Reusable Market Gets its Feet Wet in North America

By Christopher Gasson

Global Water Intelligence provides a preview of a new report on U.S. water reuse efforts, comparing them with global market.

Water reuse is about to become mainstream in America. A new survey, “Water Market USA”, by Global Water Intelligence shows that there are 43 water reuse projects now on the drawing board across the United States with a total value of $818 million. This reflects growing interest in water reuse across the south and west of the country. Still, restrictions on potable water reuse are still holding back the market.

null

Dwarfed by Desalination

In theory, water reuse should be a bigger market than desalination. Among the reasons:

1) The energy consumption of water reuse is lower than that of desalination

2) Water reuse can be employed anywhere in the country, not just along the coasts or where there is brackish groundwater

3) Reuse faces less opposition on environmental grounds than water desalination

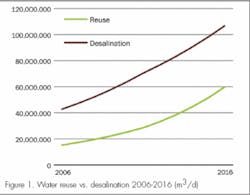

In reality, though, the market for water reuse is smaller than the market for desalination (see Figure 1). The main reason for this is public concern about direct potable reuse. This restricts the market considerably. It means that, in most cases, reclaimed water requires a separate distribution system, which dramatically adds to the cost of water reuse projects.

For example, the Western Corridor Recycled Water Project in South East Queensland, Australia, which is expected to be commissioned later this year and was honored by the International Water Association at its recent World Water Congress in Vienna, Austria, is expected to cost a total of US$2 billion. The project – which claims to be the largest water recycling scheme of its kind in the world – will take treated effluent from six wastewater treatment plants in the region and deliver it through 184km (115 miles) of pipelines to two power stations. The total volume of water provided by the project will be 232,000 m3/d (61 MGD). This suggests a price per unit of capacity of $8,620/m3/d – an astronomic price in comparison to desalination. The comparable cost for the 189,000 m3/d (50 MGD) desalination plant in Carlsbad, California, is about $1,600/m3/d.

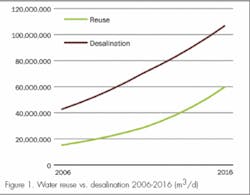

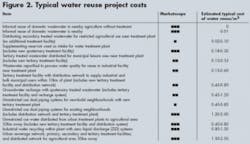

The table in Figure 2 illustrates the costs of different systems of wastewater recycling based on their operating costs and the amortised additional capital costs required. The table in Figure 3 shows the energy component of the operating cost of different water and wastewater treatment processes.

Reuse on a Global Scale

The main difficulty with treating water reuse as a market is that it’s extremely nebulous: What part of the system should be considered specifically a water reuse expenditure? For example, the Baix Llobregat project in Barcelona, Spain, involves adding tertiary treatment to an existing wastewater treatment plant and pumping the water 30 km back up the Llobregat river. The investment in the network is just as much a part of the project as Veolia’s ACTIDisk tertiary treatment system. Considerations such as these make it very difficult to draw a line around the market in a useful way.

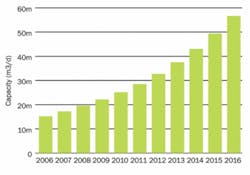

Taking the definition of reuse as planned beneficial reuse involving secondary wastewater treatment as a minimum, we would estimate the current annual capital expenditure on water reuse projects to be in the region of $1.1 billion per year. This figure is growing at a rate of around 19% per annum, which corresponds to an expansion of capacity from 15.2 million m3/d at the start of 2007 to 28.5 million m3/d at the end of 2011, and 59.7 million m3/d at the end of 2016 (see Figure 4). These are extremely tentative figures, since, unlike desalination, there is currently no systematic record of water reuse projects or system of tracking new projects. Using a ballpark figure of $0.35/m3 for the cost of reuse suggests operating expenditure of $1.9 billion a year, a figure which is experiencing an annual growth rate of around 13%.

The U.S. Reuse Market

Today, the $352 million Orange County Ground Water Replenishment System, which won the 2008 Stockholm Industry Water Award during World Water Week in Stockholm this summer, sets the standard for U.S. water reuse. The first phase of the project has a capacity of 70,000 acre feet per year (237,000 m3/d), representing a capacity cost of $1,485/m3/d. It involves treating wastewater with microfiltration, reverse osmosis and ultraviolet disinfection before pumping it 13 miles to spreading basins where it’s blended with other sources.

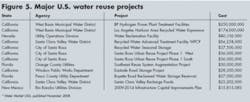

Other water reuse projects currently on the drawing board (see Figure 5) are on a smaller scale: the largest one at $250 million is a project proposed by the West Basin Municipal Water District to use recycled water to supply BP’s hydrogen power plant at the Carson refinery. West Basin is also developing a $174 million reclamation scheme for the Los Angeles Harbour area. The Inland Empire Utilities Agency in California has a $190 million project currently under way with an intermediate target of delivering 50,000 acre feet per year of recycled water by 2009/10.

Conclusion

Global Water Intelligence currently estimates the U.S. water reuse market (including on-site industrial water reuse) in terms of capital expenditure to be worth in the region of $370 million per year. This is expected to grow at around 12% per year until 2011, when increased water stress in the U.S. Southwest, together with wider acceptance of potable water reuse lead to an acceleration in the rate of growth.

Author’s Note:

Christopher Gasson is publisher of Global Water Intelligence, a monthly journal published by Media Analytics Ltd., with offices in the UK, India, Philippines and China. Contact: +44 (0) 1865 204 208 or www.globalwaterintel.com for more information.