Water and wastewater take centre stage in Brazilian politics

By Anand Hemnani

Brazil's upcoming elections and steady economy portend higher spending on water and wastewater services and equipment, but higher risk for privatisation initiatives.

Brazilian elected officials made minimal progress on water and wastewater issues in the past four years, but they are receiving much attention in election debates. Brazilian presidential and statewide government election races promise to be hot and heavy from now through October.

Opposition candidates across the board are highlighting water provision and wastewater treatment as key challenges for the Brazilian population, and attacking the current administration's lack of political will in addressing the issue. The driving argument made in the Senate and the Chamber of Deputies is that lack of planning and investment will result in water rationing, similar to that experienced in energy.

All of this is in the general context that the economy is more or less on track. Gross domestic product growth was slightly lower than 2% last year and is expected to be in the same range this year (compared to a decline in Argentina of 4%, and a prospective decline in 2002 of nearly 8%). More importantly, the annual inflation rate in Brazil is projected to be below 5% - an extraordinary figure. The Brazilian currency, the Real, should end 2002 steady in the 2.5 to 2.6 range against the US dollar. Overall, there is a consensus that the economy is generally on track and being well managed. Several investment banks recently upgraded Brazil while Argentina, Uruguay and Venezuela are in deepening crisis.

A promise of more investment in the water and wastewater sector is a winning political issue. For example, the presidential contender José Serra of the Partido Social Democrata Brasileiro (PSDB), the government party, has been very public about his ambitious water coverage expansion plans specifically for Northeast Brazil. Serra stated during his campaign launch announcement that his government, if elected, would consider potable water network expansion in the Northeast, currently at 71%, as a high priority. Serra's plans call for expanding network coverage to reach 94% of the population. Wastewater collection expansion plans also call for an increase to 72% from the current 38% of households.

Of more immediate concern, state governors who are running for second terms or who are trying to make sure that their party is elected, are pressuring state water utilities to increase their public works during 2002. CG/LA Infrastructure expects an increase of 50% in local water utility budgets this year as politicians re-direct budgets to ensure that highly public and visible investments are executed in the short-term by water utilities across Brazil.

Among one of the best examples is the case of Southern utility Corsan, the State of Rio Grande do Sul's water utility, controlled by the leftist Partido Trabalhista (PT). Corsan has pioneered a program where the state government floats a short-term bond with the private sector to finance a US$ 200 investment in water expansion and two wastewater outflow pipes.

While most utilities accumulated significant losses during 2001 due to exchange rate related revenue decreases, politicians are turning a blind eye to financial performances, focusing instead on visible investments. The result is that service contracts and equipment sales opportunities will be robust in 2002 while privatisation and equity opportunities will be highly risky.

EPC firms' local presence is key

Increased public spending will yield strong opportunities, particularly to existing service providers and those that can respond to quick bid-time triggers. Many of the investments will be directed towards the most-preferable vendors; nonetheless, the time is right to enter new markets (geographically) and/or increase market share with existing utility clients.

Caution should be taken on negotiating payment terms as all work contracted should be paid prior to a shift in administration. Several local construction companies highlighted this point, one to be considered seriously by firms banking on receivables by utilities across Brazil during 2002.

Public Debt Instruments are the only funding mechanism during 2002. Most state utilities and private concessionaires have petitioned the federal government for funds for 2002. CG/LA confirms that there have been 183 separate petitions for funding with the BNDES for civil work projects in the water sector to be executed this year alone! The message here is to be cognisant of which projects will be funded.

Several local banks - Itaú Corretora S.A., Unibanco S.A. and Banco BBA-Creditanstalt S.A. - are actively pursuing opportunities to float municipal and state public debt instruments for water projects. For example, Sanasa (Campinas Water Utility) floated an additional US $50 million last March to expand its potable water network. Similarly, after a failed attempt to issue 19.3% of equity in preferred shares (See CG/LA Market Insight, June 2002), Santa Catarina State Utility, Casan, raised US $150 million through debentures and sale of equity in non-core assets.

Loss reduction and efficiency improvements will have their budgets re-directed towards visible "ribbon-cutting" investments. Over the 2000 period, state water utility investments in metering, billing and collection systems remained constant despite a drop in overall equipment purchases due to the economic crisis. CG/LA expects investments in these types of equipment to increase by 20% annually from US$ 150 million today to US$ 311 million in 2004. The Association of Private Water Concessionnaires (ABCON) forecasts that at least 20% of the overall investments of private concessionaires will be directed towards water loss reduction during 2002-2003.

The year 2002 will yield important engineering and construction opportunities as major public works are initiated. The opportunities will be somewhat tempered by the fact that engineering, procurement and construction (EPC) contracts are awarded by politicians in this election year; hence, those contractors closest to the administration will enjoy preferential treatment. Partnering with local EPC firms and vendors is critical as sub-national units lead procurement efforts. CG/LA developed an extensive network for monitoring opportunities through utilities and local vendor relationships, and offers partner selection and due diligence services. CG/LA expects overall budgets from utilities for 2002 to reach US$ 1.2 billion.

Sector evolution

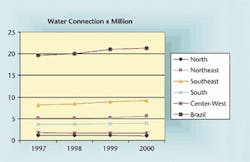

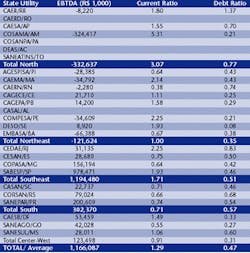

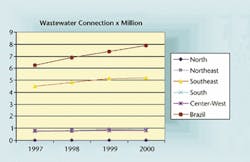

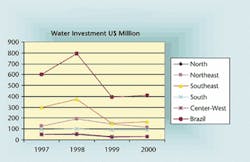

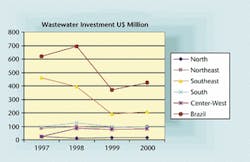

Investments have remained stagnant in terms of effective gains in coverage for most Brazilian utilities. Keeping up with new demand has largely wiped out any significant evolution in percentage expansion goals, as illustrated in Chart 1 and 2. The number of connections has not increased by the goals set by the Government Development Plans (See CG/LA Market Insight, January 2001)

Investments in water and wastewater have decreased relative to their peak during the municipal election year of 1998.

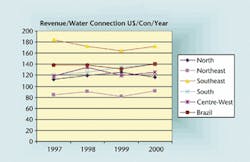

Chart 5 illustrates utility average revenue per connection and is based on all 27 state utility metrics issues during January 2002.

Utility performance summary

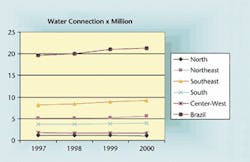

Table 1 illustrates net income figures for all 27 state utilities for 2001. Across-the-board negative net earnings before taxes, depreciation and amortisation only augment the already fully leveraged companies in the North and Northeast. The opposite is true with Southeastern and Southern utilities that have some debt-bearing capacity and post-positive operating incomes.

Author's note

Anand Hemnani is the vice president of CG/LA Infrastructure, an international consultancy that specialises in the Latin American water and wastewater sector. For more information, visit the web page: www.cg-la.com)