The outlook for Water Reuse in Engineering Markets

By Damian Corbet

Water scarcity, continuing development and population growth drive efforts to take full advantage of every drop via

increasingly innovative reuse efforts worldwide.

The current global interest in water reuse is driven by increasing demand and an often chronic lack of supply of potable water in many developed regions of the world —southern and western states of the USA, southern Europe and Australia being more well publicized examples. While these countries and regions have the economic, technological and scientific resources to confront the problem, it’s in some of the lesser developed countries where similar water shortages have a much more dramatic effect. These countries often don’t necessarily have resources and technical expertise to confront the problem.

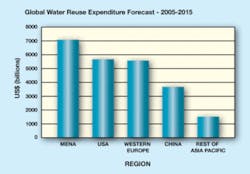

According to a Global Water Intelligence special report entitled “Water Reuse Markets 2005-2015: A Global Assessment & Forecast”, global water reuse capacity will rise from 19.4 million cubic meters a day (m3/d) in 2005 to 54.5 m3/d in 2015 — a 181% increase. The biggest growth will be in China, the Middle East/North Africa (MENA) and South Asia (i.e., India and Singapore) regions, with the USA and Western Europe equal or close behind. To achieve the required expansion in water reuse capacity to meet these demands, total capital investment in the reuse sector will be over US$28 billion. World demand for water treatment products in general is expected to rise by at least 6% annually to nearly US$40 billion by 2011.

The reuse market is being driven by two simple factors: rising demand for water and scarcity of new supplies. Key emerging markets such as China, MENA and South Asia have historically had a very limited wastewater infrastructure and there’s currently a lot of investment in building new water and other infrastructures in these regions — investment that will dramatically increase availability of wastewater for reuse. Investor interest in the water sector is now at an all time high. Environmental investors see that growing water scarcity make it a long term growth prospect, while defensive investors like the fact that, even in the deepest recession, people still have to drink water. Despite this interest, there are still a number of barriers to entry for private money. Most water utilities around the world are still publicly owned and resistance to private involvement is extremely fierce in some regions. While some Latin American countries are fiercely opposed to water privatization, others — such as Colombia and Brazil — are more in favor and are actively encouraging private sector investment.

Three things are needed for the private water market to grow: a sympathetic political environment, underdeveloped water utilities, and a clear way to make a profit. At present, only a few regions in the developing world meet all these criteria. Heavily capitalized China and the MENA region lead the way. Their governments are strongly in favor of private investment and they’re facing severe water shortages. Add to this their rapid economic growth and the stage is set for massive investment opportunities in water reuse.

China is a special case and really needs to be treated separately. Its economy continues growing at a brisk rate, despite slowing down in the latter half of 2008. While water is plentiful in some parts of the country, in other parts (especially the north) it is in drastically short supply, and what water is available is often severely polluted and unfit for human use. In fact, four hundred out of China’s 667 cities face water supply shortages and 25% of the Chinese population drinks contaminated water. The Chinese government is therefore investing huge sums in environmental protection and cleanup — in its 11th Five Year Plan (2006-2011) it has pledged to spend 1.4 trillion yuan (US$175 billion) — 1.6% of its GDP. As part of its effort to fend off the impact from a global economic slowdown caused by the recent world financial crisis, it also just announced a $586 billion stimulus spending commitment that will focus on infrastructure.

In the MENA region, while the population is smaller, it’s growing at a much higher rate than China, due in large part to sustained high oil prices of the past several years. This has been putting extreme pressure on already highly stressed water resources. Many MENA countries — particularly the Gulf Coast Countries — regard better use of wastewater as a priority and are taking advantage of higher revenue to invest in the required infrastructure. It’s not yet clear what impact the recent bust in oil prices due to the economic slowdown will have on water, wastewater and desalination projects already in the pipeline.

Major reuse projects in China and the MENA region in recent years include six large water reuse plants constructed in Beijing prior to the 2008 Olympic Games. Between them, these plants have a capacity of 370,000 m3/d and are now the main water source for recycled water for agricultural irrigation, landscape water and industrial cooling in the Beijing area. In the MENA region, the Sulaibiya wastewater treatment and reclamation project in Kuwait, completed in 2004, is one of the world’s largest water reuse installations. At full capacity, it can treat 600,000 m3/d of wastewater for applications in agriculture, industry and aquifer recharge. In India, a number of industries, particularly textile operations, have for several years taken advantage of pooling resources to create jointly owned cooperatives for treating wastewater. This not only creates a new source via reuse to reduce freshwater consumption but reduces increasingly higher costs associated with freshwater use as well, as restrictions grow to safeguard resources. Another very well publicized reuse project — this time in Southeast Asia — is the NEWater series of water factories in Singapore. Run by the Public Utilities Board (PUB), or national water agency, the NEWater plants reuse wastewater from various sources for non-potable industrial use and for injecting into reservoirs. Reused water from the NEWater plants is in fact potable, and, the Singapore government is planning to progressively increase the amount of NEWater injected into its reservoirs so as to allow people to get used to drinking it and accepting it into their daily lives. It also runs PR campaigns and promotions encouraging residents to drink NEWater. Singapore has now become a global water hub and a shining example of what can be achieved with virtually no water resources of its own.

Anticipation of the growth in reuse opportunities partly explains the merger and acquisition activity in the water treatment sector in recent years, including Siemens’ purchase of USFilter in 2004 and GE’s purchase of Zenon Environmental in 2006. More mergers and takeovers are in the offing. These companies and many others are all investing heavily in developing water treatment and reuse technology for use in projects worldwide. Despite the current downturn in the world economy there doesn’t appear to be any significant slowdown for the water reuse sector, particularly in China, India and the MENA region, which seem to have unlimited supplies of capital for water infrastructure projects.

Author’s Note:

Damian Corbet is senior press officer at Halma plc, a London-based specialist in electronic, safety and environmental technologies with 40 subsidiaries worldwide including UV units Hanovia, Berson UV-techniek and Aquionics. Contact: +44(0)20 8511 1821, [email protected] or www.halmapr.com