The Global Outlook for Public Private Partnerships Mixed

East Asia/Pacific region expected to dominate, Europe to remain strong, but North America lags in both anticipated water/wastewater capital and operational expenditures projected through 2016

By Christopher Gasson

Investor interest in the water sector is at an all time high. A number of trends are combining to make it one of the hottest investment plays of 2008. Environmental investors see that growing water scarcity makes it a long term growth prospect. Defensive retail investors like the fact that even in the deepest recession people still have to drink water. Infrastructure funds see the steady returns generated by the networks and open their wallets.

The trouble is that despite the huge amounts of money queuing up to get into the water sector, private money is in general not welcome in the water sector. Most water utilities in the world are resolutely public bodies.

Non-Regulated Utilities

The non-regulated water utility model has been widely adopted around the world, with mixed success. It grew rapidly during the 1990s, but since then, political opposition and high-profile contract failures have dampened the enthusiasm for the model.

The leading exponents of the non-regulated private water model are the French companies Veolia, Suez and Saur. The current strategy of these companies is to keep a low political profile and to focus on winning good contracts in markets which are opening up to private water (such as China and the Middle East), while squeezing value out of their existing contracts. Typically, they will expect to make no margin at all in the early years of a contract, then, through extending the network, and through driving efficiency, increase the margin to an acceptable level in later years.

When a contract comes up for rebid, the expectation is that the cost of winning it will be reducing the margin to zero once again. In that sense, a key issue for these companies is the timing of major contract renewals in the French market, (see Table 1).

Prospects for Private Water

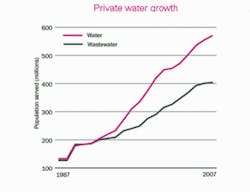

Despite the losses of some major contracts, the private water sector has continued to show cumulative growth (see Figure 1), mainly because contract losses in the Americas have been compensated for by gains in China.

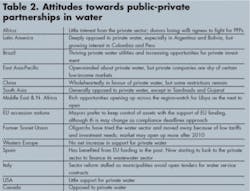

The private water market needs three things in order to grow: a positive political outlook, challenged public water utilities, and the ability to see a way to profit. At the moment, China and the Middle East are the only two regions which meet these criteria. The commentaries ‘Attitudes towards public-private partnerships in water’ (see Table 2) and ‘Private Water USA’, look at global private water trends in more detail.

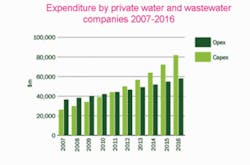

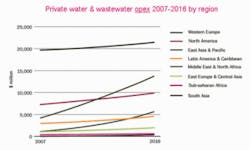

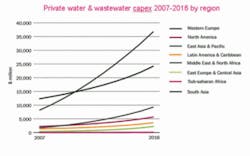

Our forecasts for the growth of private capital expenditure and operating expenditure in the water sector are summarised in Figure 2, Figure 3 and Figure 4.

null

*Western Europe and North America dominate here, but East Asia/Pacific is expected to surpass North America by 2012, with projections of Western Europe at over $21 billion, East Asia/Pacific at over $13 billion (more than tripling) and North America at nearly $10 billion by 2016. Total growth 2007-2016 is expected to be 5.3%.

null

*While year-over-year percentage growth may be comparable in other regions, the dollar amount associated with increases anticipated in Western Europe and East Asia/Pacific dwarf other regions. The first is projected at over $24 billion and second at over $36 billion by 2016 – nearly double and more than quadruple 2007 figures, respectively. Total growth is projected at 13.5% in the same period

null

Private Water Mistakes

Private water has unwittingly found itself in the pantheon of evil alongside nuclear power, animal testing laboratories and baby milk powder. How did it come to be this way?

The simple answer is Cochabamba, the city in Bolivia which turned to International Water (a now defunct alliance of Bechtel and Edison) to manage its water services. Having taken over the Aguas del Tunari concession, the management increased tariffs by an average of 35% in January 2000 before implementing the required capital improvement. There was heavy rioting during which the government refused to back down, and a 17-year-old-boy was shot by troops. Eventually, International Water left the concession and the utility was returned to public management.

International Water’s Cochabamba troubles followed the near failure of the two concession contracts for Jakarta in Indonesia, let to companies backed by Thames Water and Suez, associated with cronies of the former president Suharto. During the turmoil which accompanied the Asian crisis and the fall of Suharto in 1998, both companies removed their executives from the country, leaving two water companies without leadership. The former public operator stepped in, and later refused to relinquish control to the two concessionaries. Thames and Suez resorted to legal pressure to retake control, but following devaluation of the rupiah, couldn’t justify ongoing investment in the city without exercising escalation clauses in their contracts.

Other problems associated with currency devaluations in Manila and Argentina have also helped to bring together public-trade sector unionists and anti-globalisation organisations in a potent protest movement.

The past five years have seen the retreat of international private water, with Thames, Anglian and International Water all pulling out. The model is not dead, however. China and the Middle East are less easily swayed by trade unions and anti-globalisation protestors. The old market leaders (Veolia and Suez) continue to push ahead with the model in those markets, but indicate they’ve learned from their mistakes:

- Projects should be financed in local currency, not hard currency

- Political risk should be mitigated by working with a credible local partner-or better an IPO on a local exchange

- Don’t sell shareholders a short-term growth story based on signing new contracts. Concentrate instead on building long-term relationships

Private Water USA

The U.S. market is one of the great disappointments of the private water industry. In theory, it should be a rich market with plenty of opportunities. In practice, there are obstacles to private finance and a lack of support for private operating contracts. This lack of support reflects the fact that a minority of activists and trade unions bitterly oppose operating contracts. Mayors are reluctant to face the vilification of these groups, especially as there’s a certain degree of civic pride in America’s public water systems. High profile contract failures such as Suez’s abandonment of its Atlanta contract have made more headlines than the industry’s successes, such as Veolia’s Indianapolis contract.

On the finance side, the main obstacle is the fact that municipalities, unlike private companies, can issue tax-exempt municipal bonds to finance their infrastructure investment. This, however, may change in the near future. The U.S. Environmental Protection Agency is backing a proposal to lift the limit on tax-exempt private activity bonds to support private water projects. If the proposal is accepted by Congress, the private sector would then be able to finance water projects on the same footing as public bodies.

At the same time on the investment side, there’s considerable appetite for water infrastructure assets. These give higher yields than government securities, and are perceived to have lower risk profiles than other equity investments. Many municipalities have taken advantage of investor interests in infrastructure assets to sell toll roads to private operators. There’s hope the same might happen in the water sector.

The reality is the water sector is unlikely to offer the big deal to private investors, at least in the next five years.

The main opportunity for private operators and investors now is among small communities, with no direct access to the financial markets, and lack the expertise to manage advanced water treatment facilities.

The other factor in the equation is the return of American Water to American ownership. Hitherto, the three largest private water companies in America have been under foreign control. The IPO of American Water means that there will once again be a local champion with a strong reason to be the pro-active advocate of private water.

Author’s Note:

Christopher Gasson is publisher of Global Water Intelligence, a monthly newsletter published by Media Analytics Ltd., with offices in the UK, India, Philippines and China. Information in this article is based on data taken from GWI special market report, “Global Water Market 2008: Opportunities in Scarcity and Environmental Regulation.” Contact: +44 (0) 1865 204 208 or www.globalwaterintel.com