Regional water scarcity: increasing demand for recycling, reuse equipment

Industrial water recycling and reuse equipment markets expected to expand tremendously in the Middle East and Southern Europe within the next decade.

Water shortage is becoming a pressing global issue, especially in Southern Europe and the Middle East. Consequently, the industrial water recycling and reuse equipment market is likely to expand tremendously in the next five to ten years. With ever-tightening legislation, participants are becoming increasingly keen to consider more onsite water solutions to avoid rising water supply and effluent discharge costs.

In order to seize market share, market participants are targeting various lucrative end user segments such as organizations that use high volumes of water and those that can reclaim valuable materials by recycling and reusing water such as the pulp and paper and microelectronics sectors. Besides, the enforcement of strict regulations regarding waste disposal and resource consumption is set to bring in a more convincing economic business case for industrial water recycling and reuse equipment between 2010 and 2015.

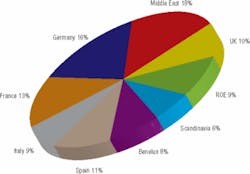

The industrial market for water recycling and reuse equipment in Europe and the Middle East earned revenues of US$ 279 million over a three-year period from 2003 to 2005. With anticipated annual of growth of about 7 percent, this market has the potential to earn $531 million from 2012 to 2014.

The drought experienced during recent times in Spain, Portugal, Italy, France, Greece and the United Kingdom as well as continued short supply of fresh water in the Middle East is further propelling water recycling and reuse, thereby increasing the demand for the necessary solutions and equipment.

Both industry participants and end users recognise the use of effective water recycling solutions and reuse equipment as a long-term measure to ensure improved quality of life. However, at this stage, many vendors find such solutions inaccessible due to lack of development and are more concerned about the long wait to earn return on investment.

“The current end-user trend is to implement lower-cost water recycling solutions and reuse equipment for the moment and later upgrade to better equipment and solutions,” according to Frost & Sullivan (http://environment.frost.com), Environment’s Practice Director John Raspin.

Vendors can expect to drive sales by approaching sectors that consume high quantities of water and accordingly have a more compelling need to manage water-related costs. Therefore, these vendors can make available recycling solutions in a user-friendly package. For instance, a solution that addresses the sector-specific needs, such as material reclaim functionality for the pulp and paper or microelectronics sectors, is likely to have greater uptake.

Raspin explained: “Manufacturers should design solutions to meet future regulatory and business development requirements. Introducing pay-as-you-go pricing models will help tackle the cost issue, as high capital costs and long payback times would hinder the buying patterns. Also, building customer base through reference will be valuable as a future sales tool.”

But it is not easy for new participants to penetrate the industrial water recycling and reuse equipment market. The relatively low cost of fresh water, the lack of end users’ capital spending power, and the lengthy time taken to earn profits are deterring new entrants.

“Even for existing participants in the market, sales cycles are long as well as costly and it can take up to two years to research and design a solution. Moreover, at the end, there is no guarantee that end users will adopt the solution,” Giddings stated. “Because of this, many participants are handling industrial water recycling and reuse projects on an ad-hoc basis, thus perpetuating slow market development,” he added.

While industries are upgrading wastewater treatment facilities, Industrial Pollution Prevention Control (IPPC) directives are focusing on promoting water recycling and reuse technologies for sustained growth. For relatively small percent (10-20 percent in extra costs, end users can invest in water recycling and reuse capabilities to improve their quality of life.

Furthermore, the long-term growth map is marked with water reduction measures brought in across Europe such as hosepipe banes. The UK, constrained by water restrictions until now due to dry conditions, is offering tax credits for industries that invest in water-saving technology, thus promising a double-digit growth for this market.

Note: John Raspin is the Environment’s Practice Director for Frost & Sullivan, in London. If you would like more information about our Environmental subscription or related research, send an e-mail to Chiara Carella - Corporate Communications, at [email protected] with the following information: full name, company name, title, telephone number, e-mail address, city, state and country. Requested information will be sent by email upon receipt of this information.