Water Rich Latin America Is Thirsty For More

The development of water and sanitation infrastructure has failed to keep up with the millions of Latin Americans migrating to urban areas over the years. Nuno Oscar Branco looks at some of the projects taking place to bring the region up to speed and meet Millenium Development Goals, including desalination development across Peru and Chile.

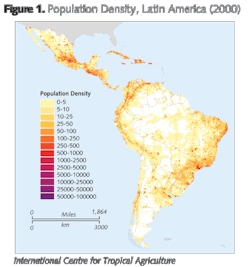

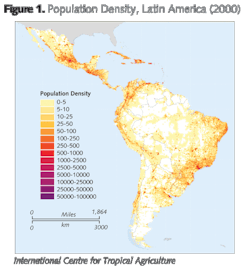

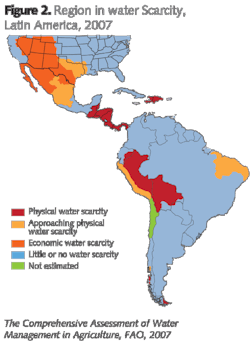

Latin America is water rich. With 500 million inhabitants or 8% of the world population distributed in 20 countries, the region possesses 31% of the freshwater resource in the world. In comparison, Asia, where 60% of the world population lives, only 28% of the freshwater resource is available.

However, this water is not equally distributed. According to the United Nations Environment Program (UNEP) - the Gulf of Mexico Basin, the South Atlantic Basin and the La Plata basin covering 25% of the region's territory are home to "40% of the population containing only 10% of the region's water resources". These are also key industrial regions with some of the most water intensive sectors.

Enforcement issues

Until very recently, leaders in Latin American did not prioritise investments in water management and environmental protection. In most countries, the legislation to protect water resources and the environment was introduced in the last 10 to 15 years and the enforcement continues to be in most cases inefficient or non-existent.

The economic growth in the urban areas that started 10 to 20 years ago in Latin America continues today: the IMF expects growth of 4% for the region in 2010. Economic and human development in Latin America will need water and demand is likely to continue increasing.

For example, the biggest drinking water plant in the world, located in Guandu, Rio de Janeiro (produces 43,000 litres per second, or 3.7 billion litres of water per day) is currently being expanded to add another 12,000 litres of water per second. Rio de Janeiro will invest $700 million to increase the supply of drinking water and tackle rising demand. The growth in demand for water exposes the weakness of countries in the region of managing their water resources. By the end of this year, Latin American countries are set to invest billions not only to increase and improve drinking water supply from rivers and lakes but also from oceans. In some countries the immediate need to increase the water supply leaves no other option to political and industrial leaders but to invest in seawater desalination treatment plants.

Urban migration

In the last 20 years, some of the economies in Latin America have witnessed a tremendous rate of development resulting in improved living standards. A study done by Banco Santander showed that, from 2002 to 2006, "15 millions households ceased to be poor and became low middle class" (El Pais 2007). One reason for this was that millions of people migrated from rural to urban areas in the region. Today, Sao Paolo in Brazil (20 million inhabitants), Mexico City in Mexico (20 Million inhabitants) and Buenos Aires in Argentina (13 million inhabitants) are three of the largest cities in the world and their metropolitan areas represent a large portion of the economic output generated in these countries.

Revitalising polluted water sources

Connection rates of drinking water and basic sanitation did not follow the same growth patterns of industrial and urban development. Some governments in the region have introduced new environmental legislation in a bid to regulate the discharge limits of industrial and municipal wastewater treatment plants and improve the drinking water quality standards for human consumption. But its enforcement is poor and in some regions non-existent.

The assessment from the Banco Interamericano de Desarollo is clear. "Although Latin America and the Caribbean region is on track to meet the United Nations Millennium Development Goals (MDG) regarding coverage in water and sanitation, the quality of services is severely deficient and the region is far behind on wastewater treatment," it said.

Most traditional water sources in the region, such as rivers, lakes, and groundwater are polluted as a result of decades of state, public and industrial mismanagement. Their revitalisation will be carried out during the next decades and will need billions of dollars in investments.

Brazil for example, under a Program of Accelerated Growth (PAC), allocated $25 billion to guarantee that everyone in Brazil will have access to safe drinking water and access to basic waste

Investment

During the next 15 years, countries in Latin America are expected to invest in the basic water and wastewater infrastructure and treatment technology. This will be to guarantee that all households are connected to water, and wastewater treatment plants; that water is safe for drinking, and wastewater does not cause environmental problems such as eutrophication.

However, if some countries in the region want to achieve their economic expectations they need to increase water supply in the short term. Desalination is a suitable solution to increase water supply and we expect governments and industries to invest into this technology over the coming years.

Desalination projects

Peru and Chile offer two paradigmatic examples of the type of desalination projects happening in Latin America. Both countries are investing in desalination plants to support economic and urban growth.

In Chile, the government is committed to supporting the mining sector in the north of the country. In line with this, most of the investments in Chilean desalination projects are in the Antofagasta region in the north of the country.

In 2010, there are 10 projects set for desalination. Some of these projects are already under construction while others need to guarantee the final permit from the Chilean government. One of the desalination projects that is currently under construction is for a $3.5 billion (345,600 m3/d) seawater desalination plant owned by Minera Escondida, a Chilean mining company.

The project for the Valle de Copiapó desalination plant is under assessment and construction is planned to start over the next two years. This $250 million project will increase the provision of freshwater to the city of Copiago and the region of Atacama. The aim of this project, according to the Chilean Government, is to supply water to meet the demand of the mining sector, households, agriculture and any other sectors in the region.

In Peru, the water supplied by desalination plants will be consumed by the industrial sector, households and agricultural plantations. The Peruvian President, Alan Garcia, considers seawater desalination a national objective and new desalination plants will be built in the country. In Pucusana, for example, the government is sponsoring the construction of a 80,000 m3/ day seawater desalination plant.

Moving forward

Latin America may well be water rich but economic and urban growth from the last two decades has polluted the traditional freshwater resources of many countries. The priority for governments in the region is to meet the MDG target and increase the access to safe drinking water and sanitation.

Latin America is thirsty for more water. Some industries and urban areas simply cannot afford to just sit back and wait for improvements in water management to take place. As with the examples in Chile and Peru, investment in desalination to quench the region's thirst is a solution that cannot be delayed.

Author's note:Nuno Oscar Branco is an industry analyst at business research and consulting firm, Frost & Sullivan.More Water & WasteWater International Current Issue Articles

More Water & WasteWater International Archives Issue Articles