EU Commission sends mixed signals for liberalising water sector

By Prof. M. P. van Dijk and drs.M.A.C. Schouten

European utility sectors are undergoing great change. Electricity, telecom and even gas operators are increasingly dealing with competition; however the water supply and sanitation sector still operates within various types of management structures and different levels of liberalisation and private sector involvement.

The liberalisation process of the European electricity, telecom and other networking sectors, and the increased involvement in developing countries of private water companies brings to the forefront questions on the evolution of the water and sanitation sector. The factors explaining the current institutional arrangements can usually be found in the history of each individual European Union (EU) member state. These include the degree to which the local water sector is vertically integrated and whether (near) monopolies were created through, for example, licenses and exploration permits.

Four generic institutional arrangements in the water and sanitation sector

In recent years, many have questioned the prominent role of the public sector in the water sector, and called for increasing involvement of the private sector, for example, through delegation-type contracts. More stringent technical requirements and financial pressures have also driven the growth in private sector involvement. Liberalisation surfaced earlier in France, Spain, England and Wales, but the water sector in other countries is still sheltered from the exposure to market forces by national borders and national policies. For example, the Dutch government recently prohibited private parties to own shares in water utilities.

Water services in Europe are traditionally the responsibility of local public authorities. In terms of the Principal-Agent theory, the municipal council typically assumes the role of Principal, and the Agents were government officials running the utility. Notable exceptions to the municipal council being the sole Principal - especially in the case of Agents delivering water and sanitation services at a regional scale and/or operating under private law, exist. Local government has been reorganised in some member states within the past 50 years.

The general trend has been towards a smaller number of larger local municipalities. This trend has been mainly driven by the recognition that it is very difficult to provide the full range of municipal services, including social and basic utility functions, in the smallest municipalities. The latest example of such reorganisation is Greece. Exceptions to this trend are France, Spain and Italy, which have retained their smaller municipalities for a variety of cultural and political reasons. They have obtained the required economies of scale in service provision through franchising with large private sector companies and the extensive use of multi-municipal service provision. Hence the adoption of liberalisation policies is partly the result of the political decision to maintain the existing fragmented local municipal structure.

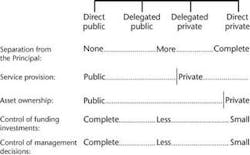

Through the liberalisation process sweeping through the utility sector in Europe, the Principal, Agent, and their roles have changed, and their relations have become more complex. New regulation has been introduced and independent regulators have been appointed in a number of countries to oversee the process. The Principal might choose between numerous different institutional arrangements in its relation to the Agent (and in view of the current "waterscape", it does). However, four main generic types have been identified: (1) direct public management by municipalised operated utilities; (2) delegated public management under public or private law; (3) delegated private management contracts with private parties; and (4) direct private management, full divestiture. These four institutional arrangements reflect the degree of separation between the Principal and the Agent, which generally decreases in strength from 1 to 4, or put another way, the extent to which the Principal has handed control of funding investment and manage-ment decisions to the Agent.

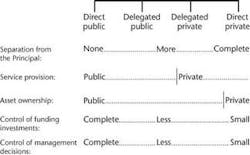

Public management, including direct and delegated, still predominates the European water and sanitation market. Some change in the nature of this public management has occurred; for example, delegated public manage-ment has become increasingly import-ant in Belgium, the Netherlands and Germany. Figure 2 presents the dominant institutional arrangements in the overall matrix.

Figure 2

Matrix indicating dominant institutional arrangements of the EU Member

No large-scale move toward direct or delegated private management has taken place in most northern member states - particularly the Alpine-Scandinavia-Lowland cluster that includes Austria, Denmark, Sweden, Finland, Netherlands, Luxembourg, Belgium and Switzerland. This is in contrast to the southern member states, such as Spain, Greece, Portugal, Italy, where private sector participation has gradually increased over the past decade. The increase in private sector participation in the southern member states is mirrored in the sanitation sector. Interestingly, and in contrast to water supply, in a number of more northern member states (Netherlands, Belgium, Austria, Ireland, Scotland) there also appears to be increasing interest in private sector participation within the sanitation sector, particularly for wastewater treatment. In the two member states with the highest level of private sector participation, France and the UK, there have been limited moves to increase competitive pressures on incumbents.

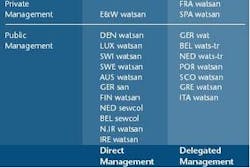

As identified within various member states, many corresponding institutional arrangements with its' respective forms of ownership, organisation and governance are capable of meeting the needs of customers, the community and the environment in a successful manner. For all institutional arrangements, a system of informal or formal regulation is required to ensure that the public interest is served properly. In general, more formal regulation is required and used as the degree of separation between the management entity and the responsible entity increases.

A certain level of regulation is required for all types of institutional arrangements, although the type of regulation may differ. Figure 3 underlines that regulation becomes more formalised as the Agent distances itself from the Principal. In direct public management, regulation is accomplished largely through community governance (political oversight) rather than explicit regulation, while in delegated private management, the regulation is largely embedded in the terms and conditions of the service contract, which is negotiated with and endorsed by the Principal. For the most distanced arrangement (direct private management), regulation is typically accomplished through formal and independent regulatory authorities.

The water supply and sanitation sector is being increasingly exposed to market forces. This works out differently in each member state or even in each municipality. The roles of Principals and Agents have changed and so have the relations between them. Regulatory frameworks have been put in place to control the process. The changing institutional arrangements towards greater liberalisation might ultimately require major upheavals. Stakeholders - especially policy makers - need to be sure that the risk of market/regulatory failure is minimal or can be controlled and that the likely costs of change will be outweighed by the benefits of the newly liberalised market. This is where policymaking is at its most difficult as there is limited information on these aspects.

Governance and regulatory interface (adapted from IWA, 2004)

No explicit liberalisation policies have been formulated for the water and sanitation markets, unlike for other network industries, so far at the level of the European Commission. Instead the Commission is giving mixed signals. The water and sanitation sector is excluded from the general competition laws and still remains under national and local responsibilities, while statements from EU officials lead one to think that future action in the water and sanitation sector is on the agenda. As EU Commissioner Frits Bolkestein, member of the European Commission in charge of the Internal Market and Taxation, put it in a speech in London in November 2003: "As far as water is concerned, the Commission has hitherto concentrated on quality. As soon as this (the implementation of the Water Framework Directive) has been done, we shall be better placed to look at water as a cross-border product." The future of the water market with regard to liberalisation in the European Union thus remains open. Open for research hopefully, for debate certainly, and possibly even open for competition.

Authors' Note

Meine Pieter van Dijk is professor at UNESCO-IHE Delft and at Erasmus University in Rotterdam, The Netherlands. Marco Schouten works as an economist and researcher at UNESCO IHE Delft, which is involved as a research partner in an EC-funded project that is identifying liberalisation scenarios for the European water supply and sanitation market. The authors want to thank David Musco, Andrew Nickson and Antonio Massarutto for their comments.