The Role of Wireless Technologies in the Water Utility Industry

by Chris Stern and Brent Iadarola

Using technology for asset and workforce management is a hot topic for water utilities these days. As both the workforce and water utility infrastructures age, many utilities are considering wireless technologies to help manage information, assets and workers.

Much has been written about the cost and benefits of using technology to automate field-to-office processes; every industry conference and event includes sessions about using hardware and software to better manage your assets, and water utilities across the country are debating about whether or not to make the investment.

Until recently, however, very little formal research has been done on the topic. To help water and wastewater providers navigate the options available, Trimble's Utilities Field Solutions business group teamed up with Frost & Sullivan and several U.S. water utilities to develop the Awwa Research Foundation (AwwaRF)-sponsored Field Computing Applications and Wireless Technologies for Water Utilities report.

Survey Findings

Over the course of 18 months, the research team conducted extensive primary and secondary research, including conducting online utility surveys, tracking market developments, technology innovations and industry trends, as well as developing detailed case studies on the current use of wireless technology by five U.S. water utilities.

Perhaps most important to decision-makers, the report uncovered a strong business case for adopting the use of mobile technology for water utilities. The findings revealed that enterprise mobile computing can provide as much as a 30% annual improvement in efficiency and service, as well as improve data security and the health and safety of workers.

The study also confirmed that technology solutions can ease the burden of regulatory compliance and reporting, as well as enable “green” fleet and mobile workforce initiatives that reduce annual carbon emissions for water and wastewater utilities.

Although many of the utilities contacted acknowledge that mission-critical mobile applications would be an asset to their organization, several challenges still exist. In fact, 58% of utilities surveyed still do not use wireless technologies for field service employees at all (see Fig.1). And, those that have implemented a wireless technology solution indicate that fewer than 25% of their field workers actually use the technology.

Avoiding Brain Drain

According to the U.S. Bureau of Labor Statistics, there were more than 183,000 water and wastewater workers in the U.S. over the age of 45 in 2007, and 11,000 of them were 65 or older. Like businesses of all types and sizes across the country, the water utility industry is facing a mass exodus of workers over the next 10 years, when all but the youngest of the baby boomers will retire. Those workers will take decades of institutional knowledge and, in many cases, the only real understanding of a utility's field processes with them when they go.

The study confirms that Mobile Resource Management (MRM) solutions, which include technologies for collecting, tracking and analyzing data about a utility's assets, can play a significant role in helping water and wastewater utilities transition knowledge to the next generation of workers.

Field computing applications and wireless technologies offer utilities the opportunity to capture knowledge in the field and implement repeatable processes to help ease the burden of succession planning.

Support for Aging Infrastructure

Researchers also confirmed that an aging infrastructure, coupled with an expanding population and stricter governmental regulations, is one of the biggest challenges facing water and wastewater utilities today.

The study revealed that Geographic Information Systems (GIS), Global Positioning Systems (GPS) and Location-Based Services (LBS) can offer significant time and cost savings related to maintaining an aging infrastructure. In fact, researchers estimate that a mobile GIS solution has the potential to double the number of valves, access holes, fire hydrants and other small features that can be visited in a day as compared to traditional techniques.

In addition, many early-adopters of field force and wireless technologies are expanding their use of supervisory control and data acquisition (SCADA), automated meter reading and metering infrastructure (AMR/AMI), computerized maintenance management systems (CMMS) and other enhanced asset management and monitoring systems in order to respond to increasing regulatory and infrastructure demands.

Improved Customer Service

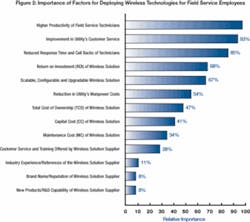

Improved customer service is one of the key drivers for deploying field computing and wireless technologies for water and wastewater utilities. In fact, it ranks second only to higher fleet productivity/utilization when it comes to the most important factors for choosing wireless technologies for field service employees among survey respondents (see Fig. 2).

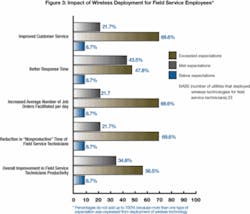

More importantly, the investment is paying off for water and wastewater utilities adopting the use of wireless technologies to help improve customer service. The survey results show that more than 91% of survey respondents believe that their wireless deployment for field workers met or exceeded their expectations when it came to both improved customer service and improved response time (see Fig. 3).

Compelling Business Case

While there are still some challenges to overcome, researchers determined that there is a strong business case for the adoption of field computing applications and wireless technology among water and wastewater utilities. In fact, the financial benefits alone rank field automation as one of the highest value opportunities for utilities.

Implementing systems that deliver real, quantifiable financial benefits provides an immediate opportunity for water and wastewater utilities to cut costs during the current market of financial uncertainty and rising supply costs.

To help utilities calculate actual cost savings, researchers developed a return on investment template and financial model to help decision-makers analyze the investment costs and the expected returns.

Using a simple return-on-investment (ROI) model provided with the report, water utility managers can enter information such as total number of mobile workers, hourly salaries for each category of worker and number of weeks worked per year to calculate the annual expected savings from various field technology solutions.

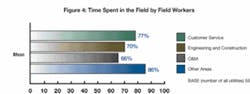

One of the most straightforward financial gains to water and wastewater utilities comes from enabling workers to spend more time in the field. Survey results show that in some cases field workers are spending as little as 66% of their time actually working in the field, away from the office or yard (see Fig. 4).

Other tangible financial benefits utilities can expect from the deployment of wireless technologies for field and mobile workforces include employee overtime reduction, paper and data entry time reduction by office workers, mileage reduction and fuel cost savings by mobile workers, an increase in the number of jobs completed by mobile workers because of increased efficiency, and more.

In addition to real, measurable cost savings, it is also commonly accepted that the use of technology also has significant intangible benefits. These include improved response times, better customer service, and easing the knowledge transfer from one generation of workers to the next.

Although the industry as a whole has been slow to adopt wireless technologies and field computing applications, there is no question that these solutions are the way of the future. Almost 69% of survey respondents indicated that they were “very likely” or “likely” to implement wireless technologies over the next two years. Those that do so sooner rather than later will be far better equipped to meet the needs of customers over the coming years.

About the Authors:

Chris Stern is director of Utilities Field Solutions with Trimble (www.trimble.com), Long Beach, CA, and principal investigator for the Awwa Research Foundation's Field Computing Applications and Wireless Technologies for Water Utilities research project. He can be reached at [email protected].

Brent Iadarola is the global research director for Frost & Sullivan's Mobile Wireless Communications Group (www.frost.com), San Antonio, TX. He can be reached at [email protected].