Legislation drives thermal sludge disposal market

By Saana Kärki

The European market for sludge disposal is entering a period of dramatic transformation. EU and national legislation seeking to develop a more environmentally conscious approach towards sludge disposals will continue to drive increasingly advanced disposal solutions and subsequent growth in this industry. Continued regulatory tensions and stakeholder pressures are provoking structural and competitive changes in the sludge marketplace.

The international market consultancy Frost & Sullivan valued the European market for sludge disposal services at US$ 2.9 billion in 2002, a significant increase from the US$ 2.5 billion in 1999. An underlying driver to this market is the heightened volumes of sewage sludge, which have risen in response to increased wastewater treatment. Compared with the 5.5 million tons of dry solids produced in the early 1990s, the volumes have now nearly doubled. Furthermore, much of the continued growth is now coming from increased attention towards advanced disposal solutions. The new landfill directive with limits on organic levels is an influential market force since it drives the demand for higher value services, such as thermal destruction. More importantly, the required skills and capacities to meet the regulations also mean that customers are more willing to pay extra for complete disposal services and for even more advanced solutions.

Such channel transformations will push revenues to approximately US$ 3.5 billion by 2009. Robust pricing trends and ongoing growth in sludge volumes will further expand this lucrative business.

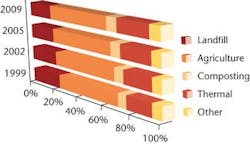

Current market conditions predict a gradual shift away from landfilling, which is eventually reaching its sell-by date because of escalating costs and restrictions. This is predicted to have a particularly positive impact on thermal methods, which allow greater pathogen kill, energy recovery and safer final disposal of ashes on soil. By the end of the decade, sludge combustion is expected to account for nearly a quarter of the total disposal market compared with the mere 14% in the mid-1990s.

The momentum behind the most economical landspreading option is still expected to remain fairly strong despite public controversy in some regions. Political conviction generally continues to encourage reuse, such as recycling on farmland and landscaping; thus agricultural recycling is forecast to retain dominance as the key disposal route in coming years, accounting for slightly less than half of all disposals. Some regions are also experiencing an increasing push for less traditional land applications such as centralised composting plants.

However, the market for land solutions will depend largely on agricultural guidelines sustaining safer "on-land" disposal practices in addition to further treatment improvements, such as dewatering, drying and anaerobic digestion, which essentially address the needs for greater pathogen kill and sludge reductions.

The most certain evolution downstream is the increase of thermal disposal and slowly rising presence of less conventional channels such as composting and land reclamation in favour of traditional land solutions.

The growth trend in thermal destruction has been particularly buoyant in the wake of land restrictions. By 2004, Frost & Sullivan forecast that thermal services (namely incineration) will exceed landfilling in terms of volume. By 2008, the value of thermal market services will outperform that of landfilling business as a result of route substitutions, greater thermal capacities, higher utilisation rates and upwards pricing pressures.

Frost & Sullivan estimate that the market for thermal sludge disposal services is now worth more than US$ 530 million, and with a compound annual growth rate of approximately 6% over the next seven years the market will rise above US$ 800 million by 2010. Particularly those companies with sludge-to-energy initiatives are increasingly generating additional revenue streams within the disposal market.

The conquest of combustion

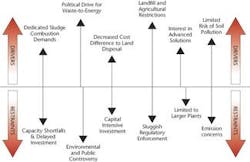

The upwards march of the thermal sludge market is largely driven by tighter control of other routes — the intensifying obligations in implementing the landfill directive, and needs to satisfy the requirements of the farming and food production industries.

Public controversy and sluggish enforcement of local regulations are key challenges faced in thermal market development. Despite the actions of many European governments to phase out landfill use, it has remained an important sludge disposal route. Its low cost has historically been a unique selling point and despite efforts to restrict its long-term role in the waste market, the method has so far continued to stand firm.

Capacity shortfalls within national markets hamper the desired move away from landfill and towards alternatives in alignment with waste hierarchical principles. These shortfalls largely pertain to delayed investment in new treatment and disposal facilities such as thermal sludge plants.

Nevertheless, amid punitive taxation, increasingly diverse alternatives and rising prices coupled with limits on organic content in landfills, the long-term shift in favour of thermal solutions should diminish the negative impact of such restraining factors.

Furthermore, the development of renewable energy sources lies at the heart of current investments in the waste sectors, and the market for sewage sludge is no exception. Disposal services that promote energy efficiencies are particularly appealing to water companies whose energy consumption has risen rapidly in response to higher wastewater treatment standards and subsequent heavy operations.

Several technologies, in addition to incineration, present an alternative to conventional combustion processes. The main ones include supercritical wet oxidation, pyrolysis, gasification and vitrification and integrated solutions such as e.g. pyrolysis + combustion, which still tend to be at a semi-commercial stage. While co- and mono-combustion of sludges are likely to dominate the future thermal market, the advantages of the newer introductions include apparent improvements in terms of environmental impacts and in flue gas and ash treatment and potential cost advantages. Already Europe is seeing an increase in various pilot plants, which are paving the future for newer solutions.

Sludge disposal management still varies from one region to another. Regional market development and subsequent strategies have differed according to the overall level of environmental, particularly wastewater, infrastructure; geographical and economic conditions; local regulations; environmental awareness levels; and public opinions.

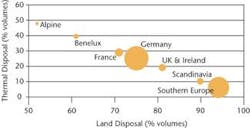

In terms of relative market sizes, Germany is clearly the largest followed by Southern Europe. Particularly good future growth rates are expected in France, followed by UK, Ireland and Belgium.

Further differences emerge in local channel emphasis. Southern European countries still insist on land disposal and future changes are likely to be slow. Scandinavian countries continue to rely quite heavily on their generally vast land capacities for most disposal. Denmark, however, is pioneering the market for thermal disposal with more than a quarter of its sludges already burnt in combustion facilities.

Most important regions with high thermal trends include the Alpine countries where recycling limits are currently most extreme. In France, land concerns are escalating and the future for thermal solutions is promising. Benelux, Germany and the UK have installed sludge incineration plants and will continue to push forward the penetration of this service segment. Only recently the German Environment Ministry decided to finance a prototype sludge incineration plant with the hope of benchmarking future developments.

The most probable scenario that Frost & Sullivan forecast for the European sludge disposal market is one, where further thermal development continues with an overall shift from landfilling to combustion, and landspreading persists on the basis of safety controls as opposed to complete bans. Future market development will generally favour the following strategies, despite the varying degree of regional channel trends:

• Increased thermal plants and sludge-to-energy initiatives;

• Solutions for environmentally safe landspreading;

• Up-stream treatment efficiencies;

• Sludge reduction efforts, and;

• Innovative solutions as opposed to single, traditional services.

Figure 2 identifies the major success factors and emerging priorities that will allow companies to effectively exploit specific thermal opportunities. Above all, size and capital are crucial, ensuring economies of scale, know how, access to disposal facilities, long-term contracts and capacities for pilot plants. Given the enormous regulatory pressures, it is also critical to build local awareness and contingency plans. Future success will largely rely on sophisticated service and product advances.

To conclude, thermal sludge disposal services are emerging as the winners of current regulatory and public pressures in Europe. In the wake of new landfill restrictions, fiscal policies and continued apprehensions with agricultural recycling, the future prospects of existing disposal methods are becoming uncertain. Not surprisingly, sludge producers and service providers have started to look for alternative solutions to meet legislative, capacity and efficiency demands. The future leaders in this market will be those that can meet environmental credentials and provide flexible and advanced solutions to the most complex sludge concerns.

Author's noteSaana Kärki is an industry analyst for Frost & Sullivan's European Environment Group, based in London, England.