Desalination race Lifts Ancient African Infrastructure

Algeria is leading the North African desalination race with a planned capacity of over two million cubic meters of capacity per day. How have the facilities secured finance and what will the infrastructure mean for other countries on the continent? WWi speaks to Miguel Jurado and Luis de Lope from Aqualia, part of the FCC group, to find out more.

The word ambitious is often overused. Government leaders set "ambitious" targets. In reality this is glamorous way of saying challenging. One country where this phrase can be used freely is that of Algeria and its desalination plans. Algeria continues to aim for a milestone programme of desalination capacity building, despite difficult market conditions, with the economic downturn freezing the majority of project finance.

To put this ambition into context, by 2011 a total of13 seawater desalination projects with a total capacity of 2.26 million m3/d will be developed in the country - one of the most far-reaching construction plans the water industry has witnessed.

Egypt is also another example where such ambition can be seen. The country has embarked on a programme to refurbish and expand its aging water infrastructure. A helping hand came along in April 2010 following parliamentary approval of a public-private partnership law, which will hopefully open the door to privately funded and operated water projects.

Prior to the establishment of this law, Egypt signed an agreement for its first PPP project in wastewater treatment back in 2009. The Spanish/Egyptian joint venture between Aqualia and Orascom Construction Industries closed the financing seven months after being awarded the $480 million, 20-year build-own-operate-transfer contact by the Ministry of Housing, Utilities and Urban Development.

A club of four Egyptian banks helped meet 70% of the engineering, procurement and construction cost of the new 250,000 m3/day wastewater treatment plant to serve New Cairo City.

Water & Wastewater International magazine (WWi) spoke to Miguel Jurado, Aqualia's VP and head of international operations and Luis de Lope, concessions and industrial director from Aqualia to find out more about the company's activity in the North African market.

WWi: The public-private partnership model used for the Aqualia WWTP project in Egypt has been recognised for helping to further develop PPPs in the water sector. What impact will the project have on other PPP projects in Africa?

MJ: The main impact this project will have for further development across North Africa is that it will act as a sample for this type of partnership to follow in the future.

We did run into certain difficulties during the start of the project, but we were able to resolve these. Regarding the country risk, Egypt is qualified as BB+ by Standard & Poor's, other countries like Morocco (BBB-) and Tunisia (BBB) that have better investment grades, could translate the model.

Other countries with worse credit qualification will have to grant enough guarantees to the investors and lenders to make the model workable. Talking about the methodology, it's necessary to assure transparency and clarity to the investor company during the tender processes, as demonstrated in Egypt.

Considering the difficulties of the model, countries should involve technical, legal and financial advisors to assure the feasibility and bankability of the potential projects

WWi: The financial package includes a 15-year EGP566 million ($102 million) debt package. This was from a club of four Egyptian banks to meet 70% of the engineering, procurement and construction cost of the new 250,000m2/d wastewater treatment project to serve New Cairo City. What challenges did Aqualia face when convincing the banks to finance the project?

MJ: Aqualia faced four major challenges before reaching financial close on the project. These included the inexistency of a specific PPP law. This forced Aqualia to provide additional guarantees to the lenders, until the new PPP law is in force. Furthermore, there has been further lack of experience in such PPP projects in the region - the negotiations have been longer than usual for such deals. However, the deal was closed in seven months. Also, the usual periods for repayment of the debt provided by local banks are much lower than needed for this kind of project. Finally, there was a shortage of financial entities able to provide financing in the local currency. Hopefully the experience of this project will help transmit confidence to the market.

WWi: Aqualia is also involved in its second large-scale seawater desalination plant in Algeria. How close is this project to finishing?

MJ: We are developing two big projects in this area. Construction for the first, Mostaganem, with a capacity of 200,000 m3/day, finished at the end of August, with testing beginning at the start of September. The second plant is the Cap Djinet project, near to Algiers. The capacity of this plant is 100,000m3/day and this is scheduled to be finished at the end of this year, when we will begin testing. The Mostaganem plant will be operational at the end of 2010 and Cap Djinet during the second quarter of 2011.

WWi: The facility is said to boast "the most highly advanced industrial technologies in seawater desalination plants using inverse osmosis" — can you provide more detail on this technology?

MJ: It is very important to remark that all of the design has been done considering the characteristic of high production as parameters, which are not the same when designing a 15,000 m3/d plant than a 200,000 m3/d - such as the capacity of Mostaganem SWRO.

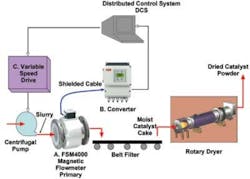

The equipment needed for this big production includes intake pumps regulated by frequency converters, pre-treatment by double step dual filters with high filtration surface and backwash with brine, high pressure pumps equipped with high performance 2500 KW engines.

Regarding the pretreated water to the RO membranes, it has been designed using a pressure center. This means it is fed in one common collector, feeding the RO racks equipped with the last generation of low energy membranes. It also includes energy recovery systems by means of high performance isobaric chambers.

WWI: What is being done to make the facility more energy efficient?

MJ: Our design includes energy recovery systems but this is not the only tool used to reduce energy. All the design has been done under the concept of optimizing the energy required for its performance. We have applied three fundamental criteria for the design of big installations. First of all is the reduction of the process lines. Our design is based on eight big lines of 25,000 m3/d, each using high performance equipment. The bigger the engine is, the more energy efficient it is.

Secondly is the pressurized design of all the water line, from the sea water intake to the product water storage tank. All flows go through pressurized pipes with no pressure drop at any point, taking advantage of the energy invested for moving the water. Finally, a detailed design lies at the heart of the plant, with high pressure pumps (HPP), RO racks and energy recovery system.

We have included high performance HPP, higher that 85% energy efficiency, RO racks equipped with low energy consumption membranes and energy recovery systems with more that 95% energy efficiency. All those improvements leads to a specific electrical consumption of 3.4 kwh/m3 of product water. This value includes all consumptions of the process from the deep seawater intake to the big product water storage tanks.

Luis de Lope: We think that this will be the technology of the future with the materials used for membranes and devices designed to help reduce energy consumption. We can use other kinds of technologies when the water projects are together with power projects. In this case, we have a steam flow we can use to heat the concentrate and eliminate the dissolved particles of the water - evaporation technology such as MSF (multi-stage flash) or MED (multiple-effect distillation). This is really useful for PPP projects in the Middle East.

WWi: There are a lot of trials going on at the moment for renewable powered desalination, such as solar power and wind power, in the Middle East and Australia. Is it something the company is looking at for future projects?

MJ: Plants need a high energy capacity to implement desalination technology and we promote combined renewable energy to work with these type of facilities where there is a lack of power.

For countries like Spain, there is a healthy energy mix of hydro power, renewable energy and thermal energy, which will provide enough energy for such facilities.

For countries where there is not enough energy, such as in the Middle East, we recommend establishing renewable energy sources to connect with desalination plants.

WWi: Is there a danger that desalination capacity will cluster in Algeria but leave the rest of North Africa still with serious water demand issues?

MJ: As far as the desalination facilities take the intake water from the sea, all the seaside African countries have the opportunity to use this technology to solve their lack of water. Because of this, it could be declared that the clustering in Algeria won't damage other countries' chances.

Africa will definitely be an area that we will focus our business on in the future. For example, we are watching Morroco at the moment - a country that is considering the PPP model and which will probably launch new tenders at the end of the year. These plans won't be on the same scale as the Algeria region because they don't have the same necessities.

Tunisia is another country that recently implemented a desalination plant - they recently installed capacity for a 16,000m3/day facility and also on the table is a plan for a wastewater treatment plant. They need water and have finance.

More Water & WasteWater International Current Issue Articles

More Water & WasteWater International Archives Issue Articles