Optimistic long-term growth forecast for Central & Eastern Europe

Frost & Sullivan reports mixed results with high growth potential in the medium to long term for the Central and Eastern European municipal water and wastewater treatment equipment markets.

The Central and Eastern European (CEE) municipal water and wastewater treatment market has been receiving increasing attention on account of the high buoyancy due to high activity in the water and wastewater market and resulting high growth rates.

Substantial European Union (EU) funding to assist these new member states during EU accession has catalyzed market growth. EU funding is helping these countries comply with the high standards of the Drinking Water Directive and Urban Wastewater Treatment Directive (UWWTD).

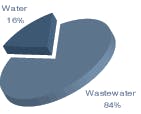

The huge gap between the drinking water quality and wastewater collection and treatment in the CEE countries and high EU standards is fueling growth prospects for the treatment equipment market over the next ten to fifteen years. Frost & Sullivan estimated the worth of the Central & Eastern European municipal water and wastewater treatment equipment market to be US$ 874 million in 2005, and forecasts double-digit growth in the long term to reach a market size of $1.6 billion by 2011.

There is an increasing optimism of further growth especially in the new member states such as Poland and Hungary as they intensify efforts of establishing compliance with UWWTD requirements by 2010. Even though the Czech market is maturing, it still is one of the significant regional markets as it provides sizeable upgrade and refurbishment opportunities. In the remaining new member states of Slovakia, Baltic States, and Slovenia, the growth opportunities are largely going to be in providing treatment solutions for small- and medium-sized agglomerations with a few upgrading projects.

Among candidate countries, the Romanian regional market provides significant growth opportunities in the near term, with Bulgaria expected to follow in the long term. Turkey presents decent opportunities though the pace in the medium term is still crippled by lack of funds and still pales in comparison to the other more dynamic markets

Market growth opportunities

The majority of the investment has been targeted at improving the wastewater treatment infrastructure and upgrading existing treatment plants with the addition of a secondary treatment system. The more advanced and new wastewater installations provide high growth opportunities for end-of-line sludge treatment equipment in most of the CEE countries.

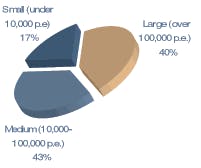

In some of the regional markets, such as the Czech Republic, where most of the work with regard to water and wastewater treatment has been completed in the few large cities, attention has shifted to small- and medium-sized agglomerations. Projects such as the Clean River Becva project provide growth opportunities over the next few years for equipment companies targeting this particular niche segment.

CEE countries have successfully implemented or are in the process of completing water sector reforms, which increase the ability of municipalities to involve private companies in upgrading and operating water and wastewater services. The limited affordability of many municipalities in the CEE region provides an opportunity for private companies to take up contracts of upgrading water and wastewater treatment plants and extend the same into operating and providing services.

Industry segment trends

Drinking Water Treatment: Filtration is the dominant equipment type in the CEE market with a majority share and is benefiting from the moderate growth in the drinking water treatment segment. Programs such as the Drinking Water Quality Improvement Program in Hungary are expected to provide an increasing demand for advanced filtration equipment to tackle contaminants such as arsenic.

The clarification and disinfection equipment segment is experiencing relatively lower growth, largely attributed to the refurbishment and replacement of ageing treatment equipment. Few opportunities are expected for the use of ultraviolet (UV) and ozone disinfection equipment in the relatively developed and privatized regional markets such as the Czech Republic, Hungary and Romania.

Membranes are yet to make a significant impact on the Central and Eastern European municipal water treatment equipment segment and are limited to pilot projects with market potential expected to be initiated in the next five to six years. Among the factors restricting the role of membranes in the drinking water segment is the investment focus at present on the wastewater segment and the long transition period for compliance with the Drinking Water Directive.

Wastewater Treatment: The wastewater treatment equipment market segment is experiencing high growth rates on account of the substantial investment on constructing and upgrading wastewater treatment plants to comply with the requirements of the UWWTD. The accession of eight member states in 2004 has enhanced the funding and contributed to an increase of the wastewater treatment equipment market segment.

Over the past couple of years, secondary treatment equipment has increased its share on account of its role in upgrading of existing treatment plants as well as its substantial part in the newly constructed treatment plants.

Because of the large number of designated Sensitive Areas in the Central and Eastern European region, including the entire countries of Romania and Lithuania, there will be an increasing demand for tertiary and advanced treatment equipment. Sludge treatment equipment presently is set to gain substantially on account of the upgrading as well as construction of wastewater treatment plant.

Regional trends

The Central and Eastern European municipal water and wastewater treatment equipment market structure and growth show great regional variation.

New EU member states: The Polish regional market is the leading revenue contributor and its dominant position has been largely due to the fact that it has received the largest share of ISPA funding prior to its accession to the EU in 2004. The Polish regional market provides the most growth opportunities in the region given its extensive program of constructing wastewater treatment plants and an increasing funding package under the Cohesion mechanism,

The Hungarian regional market is the second largest contributor to the CEE treatment equipment market. Hungary is expected to further increase its revenue contribution share and maintain its second position in the overall CEE treatment equipment market with projects such as the Csepel and South Buda wastewater treatment plants scheduled to be constructed with a cumulative investment of US$ 900 million.

Growth opportunities in relatively developed regional markets, such as the Czech Republic, are largely limited to refurbishment works and the construction of wastewater treatment plants for small- and medium-sized agglomerations.

In the other new member states of Slovakia, Baltic States and Slovenia, the prospects are largely to do with construction of wastewater treatment plants for small- and medium-sized agglomerations with the addition of upgrade and refurbishment requirements in the Slovakian market segment.

EU candidates and other CEE countries: The Romanian municipal wastewater treatment equipment market is one of the most promising regional markets in this segment. With the accession of the new member states, there has been an increase in ISPA fund allocation to Romania, which has catalyzed the growth in the wastewater treatment equipment. Its scheduled accession to the EU in 2007 will also result in an increase in funding through the Cohesion mechanism.

Growth prospects in the Bulgarian municipal market have been delayed largely due to the lengthy process of funding. This regional market is expected to provide high growth potential in the long term assisted by its scheduled accession to the EU in 2007.

The treatment equipment market in Turkey lacks the momentum largely due to funding constraints. However, it is seeing slow developments and is expected to become one of the dynamic regional market segments in the long term as its share of EU funding mechanisms falls in place.

The regional market segments that are much below par are Ukraine, Croatia, Serbia, and Montenegro. These countries are in a transition from passing through years of armed conflict to gradually rebuilding the economy. Although there is a dire need for replacing treatment equipment in close to half of the treatment works in the large Ukrainian market, the lack of funding has restrained it to a large extent. In Croatia, the Zagreb wastewater treatment plant project has provided the momentum and could be carried further once the remaining projects are successful in securing the funding.

The Central and Eastern European municipal water and wastewater treatment equipment market is uniquely structured with a high price sensitivity and strong local dynamics. Therefore, it is paramount for equipment companies to have a high level of market focus, create innovative pricing and cost efficiency strategies, establish local partnerships, and concentrate on niche markets such as treatment plants for smaller communities.

The CEE treatment equipment market has a long-term growth potential and the companies that commit for the present will eventually be well-positioned to reap the benefits of the developing CEE water and wastewater market in ten to fifteen years.

Author’s Note

Fredrick Royan is a senior industry analyst for Frost & Sullivan, located in Bangalore, Karnataka, India. If you would like more information about our Environmental subscription or related research, send an e-mail to Chiara Carella - Corporate Communications, at [email protected] with the following information: full name, company name, title, telephone number, e-mail address, city, state and country. Requested information will be sent by email upon receipt of this information.