How water-related factors can present risks — and indeed, opportunities — to the industrial, energy and agricultural sectors

By Beth Burks

Industrial and agriculture sectors face a significant challenge: water scarcity. Global groundwater reserves are diminishing, causing demand for water to outstrip supply. For these water-dependent sectors, this presents both operational and financial risks, affecting numerous points in the supply chain and multiple regions worldwide.

Only exacerbating water-related risks are the profound effects of climate change. The higher frequencies of flooding, droughts, saltwater intrusion, subsidence and weather events are increasing the global water deficit, which is expected to reach 40 percent by 2030. This will cause water stress (i.e., the ratio of demand to annual renewable supply) to heighten.

Moreover, as climate change continues to disrupt weather patterns, both the provision and quality of freshwater resources needed for industrial and agricultural development will likely fall short. Although bad news for some, those companies that seek to solve water-related challenges may, in fact, find that water stress presents opportunities alongside risks. As a result, water-related factors are becoming an increasingly prevalent environmental, social, and governance (ESG) risk factor for industrial and agricultural businesses and, of course, their credit ratings.

Water’s Material Effect on Ratings

S&P Global Ratings has found water-related factors to play a significant role in its ratings analysis. In a two-year review from July 2015 to August 2017, water-related factors were the main driver of 28 ratings actions and were mentioned in 169 rating action articles — meaning they played some role in the corresponding rating, outlook or CreditWatch action.

Importantly, water-related factors were shown to lead to a higher proportion of negative rating actions (either a downgrade, revised outlook or CreditWatch action) compared to environment- and climate-related factors overall. Indeed, approximately 70 percent of ratings actions in which water risks were a key factor were negative — of which half were downgrades. By comparison, 50 percent of all environmental- and climate-related rating actions were negative.

One-off vs. Continuous Risks

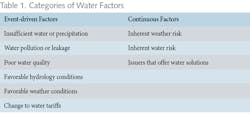

Not all water-related factors are equal, however. The degree of impact that water-related factors had on individual ratings varied depending on whether the risks at play were considered “continuous” or “event-driven.” The former relates to water-related risks or opportunities for issuers where water is inherent to operations as either a resource or service. The latter considers one-off events such as droughts, heavy precipitation and floods (see Table 1).

Over the two-year review period, S&P Global Ratings found that event-driven factors were most likely to drive a rating action — despite continuous factors being more prevalent across credit analyses (61 percent). Among these event-driven factors or drivers in a rating update, the most frequently cited was insufficient water or precipitation, followed by excess water or precipitation, and water pollution or leakage.

Insufficient water and precipitation were behind our negative rating action on K+S, a Germany-based potash producer, in October 2016. Because the company’s Werra plant needs to discharge saline wastewater into the Werra River, drought conditions can constrain operations. We lowered our rating on K+S from “BBB-/A-3” to “BB+/B” due to water scarcity following low rainfall in June 2016, which also coincided with a period of weak market conditions, low potash prices and low sales volumes from its new North American site.

Water leakage, the third most frequently cited water-related factor, led to the 2017 downgrade of Thames Water Utilities’ class A and B debt to “BBB+” and “BBB-,” respectively. Poor water management related to leakage from below-ground water assets resulted in regulatory penalties. Despite improved operational performance in several areas, performance of the company’s below-ground water assets continued to have an effect, leading to consumer interruptions and a failure to meet the company’s 2017 leakage target.

As seen in this example, and across our review, it is the water-intensive industries — such as utilities and power, metals and mining, and agriculture — that are most exposed to the impact of water-related factors on business and credit ratings. But importantly, this impact can be not only negative but also positive.

Opportunities Do Flow

Indeed, water-related factors are not always negative for credit. In fact, as markets and issuers absorb the impact of water-related risks, they could see opportunities as well as challenges. Our analysis found that where continuous water-related factors were a key driver of a ratings change, there was an even split between positive and negative results.

It is possible for water-related factors to improve following a previous negative impact, which reflects the cyclical nature of water. For example, the 2017 São Paulo drought led to negative rating actions for SABESP, a water and waste utility, and Companhia Energética de São Paulo, an electric utility that operates hydropower plants. But after hydrological conditions became more favorable, we were able to take positive ratings actions.

A similar story exists for Croatia-based utility Hrvatska Elektroprivreda (HEP), which owns and operates hydropower facilities. Following favorable hydrological conditions and commodity prices over the two years prior, we upgraded HEP from “BB-” to “BB” in October 2016. This is because the improved conditions allowed the company to strengthen its liquidity — in this case, accumulating a large cash balance of Croatian kuna (HRK) 2.8 billion.

What’s more, issuers that offer solutions to the water deficit can see a positive influence on credit. For example, our ratings affirmation on SPCM S.A., the parent company of French chemicals company SNF, referred to SPCM’s exposure to municipal and industrial water treatment end markets as supportive of its resilience to GDP cyclicality. Instead of impeding operations as they might with other sectors, water risks such as clean water and natural resource scarcity act to bolster the company’s business.

Water Risk Passes Through the Supply Chain

With water so inherent in the operations and output across the industrial, energy and agriculture sectors, we supplemented our review with a study on how water risk passes down the supply chain.

Given the high water dependency of cotton crops, combined with the heavy use of water for bleaching, dyeing, printing and finishing fabric, the cotton agriculture-to-apparel retail supply chain is particularly subject to both continuous and event-driven water-related risks and opportunities.

Although heavily reliant on water, whole cotton fields can be decimated by too much. Major flood events, therefore, can have a tangible impact on cotton production and pricing. In 2010, severe flooding across China’s cotton-growing provinces, Henan and Hubei, led to increased Chinese demand for cotton imports. Low supplies in previous years meant that the ratio of cotton stocks to consumption hit its lowest point in 15 years.

The following year saw further major flood events in other key cotton-growing markets such as Pakistan. This led to the highest rise in cotton prices on record since the American Civil War. This rise was cited in our rationales for several rating actions at the time (see Fig. 1).

Although these rating actions were largely in the negative direction, we did see outlooks shift in the positive direction in late 2012.

But recently, it has been widespread droughts that have had an adverse influence on the cotton-to-apparel retail supply chain. In 2018, droughts affected large cotton-growing regions in the U.S. and India. China’s cotton stockpile in 2018, however, was more resilient than in 2011. What’s more, India chose to continue exporting — unlike in 2011, when it placed a temporary ban on exports. These contemporary market conditions mean that the return of water risk for this supply chain is unlikely to prompt a cotton price rise of the type seen in 2011.

Despite this, we consider water risk to remain a prevalent ESG concern that will continue to increase as climate change takes its toll on global water supply and quality. If that trend continues, we could see water risk and opportunities have more tangible impacts on credit ratings across a wider range of sectors and regions across the world. IWW

About the Author: Beth Burks is an analyst in S&P Global Ratings’ Sustainable Finance team. She is the primary author of a recent report entitled “The Credit Impact of Water Risk,” which explains the role that water-related factors play in S&P Global Ratings’ assessment of corporate credit profiles.

Circle No. 153 on Reader Service Card