By Andrew Walker

A barometer reading on the outlook for the European water sector in 2009

In light of the crisis of financial markets and knock-on effects in economies worldwide, how will the water industry be affected? A precise prediction seems impossible at this stage. But leading economic experts and sector professionals are optimistic, some even viewing current problems as a great opportunity. But without making resource No. 1 more attractive to private investment, much of the world’s money may continue to be channeled elsewhere.

Organisation for Economic Co-Operation and Development (OECD) water expert Roberto Martin-Hurtado remarked on increased difficulty of accessing financial resources due to the credit crunch and a dwindling willingness of politicians to charge water tariffs to reflect the true cost of water services in these times. When investors recover from the shock, though, he believes many will seek safer waters and be prepared to accept lower returns to avoid risk.

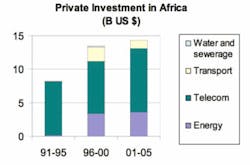

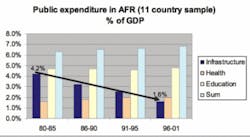

So how safe a haven is the water sector? Some would argue its relatively low volatility means economic repercussions have larger lead-times. Add to that high regulation and simple sheer necessity of good water services, and you have a perfect replacement for those blue chips that have turned red. Still, this hasn’t convinced investors in the past. In his presentation at the IWA World Water Congress in Vienna in September 2008, World Bank Water Sector Manager Abel Mejia noted that, while private investment has been increasing, less and less went to the water sector as new financiers preferred transportation, energy and telecommunications. At the same time, public investment is also declining (see Figures 1&2).

The World Bank also has drawn attention to how exposed many utilities have become thanks to rising operating expenses (particularly from higher commodity costs like energy), and the chronic problem of not actually being able to charge market rates for the services they provide. Estimates in 2007 underscored that around 30% of water utilities worldwide operated at a deficit, with predictions putting that as high as 50% in the near future (and this before the global downturn). Such a situation is unlikely to give confidence to potential investors.

Is water on the map?

In a 24-page Ernst & Young report in 2008 entitled “Bridging the gap — investing in European infrastructure”, the word “road” appeared 69 times, “airport” 22, “transport” 38 and “water” just five times. A similar recent report from Price Waterhouse Cooper (“Building New Europe’s Infrastructure”) showed the water sector investment-needs until 2010 account for a massive 36% of all infrastructure in Central and Eastern Europe. On the next page, the report shows a grand total of one public-private-partnership (PPP) project (from a total of 68) for water in the same region to be completed in or after 2008, although it’s widely viewed that PPPs play a significant role in increasing capacity. Water is apparently not a sector at the forefront of the investment community’s mind.

The fate of many publically-traded water companies share prices over the past year compounds the problem, with the amount of capital available for R&D and projects being flushed down Wall Street and High Street drains. While smaller, privately-owned companies and those with low debt have suffered less, the credit-crunch reduces their flexibility and bullishness, too.

Paradoxically, there are amazing things going on many believe could capture at least as much investor attention as solar power or biotechnology. For example, take wastewater plants that are >100% efficient, increased application of water reuse technologies, breakthroughs in nanotechnology, major reductions in the cost of desalination or new technologies to combat water leakage.

How green is blue?

Equally important to technological innovation in winning attention is a general perception that the sector is making a contribution to society. The water profession appears slow to embrace the green movement, one undeniably gaining in popularity and becoming an important criteria for investors. Without being seen to be a leader in this field, the sector is unlikely to win the hearts of increasingly environmentally conscious citizens. Apart from more substantial efforts required to reduce the industry’s carbon footprint, easier ways of being green aren’t being embraced as quickly as in other industries. Consider one small but symbolic example: How many of the numerous events water professionals travel to in the course of the year have schemes to offset the carbon emissions they cause, or participants’ travel?

In the UK, the environment has become central to governmental policy. Global engineering consultant Black & Veatch is helping a number of water companies there reduce their energy use, recover energy and cut reliance on fossil fuels. Apart from a new wave of cost saving, increasingly measuring carbon footprint and making reductions is becoming a stipulation for funding. Moving into a new regulatory period in 2010, the company doesn’t view less activity as likely, as water companies invest to meet stricter quality and operational efficiency standards.

Water as economic stimulus

Will new governmental-led investment go to water? Commenting on the spate of government stimulus packages for infrastructure in the pipeline, or being speculated on, Phil Weller of the UN- based International Commission for the Protection of the Danube River (ICPDR) in Vienna, stated, “It remains to be seen whether the current economic situation will be damaging or helpful for the Eastern European countries along the Danube catchment area. On the one side, the countries have a massive challenge in bringing their water and wastewater treatment to the required standards, and additional government investment would help significantly. On the other side, such financial packages depend on availability of affordable credit, and firm governmental commitments, both of which are in short supply. The Danube nations are unsettled, but we have not observed a slowing-down in progress as yet.”

Hurtado’s and OECD’s confidence in the sector’s stability lies in a combination of both longer-term programmes to build-up capacity and revamp crumbling systems, as well as initiatives like the U.S. Alliance for Water Efficiency program (www.a4we.org), which have a more immediate effect.

Options of both short and long-term opportunities, geographical and technological diversity of the sector, the massive gap between supply and demand, and sheer necessity of water must surely make a range of attractive and differing investment portfolios possible. If a significant amount of private investment were added to the multi-billions some governments plan to spend on infrastructure (assuming some of it goes to water), the sector may at last see a level of investment that would help secure a sustainable water services system and connect billions of people still without the luxury of tap and toilet.

Developing countries

Will the developing world suffer? Again, precise answers to how the economic downturn will affect the poorest among us are few and far between. But Hurtado stated OECD secured an “aid pledge” recently from each and every donor country that confirmed they will continue to honour all outstanding donorship commitments, include the 9% of total aid that flows to the water sector.

According to him, “Any additional infrastructure investments and donor aid will no doubt carry stricter conditions that foster reform. Better governance in handling foreign investment and improved managerial and operational efficiency are areas of improvement in the sector that need to be more urgently addressed. The economic changes we are experiencing may prove to be a catalyst in making these improvements.”

That good water and sanitation are vital for the economy as well as health, while water stress is on the increase is no longer up for debate. But in the privileged parts of the world where good water and sanitation is easily available (and where the bulk of investment sources lie), water paradoxically flows freely and cheaply.

Promoting water’s image

Building awareness and polishing up attractiveness of the sector here is key to unlocking more investment. With water being a very local affair, it’s unlikely that a water-rich Scandinavian citizen, no matter how philanthropic, would be willing to pay higher tariffs to help thirsty people in water-scarce countries. But she or he may well be happy to invest money to do just that if a reasonable return at a calculable risk is offered.

If blue was in fact the new gold in people’s minds, the sector would flourish. Those minds are sensitive to issues like climate change mitigation, institutional efficiency and governance, getting water and sanitation to all, and simply hearing fascinating stories that too often are told behind closed conference doors.

In a society that seems more willing to react to scare tactics, the power industry is busy painting scenarios of widespread blackouts. Sure, it’s not nice to have the lights turned out. But having your tap dry or not being able to flush would seem at least just as problematic.

As Dan McCarthy, CEO of Black & Veatch, puts it: “Water efficiency will need to be promoted in the same way as energy efficiency so that consumers understand it as a way of controlling living costs and achieving a sustainable lifestyle. Too few are aware of how much water we use, let alone the cost to the environment of treating potable water and wastewater. The days are over when it was possible to use water as if there were no tomorrow.”

It now seems inevitable that future generations will pay the largest chunk of the price tag for our current economic woes. So rather than giving them another bank or automobile manufacturer for that money, how about an efficient, sustainable system that provides water and

sanitation for all?

Author’s Note:

A media communications coordinator at Siemens and the International Water Association previously, Andrew Walker is a marketing consultant to water organisations and corporations worldwide: [email protected]