN’s Millennium Development Goals, we still have a long way to go, particularly in the area of sanitation”.

And, thirdly, private investment and public private partnerships (PPP) continue to hurdle obstacles. Pinsent Masons notes that in mainland China 331 contracts with private sector participation (PSP) had been finalised to date. That has more than doubled since October 2006 when 149 were reported. On its website, ADB states “Expanding private sector activities are vital for ADB’s fight against poverty in Asia and the Pacific Region.” ADB has made a lot of effort facilitating PPP workshops and publishing handbooks with practical guidance on making projects “bankable”. Yet, according to the World Bank in its 2008 review, since 1990, there are 23 PSP water/sanitation projects (representing US$7.7 billion) which it lent money to that were cancelled or are under distress in East Asia and the Pacific. The global proportion of water projects in trouble compares poorly to other sectors (three–fold that of electricity or transportation projects, for example). But a decrease in that proportion in recent years and China nurturing private sector involvement — 38% of people served by the private sector worldwide are in China, according to Pinsent Masons — suggests that the approach is maturing.

Human resource prospects

Interestingly, MWH’s Darmody said: “Multi–sector firms are pushing their transport and energy engineers to reinvent themselves as their opportunities dry up”, noting that many are looking to the water sector for growth. Tom Mollenkopf, chief executive of the Australian Water Association, doesn’t believe this will quench the sector’s thirst for good people there: “It has become easier for water organisations to fill positions as other industries like mining have seen the end of a boom. But the underlying skills challenge will not go away. Our workforce is ageing and we expect to still have a gap of 40,000 in 2018, the systems are becoming more complex and student enrolments in science and engineering continue to decline.”

Commenting on the effects of the global financial crisis on Australia’s very substantial water infrastructure investments, Mollenkopf remarked that problems like too little rain aren’t going to go away, so there’s no turning around, even as private capital becomes more rare and expensive. “We have observed no major project cancellations, and expect current funding uncertainties for future projects to be resolved.”

Darmody added, “The Sydney Harbour Bridge was built during a time of economic uncertainty. Similarly, the Snowy Mountains Hydroelectric Scheme — one of Australia’s largest engineering projects — was part of the rebuilding effort that followed World War II. This is our chance to turn adversity into opportunity and leave a lasting legacy.”

This fighting spirit and outright optimism is echoed on many fronts in the sector, with a feeling the time has never been more opportune. Indeed, the “conservative” and “change averse” water sector living within its means has in the past drawn cynicism and outright criticism, especially from those driving Porsches in the financial sector. But it seems this slow–and–steady–wins–the–race attitude may today not only prove to be literally vital to communities around the world and a catalyst to global and local economies, but also perhaps a role model for other sectors and the way we live, entering a new era of responsibility.

Author’s Note: Following global communication management posts at Siemens and the International Water Association, Andrew Walker advises and supports water organisations and corporations as an independent marketing consultant worldwide: [email protected]