The New Face of the European Sludge Dewatering Industry

Amid total market growth of 6.3%, niche and novel solutions with multiple benefits such as reduced costs and high dewatering output will grow but remain a fragment of mainstream technologies, predicts Frost & Sullivan

By Jaishri Srinivasan

Sludge dewatering equipment is a multibillion dollar industry worldwide, and the market in Europe has been sized at US$666.4 million at present and is expected to grow at a CAGR of 6.3% until 2013 driven mainly by demand from southern and eastern European countries. The major market driver for the growth of demand for equipment is increased sludge production as well as increasingly strict European Union sludge management legislation.

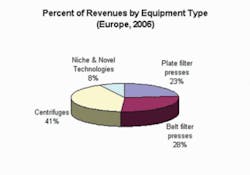

Major technologies predominant in the European sludge dewatering equipment market include plate and chamber filter presses, belt filter presses, centrifuges, and other niche and novel solutions. The revenue share contributions of each of these technologies to the overall sludge dewatering equipment revenues are shown in Figure 1.

Niche & Novel Technologies

Of particular current interest is investment in the emerging niche and novel technology segment, which occupies about 8% of total revenue shares by equipment in the sludge dewatering equipment market in Europe. This segment is mainly used in areas where mainstream technologies aren’t best suited, such as to enhance performance of already existing dewatering installations or to serve niche applications in industrial or municipal sectors on a small scale.

This segment includes solutions that find niche applications such as screw presses as well as advanced and innovative solutions that are either patented or protected technologies. The latter segment includes such product and technology innovations as Passavant Roediger’s Duodrain thin sludge dewatering system, Teknofanghi’s Monobelt and Draimad dewatering equipment, Alfa Laval’s Octopus process automation and optimization software, Huyck’s dewatering felts and wires, and Black & Veatch’s Rapid Dewatering System, to name a few.

Within the niche and novel technology category, screw presses are the dominant technology segment. Major screw press manufacturers in Europe include Andritz, Läckeby Water, Veolia’s subsidiary Krüger and Hans Huber AG. Other manufacturers include Sernagiotto, Spirac, Meva and Compura. This segment is expected to face increasing demand from small municipal wastewater treatment plants, in agriculture for manure dewatering as well as from the industrial sector, especially pulp & paper mills and the food & beverage industries, as the technology is suited for dewatering in small scale applications in these segments.

Vacuum filter systems aren’t currently in any significant demand in Europe and are mainly used for niche applications such as to dewater mining and construction industry slurry as well as in heavy metals and engineering industries for sludge dewatering. The two major and well-known manufacturers in this category are Andritz and Metso Corp.

The overall trend in the niche and novel solutions segment currently is more towards modularized systems, i.e. systems with a smaller footprint as well as combining thickening and dewatering into a single operation. Quite a few market players have products in the latter category. Passavant-Roediger markets the Duodrain thin sludge dewatering system, Teknofanghi offers Monobelt among its product offerings. Both these products can take thin or very dilute sludge and dewater it to a high efficiency. This solution is set to see high growth in the future, particularly from ageing wastewater treatment plants (WWTPs) across Europe unable to handle treatment capacities for current population levels or achieve efficient thickening and dewatering.

Though the demand for niche and novel solutions is significant at present, high growth from the mainstream technologies due to refurbishment demands from mature markets and rising demand from emerging markets continues to show more growth in market share. Therefore, although the market will grow, this segment is expected to show a perceived overall decline in market share as the demand for these technologies is currently largely restricted to maturing markets.

Figure 2 shows the market revenue forecasts for niche and novel sludge dewatering technologies in Europe over the forecast period 2003 to 2013.

Process Automation Technology

The main technology development that looks set to influence the “future face” of sludge dewatering is process automation and optimization. SCADA systems have been used, albeit not on a large scale, in process automation and optimization of wastewater treatment plants. Also process optimization for dewatering has only been implemented in pulp dewatering applications in pulp & paper industries and these solutions are currently being offered by Andritz and Metso Paper.

Photo courtesy of Hydro International

Application of process optimization in sludge dewatering, however, hasn’t been implemented extensively until recently. Alfa Laval’s Octopus system is the only solution in this category at present. This is in response to preferences by municipal WWTPs to reduce the costs of dewatering sludge, achieve high dry solids content as well as high process efficiency. To accomplish all this is clearly beyond the scope of a single type of equipment at present and requires a process optimization solution. The Octopus system comprises both software and associated hardware components. The software consists of optimization algorithms specially developed for use of decanters based on Alfa Laval’s considerable expertise with them. The associated hardware systems include measurement systems that monitor various input parameters as well as sensor systems.

The first such system was successfully tested in the Almere WWTP in the Netherlands and a handful of further demonstration sites were later implemented in countries such as the UK, Holland, Sweden, Denmark and Spain. The market potential of this technology is enormous and this solution can potentially be implemented in all plants across Europe equipped with decanter centrifuges and enjoy capacities greater than 4,000 tonnes per year of sludge throughput to achieve high efficiencies.

Conclusion

As the market for dewatering equipment is becoming more mature in major Western European countries, the preference for equipment is trending more toward advanced and innovative solutions that can bring multiple benefits such as reduced costs of dewatering, high dewatering output and so on. While the market for niche and novel solutions is expected to grow in real terms, the rising demand for mainstream technologies will overshadow growth in this segment resulting in a perceived decline in market shares for this segment. For all purposes, niche and novel solutions will take off in a significant way in the sludge dewatering equipment market but will continue to hold a minority share of the market for the foreseeable future.

Author’s Note:

Jaishri Srinivasan is a senior research analyst for Environment & Building Technologies at Frost & Sullivan, with headquarters in San Antonio, Texas, USA. She recently relocated from its Chennai, India, office to its London office. Contact: +44 (0) 20 7730 3438 or

www.environmental.frost.com

FOCUS - EU Sewage Sludge

The following reports can be found at the European Commission environment webpage:*

- “Pollutants in urban waste water and sewage sludge” – http://ec.europa.eu/environment/waste/sludge/sludge_pollutants.htm

- “Evaluation of sludge treatments for pathogen reduction “ – http://ec.europa.eu/environment/waste/sludge/sludge_eval.htm

- “Organic contaminants in sewage sludge for agriculture use” – http://ec.europa.eu/environment/waste/sludge/organics_in_sludge.pdf

*SEE: http://ec.europa.eu/environment/waste/sludge/