Market Insight: Water sector outlook for Russia

• Market insight article from Frost & Sullivan analyst notes investment of $459 billion required over next decade

By Tomasz Zagdan

A staggering sum of $459 billion (15 trillion Rubles) is needed to complete necessary upgrades, refurbishment and new construction for water and sanitation infrastructure in Russia by 2020. Announcing the investment plans earlier this year, Boris Gryzlov, the chairman of the State Duma added that it's still a top level estimate for implementation of the "Clean Water" program, but further details are yet to be announced by the federal government.

The initial draft of the program published in 2008 indicates ambitious goals (see Figure 1), and mirrors the scope and magnitude of the needs of the Russian water sector. Public access to water supplies and sewerage networks is still low, with over 20% of people without access to centralized water supply and over 60% of wastewater discharges not meeting requirements. More importantly, little progress has taken place over the last two decades. Existing infrastructure is inefficient and largely outdated resulting in frequent breakdowns, high energy consumption and substantial water losses. According to the Federal Agency for Construction, Housing and Utilities, the present level of wear and tear of water and wastewater infrastructure and equipment ranges from 50% to 70%. Moreover, the deteriorating quality of drinking water in Russia is a significant concern.

Regulatory agencies are faced with limited resources, and have little or no control over indiscriminate discharge of untreated industrial wastewaters into water reservoirs. This has resulted in the deterioration of water quality with a negative impact on the health of Russian citizens. According to the UN World Population Prospects, Russia has the shortest average life expectancy in Europe. The Duma Chairman Gryzlov expects implementation of the Clean Water program over the next decade is likely to bring about a tangible improvement in the water environment and increase life expectancy in Russia by five to seven years.

With massive capital requirements, implementation of this infrastructure program is a challenge, particularly during a period of severe economic downturn. Andrei Klepach, Russian deputy economic development minister, issued a statement in April 2009, stated the economy contracted by a staggering 7% in Q1 of 2009, indicating the worst decline of the national economy since the "Ruble crisis" in Q4 1998. Poor economic conditions also affects performance of Russia's water sector. Initially, the plunge in manufacturing output translates into a decrease in the water consumption by the industrial sector, which accounts for over 60% of water use in Russia. The crisis also hit average Russian households by influencing their income level and stretched their ability to pay for the water bill.

As executive director of the Rosvodokanal Group -- one of Russia's leading utilities -- Mikhail Nikolskiy commented in an interview for Frost & Sullivan: "We cannot switch off the water supply for the population, especially in big houses. Most of the people are paying for the water and only some of them are not, and we have no possibility to cut the supplies for whole building and have to continue providing them with water." Moreover, a residential construction slowdown also impacts water utilities, as some previously planned investments were cancelled and initiated projects put on hold. Nikolskiy said: "Because of this [crisis] we don't see the addition of new facilities in such scope. We don't see the demand for new water pipelines for new homes. It means that we have to revise our initial investment plans."

Turmoil in the banking sector has influenced availability of financing for water companies as well. Nikolskiy stresses this as an important factor and adds: "Credits in Russia right now are very expensive with an interest rate of 22% to 25% per year. Unfortunately, because of this we have to stop our leasing operations. 'Til a year ago, it was so easy to buy new machines or technology with lease agreements; right now, it is impossible." Difficulties in the access to financing also encompass loans for key investment programs. "It's the same problem here. Blue chips such as Lukoil could get money from VTB bank for 8% per year. We have no chances for that. Most of the Russian economy has no chances for that," he adds.

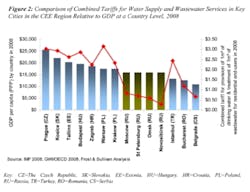

Securing the necessary capital is critical for ensuring realization of the "Clean Water" program. Still, there has always been a hiatus between funds available and actual investments required by the Russian water utilities, regardless of the country's economic situation. Water tariffs traditionally constitute a major source of water utility revenues. The fact such tariffs in Russia are very low and also substantially below the level of most other countries of the Central and Eastern European (CEE) region highlights a major money crunch.

Figure 2 illustrates the comparison of tariffs in key cities of the CEE region to GDP per capita at a country level. Tariffs in Moscow, the most affluent city in Russia, are 30% lower than the tariffs in Bucharest, nearly three times lower than in Istanbul, and more than three and a half times lower than in Warsaw or Prague. Moreover, the water tariffs in Moscow constitute the ceiling in Russia, as prices in the remaining cities such as St. Petersburg, Omsk or Novosibirsk are much lower. In certain places, the tariffs are three times lower as in the city of Novosibirsk.

Water tariffs in Russia have increased only slightly since the early 1990s. Unlike countries in the CEE region, the level of water consumption in Russian households has remained invariably high over the last two decades, translating to substantially higher energy and operational costs for water utilities. Revenues generated by the utilities on water bills are typically insufficient to cover not only the critical capital investments but also operational expenditures. As a result, water utilities require financial endorsement both for their daily operations as well as investments in infrastructure rehabilitation and expansion. "Unfortunately cities have to pay additional money to maintain water facilities. It's the other side of coin of low tariffs in Russia. If you are a good manager of cities, you understand that money we have from our tariffs is rarely enough for modernization of all water facilities" says Nikolskiy. "Due to low tariffs, we have a relatively high consumption of water in big cities. Because of this we have 2-3 times more operational expenditures. Combining low tariffs with high OPEX leaves us with limited resources for capital expenditure," he adds. The tariff policy in Russia has always been dominated by political reasoning and superseded economic requirements. Increasing tariffs are likely to require actions to be taken at the federal level, which is a very difficult goal to achieve during the current economic recession. "Right now, none of the cities where we work and no other municipal operators could increase tariffs by themselves. Unfortunately, we are in the mainstream of the federal and local politics," says Nikolskiy.

Providing the necessary funding for the implementation of the "Clean Water" program currently remains beyond the capacities of municipalities and the federal government. Luckily, Russian authorities have demonstrated an increasing understanding of this challenge and aim to encourage more private sector involvement into the water business. "Right now, local authorities will be interested in finding a good partner for these difficult years. With economic growth, it was easy to solve problems in the water sector. Right now, it is necessary to work on a different level -- the anti-crisis level. This first of all means the managerial level and in this situation, we [privately managed operators] are more effective than municipal companies," Nikolskiy said.

Privatization is another area where political expediency has resulted in preservation of the status quo for many years. Transferring assets into foreign hands didn't gain wide acceptance in Russia, due to skepticism and ideological reluctance toward foreign ownership of what's referred to as "critical assets." "Privatization of facilities is not so popular in Russia. I recall just limited number of examples like the city of Solikamsk in the Perm region with a population of 100,000 people. But for Russia this is a small city," says Nikolskiy. Yet he remains optimistic and points to substantial opportunities in public private partnerships (PPPs) involving introduction of private, Western-style management. "The trend in Russia and most part of private projects is privatization of management -- creation of new business units with old people, old facilities and renting agreements with local authorities. The legal entity is new and people and facility are formal municipal agencies. Typically, this is a situation linked to privatization of management in utilities. Speaking about this privatization I'm very optimistic. I'm hoping that the crisis will help us grow the private sector in the Russian water economy as a whole," maintains Nikolskiy.

Private sector involvement and effective management are essential to enable the implementation of the "Clear Water" program, particularly when utilities are expected to improve operational efficiencies and increase the share of capital expenditures. Authorities recognize the significance of private sector's involvement, and are already working on amendments to the concession law to promote and facilitate private investments for the utility sector. Changes in regulations are necessary as existing legislation on concessions hasn't delivered the desired results. "All our projects in regions we operate could be named PPP -- our formal agreement is a rental agreement. It's not a concession because legislation on concession is not so good in Russia. It's better to use a rent agreement than that of a concession," says Nikolskiy. "Right now, the Ministry of Economy is developing a new scheme to change the concession legislation in order to make it more relevant for utilities."

Crisis and budgetary constraints also push utilities to consider alternative ways of increasing effectiveness or reducing operational costs. Promising short- and medium-term measures such as managerial and engineering work are aimed at improvement of operational effectiveness, reduction of water loss due to leakages, and increasing energy efficiency. Nikolskiy underscores: "Crisis is a good time for increasing effectiveness. That's why engineering companies attempting to reduce costs have good chances in Russia." In fact, Rosvodokanal also focuses more on investments in this area. "If the crisis in the construction sector continues they won't need new facilities and thus we don't need to invest. It's necessary to change our investment plans and focus on energy efficient machinery and water losses. We will need to change the direction of our investments" maintains Nikolskiy. "Right now, in this sector, good management is more important than investments. Imagine that you are in a boat with a lot of holes inside. First of all it's important to fix the holes and after that to pour water outside Water in this context is investment, holes -- managerial holes. First of all, it's necessary to modernize the managerial system in these companies and only afterwards can we think about investments."

The water sector in Russia provides a significant business opportunity for another important reason -- security of ownership, which is typically one of the key market entry barriers for foreign investors. Over the recent years, even large multinationals such as British Petroleum struggled with political interference of the state into business. At present, investors lose sleep over nationalization and continue to report new rumors. "Speaking about the economy in general," says Nikolskiy, "right now, we can see nationalization of some entities in other sectors -- a few examples being the banking sector and Norilski Nikiel in metallurgy. We are not afraid of such processes in the water sector -- most of it is municipal. Maybe just 15% of the water sector in Russia is privately owned. We are not afraid that municipal sector will want to get back their assets. It's not so interesting for them. It would mean that in times of crisis, they would have to take the responsibility for the water sector. Right now, we work as partners and divide the risk evenly between the municipal authorities and Rosvodokanal. If they take back the facilities they also take back the responsibility and the present times are not favorable for taking on extra responsibility."

The poor condition of the Russian water sector is less of a surprise. Neither is the magnitude of investments required to address essential needs and improve water & wastewater infrastructure up to the required standards. Russian authorities will have a tough nut to crack trying to obtain the funds for financing the "Clean Water" program. It is evident that the staggering $459 million mentioned by Duma Chairman Gryzlov is a sum likely to stretch Russian Government resources, particularly due to current economic conditions. Involvement of the private sector isn't an option to consider, but rather a necessity to ensure even a partial realization of the program. Structural changes need to be initiated at the federal level to provide a proper framework endorsing public-private cooperation. Plans to amend the concession law are the first and important step toward achieving the goal. Finally, the water tariff policy in Russia will require revision. The current level of tariffs is insufficient to cover the necessary capital costs associated with the implementation of the program. In the short term, the socially sensitive aspect of low tariffs is likely to prevail, thereby putting any increase of tariffs on hold. In the medium to long term, however, a change of perspective at the federal level will be required, not only to enable the necessary capital for investments but also to ensure water operators can exist independently without requiring subsidies to cover operational expenses.

Nevertheless, despite the harsh reality and challenges ahead for the Clean Water program, the perspectives for the Russian water sector for the coming years is more one of promise than what's been witnessed over the last decade. Water utilities already demonstrate an increasing interest in managerial privatization. Construction and rehabilitation of infrastructure between 2010 and 2017 are expected to create new opportunities for equipment suppliers, engineering firms, as well as construction companies. Even with all the gloom and doom around the Russian economic climate, the water sector has the potential to be better off over he next decade than it has in the past decade. WWi

August 2009

###